GBP flows: GBP slightly softer after UK MPC leaves rates on hold

GBP has weakened modestly as BoE leaves rates unchanged with an 8-1 vote. Two hawks from the February meeting now voting for no change

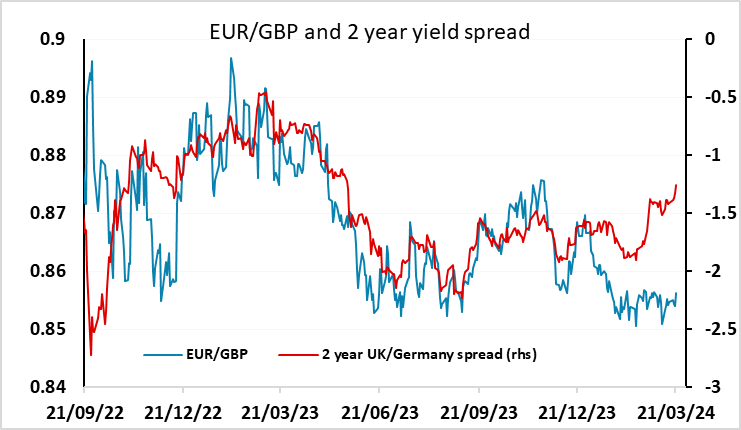

EUR/GBP moving a little higher after the BoE voted 8-1 to leave rates unchanged. The two hawks –Mann and Haskel - who had voted for a hike last time have moved into line with the majority and vote for no change. There’s nothing particularly unexpected in the statement, but 2 year UK yields have fallen around 5bps in response, perhaps reacting to the hawks’ capitulation and the implicit easing bias contained in the statement 'the Committee will keep under review for how long Bank Rate should be maintained at its current level'. The Bank is still concerned about inflation persistence and the high level of services inflation, but is seeing some positive signs in a loosening labour market.

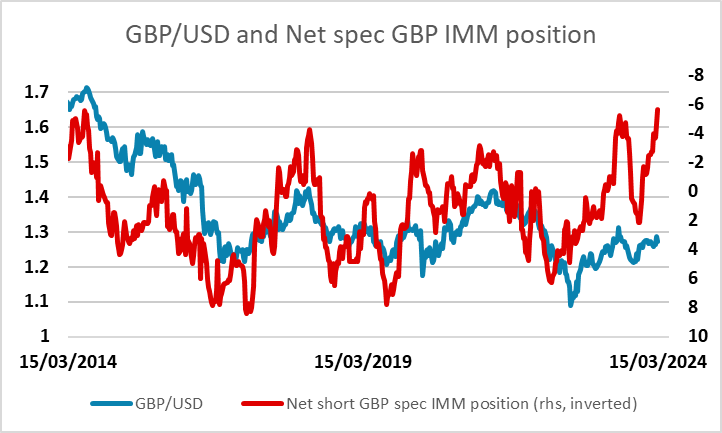

EUR/GBP has edged higher, and should have a little scope to move up a little further, given the way yield spreads have moved this year. Net long GBP positioning also looks overextended in the latest CFTC data. However, there is still greater uncertainty about the scope for UK easing than there is elsewhere in Europe, mainly because the UK economy supply side’s limitations mean weak demand is having less impact on inflation. So we see initial GBP weakness as likely to be modest, but there should be more scope for GBP declines once the rate cutting cycle gets underway, although this now seems likely to be June at the earliest.