FX Daily Strategy: Asia, February 17th

RBNZ To Be On Hold

Australian Wage Growth Could Support the Aussie

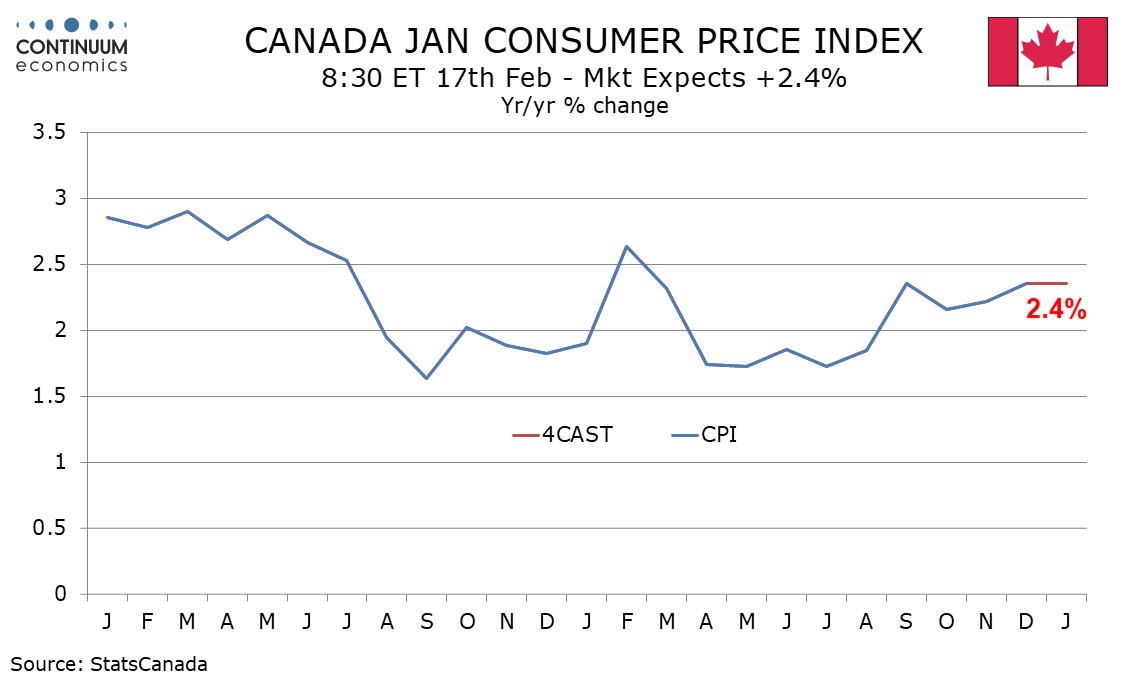

Canada January CPI Little change from December

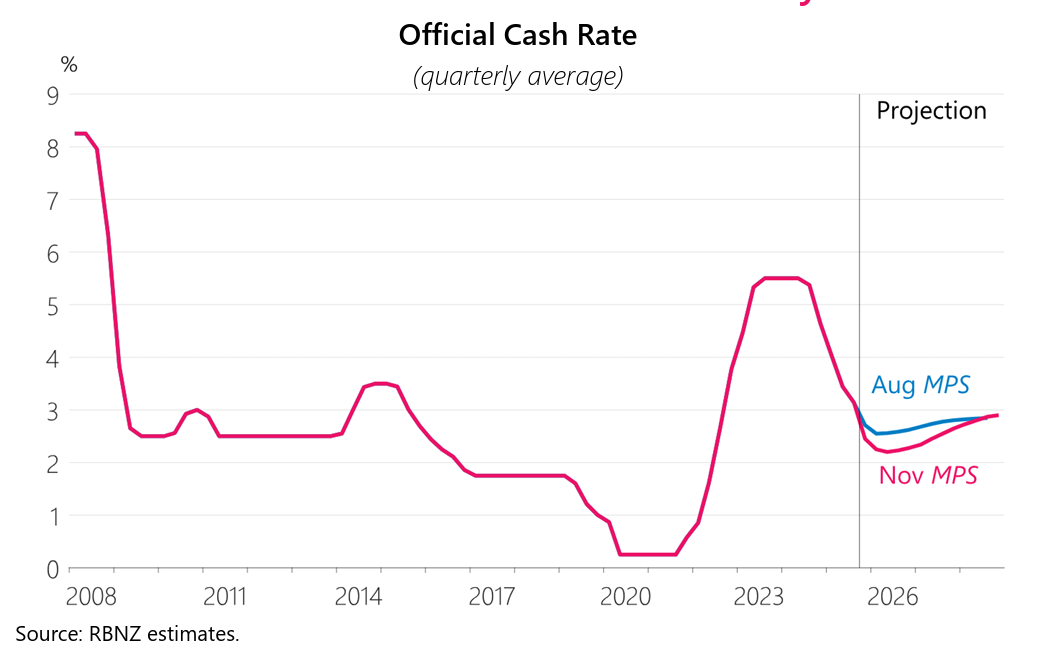

The RBNZ rate decision will be announced on late Tuesday and we expect the OCR to be on hold at 2.25%. The November OCR forecast shows the RBNZ will likely keep rates unchanged at current levels at least till 2027. We do not believe the RBNZ will either hike/cut due to current inflation above target range. The overshoot has been addressed by the RBNZ to be transitory. It will be a hawkish surprise if they change their wordings or revise their OCR forecast.

On the chart, NZD/USD is in the neighbor hood of annual high. With a hawkish push, we could easily see a jump above the 0.61 figure. Yet our base scenario see no change to rates, forward guidance or forecast and suggest little last impact towards the Kiwi.

The RBA has tilted hawkish and is forecasting two more hike in 2026. Thus, economic releases are going to be more dynamic going forward, especially wage data. The Australian Wage is expected to continual its growth and may accelerate on the release from preliminary data points like job ads. A strong wage growth may trigger market participants'' anticipation of an earlier hike from the RBA and support the Aussie.

On the chart, anticipated losses have tested below 0.7065 to reach 0.7045~, before bouncing back into consolidation around 0.7075. Daily stochastics have turned down and the flat daily Tension Indicator is also coming under pressure, highlighting a deterioration in sentiment and room for deeper losses in the coming sessions. A close below the 0.7065 lows from 10-11 February will add weight to sentiment and open up congestion around 0.7000. Meanwhile, a close back above 0.7100 would help to stabilise price action. But a further close above the 0.7147 current year high of 12 February and the 0.7155~ year high of February 2023 is needed to turn sentiment positive and open up strong resistance at the 0.7200 Fibonacci retracement.

We expect January Canadian CPI to be unchanged at 2.4% yr/yr, with both December and January at 2.36% before rounding). We expect the Bank of Canada’s core rates to be on balance softer, with CPI-Trim and CPI-Common both slowing, but CPI-Median stabilizing after a sharper fall in December. Yr/yr rates will see some upward pressure from a sales tax holiday which lasted from mid-December in 2024 through mid-February in 2025, meaning the maximum boost to the yr/yr rate will come in January. However, underlying prices were increasing at a faster rate in January 2025 than they are now, weighing against the boost to yr/yr growth coming from the tax shift.

On the month we expect CPI to rise by 0.2% both overall and ex food and energy seasonally adjusted, though unadjusted the ex food and energy rate is likely to show seasonal weakness with a 0.1% decline, partially offset by a seasonal increase in gasoline, seeing overall CPI up by 0.1% unadjusted. The seasonally adjusted ex food and energy pace will be following an above trend 0.3% rise in December that rebounded from a below trend 0.1% increase in November. December’s gain was inflated by a sharp rise in air fares which is unlikely to be repeated. On a yr/yr basis we see the ex food and energy rate at 2.4% (2.43% before rounding), down from 2.5% in December.