JPY, EUR, USD flows: Risky currencies benefit from equity strength

A new high in the S&P 500 overnight helped propel the riksier currencies higher, but USD/JPY yields spreads continue to decline and equity risk premia continue to rise as US yields decline, suggesting upside risks for the JPY

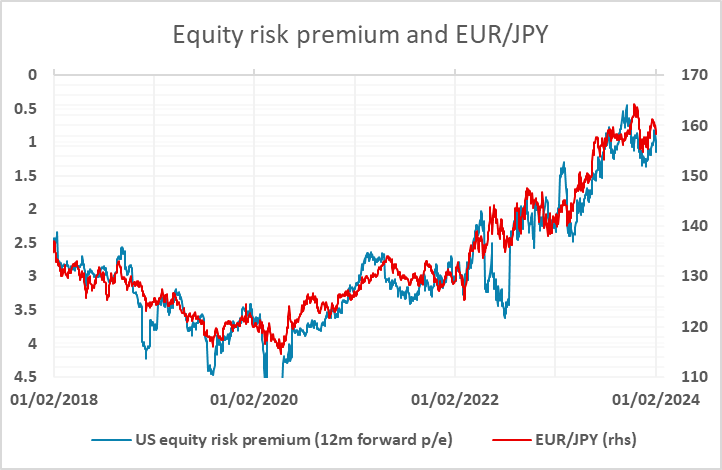

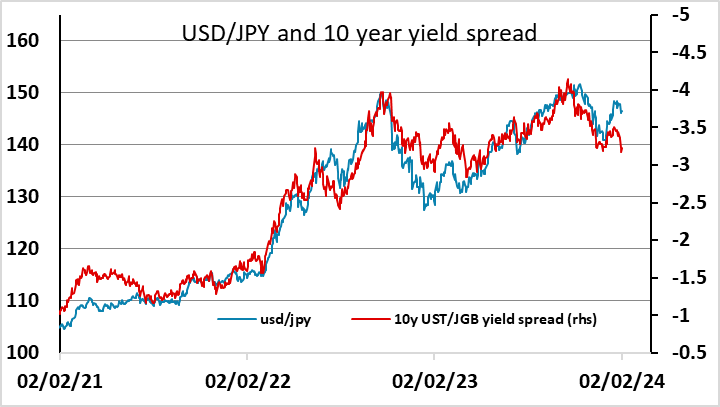

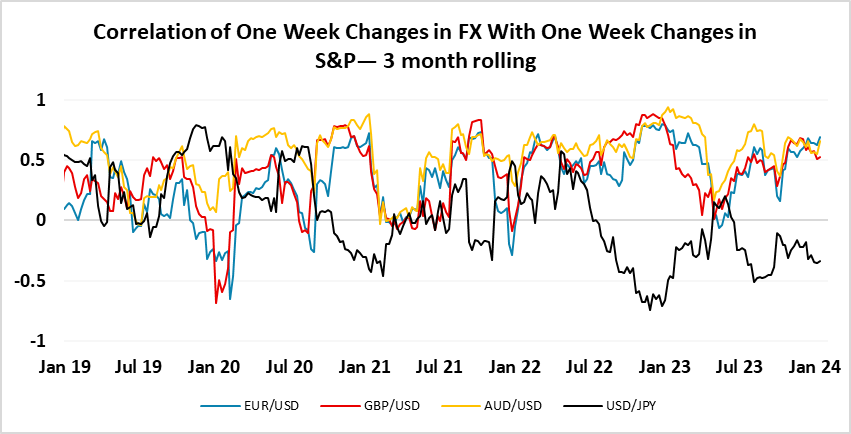

It looks like a quiet morning ahead of the US employment report, with no significant data scheduled in Europe and minimal FX movement overnight. Boosted by the decline in US yields, the S&P 500 managed to hit a new high as the US closed yesterday, and this helped sustain strength in the riskier currencies both against the USD and the JPY. The fact that equities rallied on lower yields suggests that the decline in yields was not due to US banking concerns or geopolitical concerns, but rather related to the rise in initial claims and the weakness of unit labour costs in the US data. Even so, despite the gain in equities the decline in US yields has meant a rise in equity risk premia, and this suggests that the cross JPY recovery is overdone, while USD/JY continues to look a long way above the level suggested by yield spreads. While sentiment towards the JPY maybe won’t improve until or unless the BoJ tighten policy, it’s still hard to find a rationale for JPY weakness here. Of course, if the US employment data is strong, expect the USD to make general gains, but the upside against the JPY looks more restricted, and any rise in US yields that undermines equities will probably help the JPY against the riskier currencies.

However, the initial strength of equities will tend to sustain the riskier currencies against the USD this morning, with the correlation still strong, although the EUR will tend to struggle if European equities underperform. But a fairly quiet morning is likely ahead of the US employment report. We expect this will be broadly in line with consensus, and see the USD as vulnerable, particularly against the JPY, in that eventuality. See the Daily FX Strategy for a fuller preview.