Published: 2024-07-03T12:52:31.000Z

USD flows: Softer on ISM

2

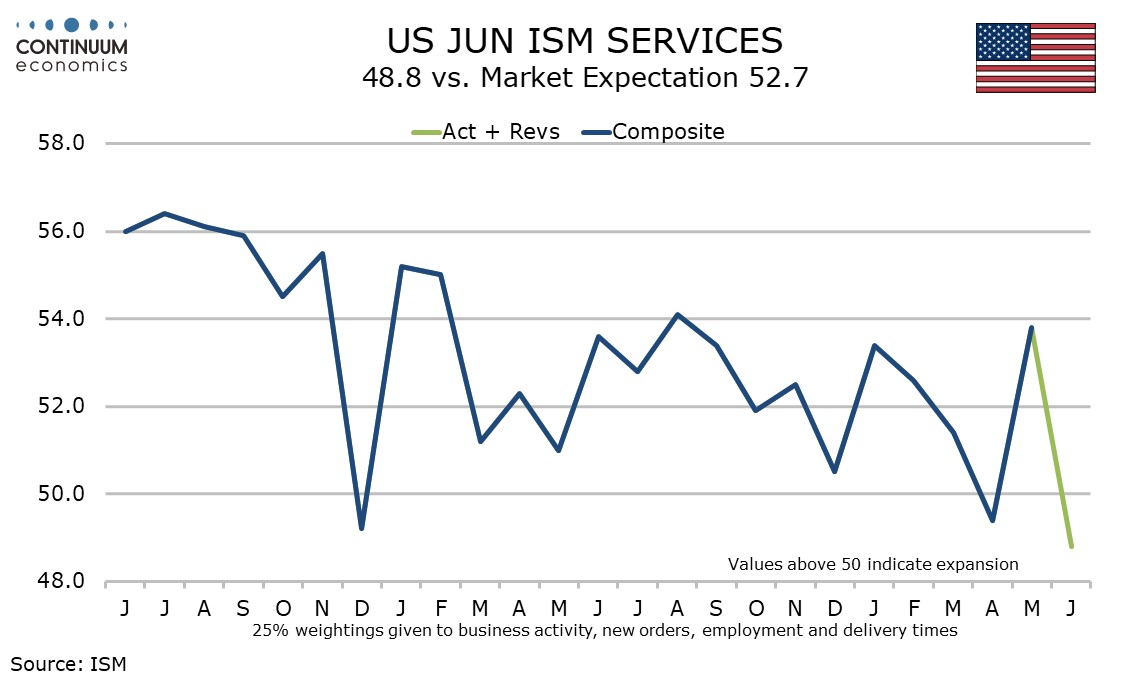

USD lower on weaker ISM

The USD has fallen back on a weaker than expected June non-manufacturing ISM survey, continuing the trend of softer data in the last few days. This is generally taken more seriously than the S&P PMI, and US yields have fallen as a result. EUR/USD has broken above 1.08, and even USD/JPY has fallen more than half a figure. With European yields also lower, this would normally be seen as JPY positive across the board, but the current negative JPY sentiment means that EUR/JPY is not much changed. However, with the July 4 holiday and the employment report approaching, there is potential for some unwinding of short JPY positions, so the risk may be shifting to the JPY upside.