FX Daily Strategy: N America, February 6th

Improving Japan labour earnings still not enough to boost JPY

RBA kept rates on hold, but with hawkish tone

Rise in front end EUR yields hard to justify

JPY gains on the crosses on Monday may not be sustained unless equities show more weakness

Improving Japan labour earnings still not enough to boost JPY

RBA kept rates on hold, but with hawkish tone

Rise in front end EUR yields hard to justify

JPY gains on the crosses on Monday may not be sustained unless equities show more weakness

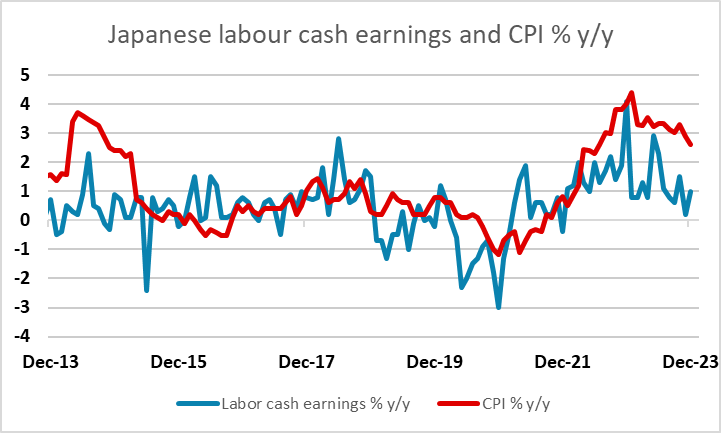

The December Japanese labor cash earnings data released overnight, along with the household spending numbers, were both stronger than November and weaker than consensus. So there was little in the data to encourage those looking for a spring BoJ tightening, although this is still on the cards if the spring wage round produces significant wage increases that PM Kishida has urged companies to enact.

The JPY continues to look weak relative to yield spreads, but the better equity market tone is likely to keep it under pressure on the crosses for today.

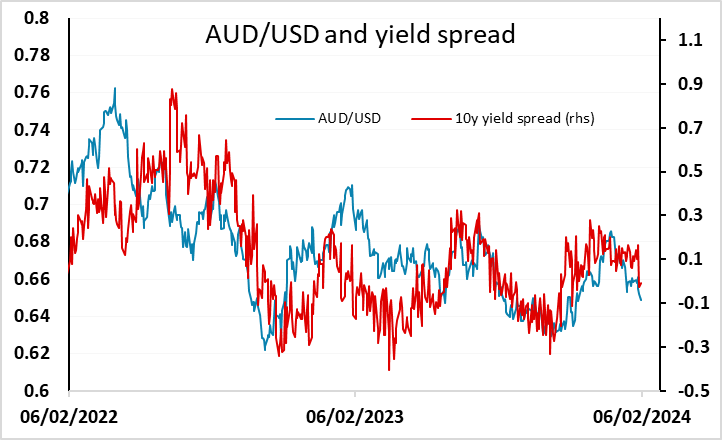

The USD is generally softer overnight, mainly due to a stronger performance from Chinese equities, although the AUD also got support from what was perceived as a slightly hawkish RBA stance. The rise in Chinese equities was triggered by reports that President Xi would discuss the stock market with financial regulators, triggering the largest one day gain in Chinese equities since 2022. This helped the AUD and the other risky currencies, but the AUD also benefited from the RBA meeting. The RBA left rates unchanged as expected, but the key forward guidance statement of "Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks." has changed to "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks, and a further increase in interest rates cannot be ruled out.". Market participants read this change in forward guidance to be hawkish, but the market impact on AUD yields has been quite modest, with 2 year yields still below where they were at the beginning of last week. Nevertheless, with the AUD starting from a point that looked a little cheap relative to yield spreads, there is some scope for the AUD to edge up further in a risk positive environment.

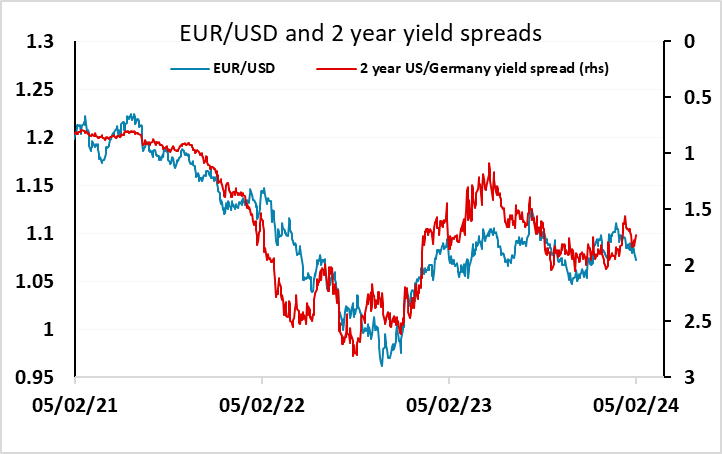

There isn’t a great deal that is likely to be market moving on the European or US calendars on Tuesday, and it remains hard to oppose USD strength given the strong US employment report. However, it is noticeable that in spite of the strength of the employment report, and the big rise in US yields that has resulted, there has been relatively little yield spread widening between the US and Europe, as European yields have risen with the US. This is to be expected at the long end of the curve, where the correlation is strong and global factors dominate, but is more surprising at the front end of the curve, which is more dominated by policy, as the European economy is not showing the evidence of strength we are seeing in the US, the better Germna order data this morning notwithstanding. So although EUR/USD looks a little low given the moves we have seen in front end yield spreads, it is reasonable to expect some renewed widening in these spreads as the ECB is likely to cut faster than the Fed.

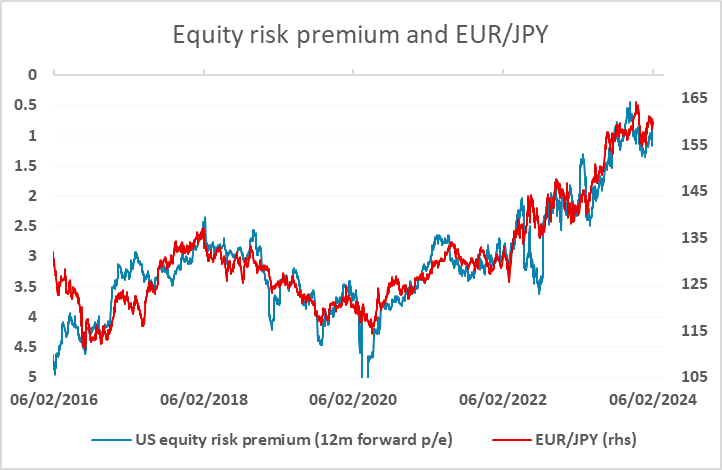

We did see some weakening in the risk sensitive currencies on Monday, as equities fell back in response to the widening in US yields. However, we are a little wary of this move. While there is a strong negative correlation between equity moves and the USD, JPY crosses tend to move much more with equity risk premia than with equity prices themselves. This means that equity declines that are due to higher yields should not be expected to have a positive impact on the JPY on the crosses, as they don’t represent a rise in risk premia. Indeed, the opposite is usually true. Of course, from a yield spread perspective there is a strong case for a JPY recovery, both against the USD and particularly on the crosses, but until we see a rise in risk premia, or some evidence of a break in the correlation with risk premia, we wouldn’t assume the JPY will sustain the cross gains seen on Monday.