USD, JPY flows: USD gains on strong ISM services

ISM services gain strongly, JPY threatening recent lows

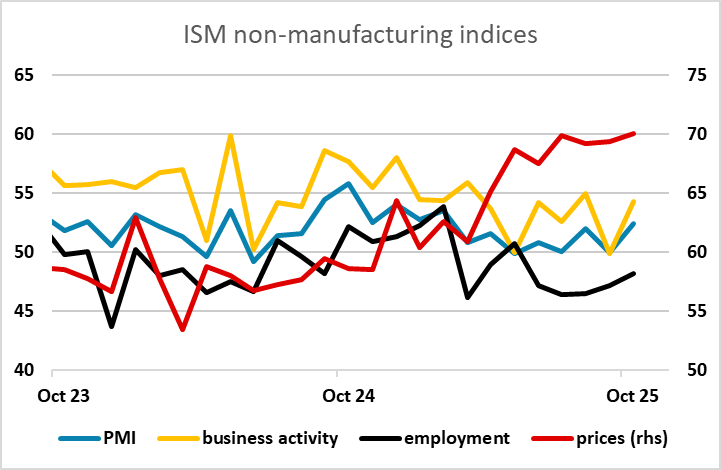

A much stronger than expected ISM services survey is giving the USD and riskier currencies a boost, with US yields up around 5bps along the curve in response. The biggest impact has been on USD/JPY, which is threatening the recent high at 154.40, while EUR/USD has only edged a little lower to test the lows of the day (and the last three months) at 1.1470. The impact on currencies is coming more from the general positive response from equities than the movement in yield spreads, which have had a diminishing impact in recent months. Commodity currencies gained ground as equities rallied at the cash open in the US, and have broadly held their own against the USD in response to the data. The JPY is consequently under general pressure on the crosses, and EUR/JPY will be targeting retracement levels after the recent decline, with 1.7725/50 looking like the resistance area. A USD/JPY break of 154.40 would bring the possibility of BoJ intervention back into focus after recent comments from Finance minister Katayama calling the recent JPY weakness one-sided and rapid, although this would be unlikely today.