USD flows: Weaker on Powell comments

Powell mildly dovish, USD slightly lower

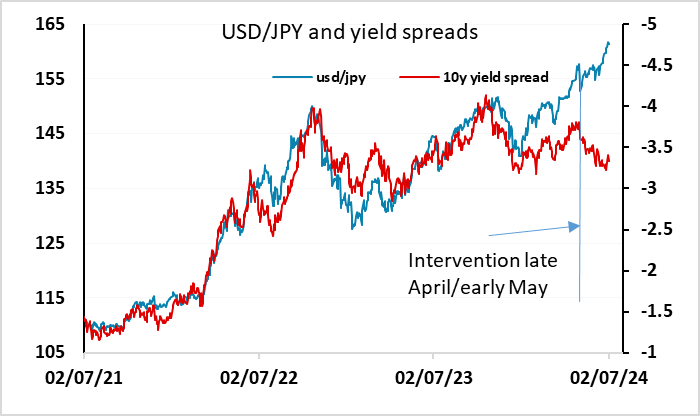

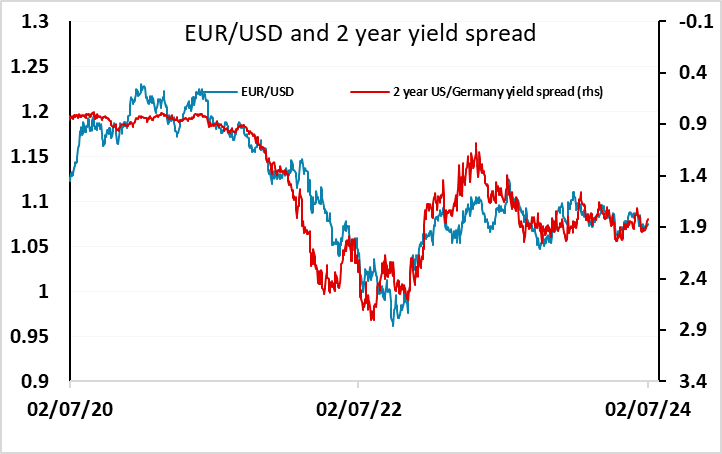

The comments from the Fed’s Powell are on the dovish side. He is indicating that the disinflation trend appears to be resuming (presumably referring to the pause in the trend in Q1), and that the risks are now much more balanced. US 2 year yields have dropped around 3bps in response, and the USD has edged lower, but remains at high levels, particularly against the JPY. While the decline in US yields means spreads have moved slightly against the USD, spreads have broadly guided EUR/USD but haven’t been significant for USD/JPY for a month. The employment report on Friday is still the main focus, and could be more significant in the light of Powell’s comments, particularly if it is on the soft side. But the lack of correlation between USD/JPY and yield spreads means USD/JPY may need more than just lower US yields to turn the trend.