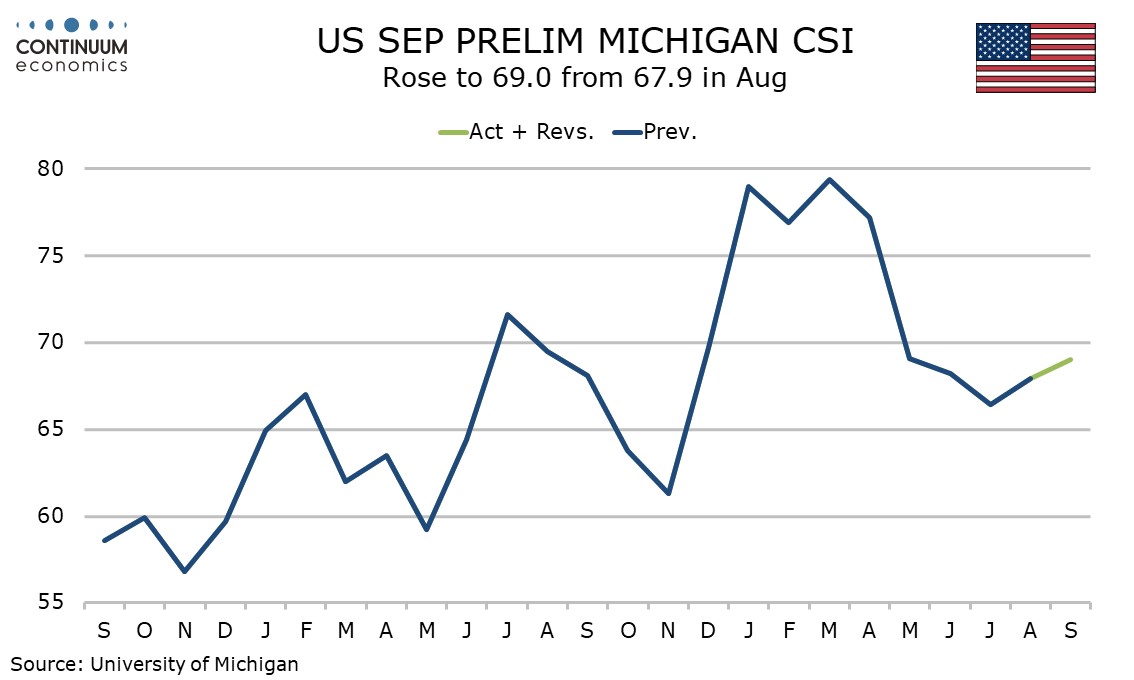

U.S. September Michigan CSI - Higher, including long-term inflation expectation

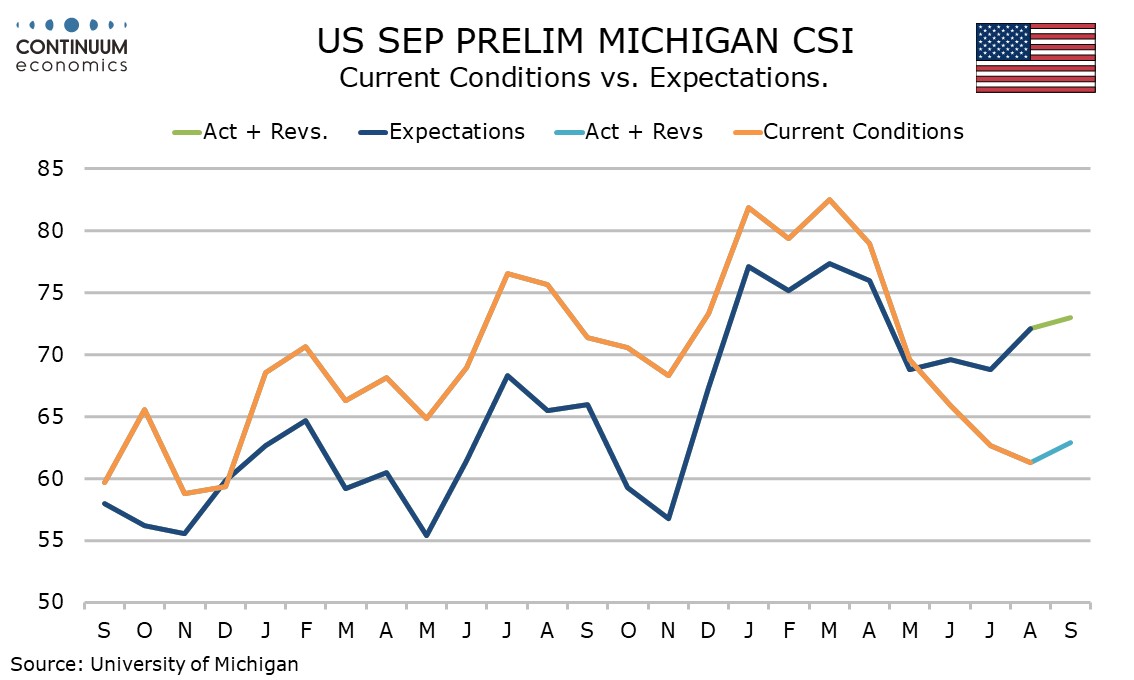

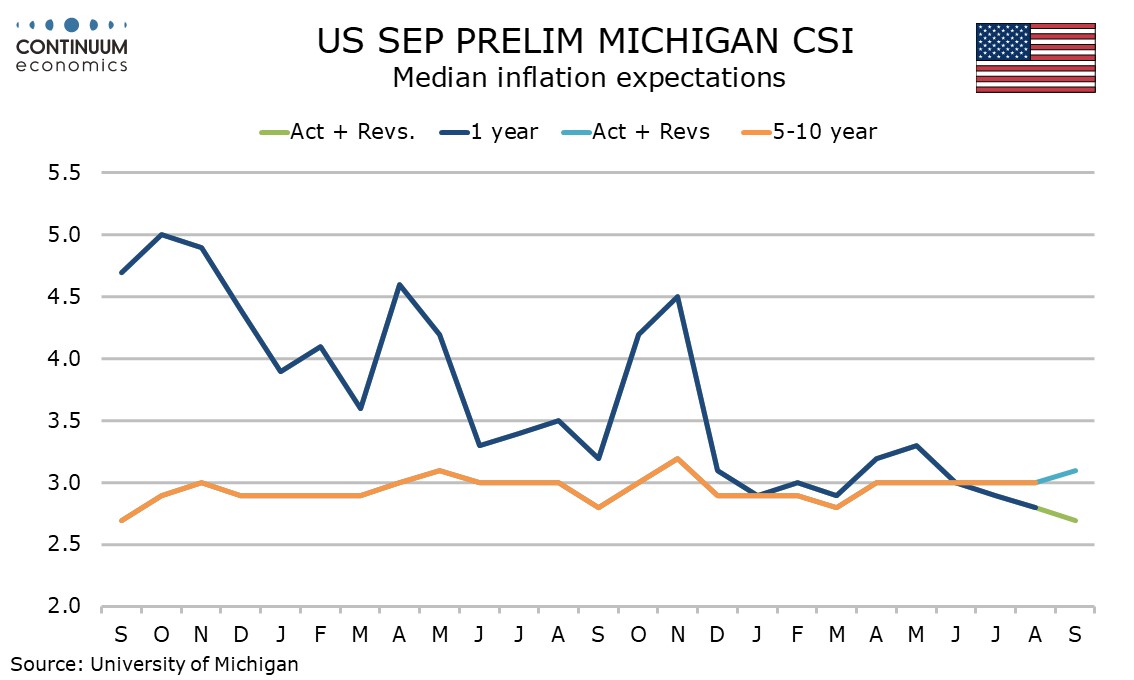

September’s preliminary Michigan CSI at 69.0 from 67.9 is slightly firmer, with both current conditions and expectations contributing. Inflation expectations are mixed, but a rise in the 5-10 year view outweighs a fall in the 1-year view.

Current conditions rise to 62.9 from 61.3, breaking a string of five straight declines from March’s 82.5. The rise is modest but suggests that the recent loss of momentum in the economy is stabilizing. Initial claims are giving a similar message in early September.