FX Daily Strategy: Asia, January 16th

Quiet data day likely to see the USD maintain firm tone

More scope for EUR/USD losses than USD/JPY gains

EUR/JPY has plenty of downside scope

GBP failure to gain on strong data suggests upside now capped

Quiet data day likely to see the USD maintain firm tone

More scope for EUR/USD losses than USD/JPY gains

EUR/JPY has plenty of downside scope

GBP failure to gain on strong data suggests upside now capped

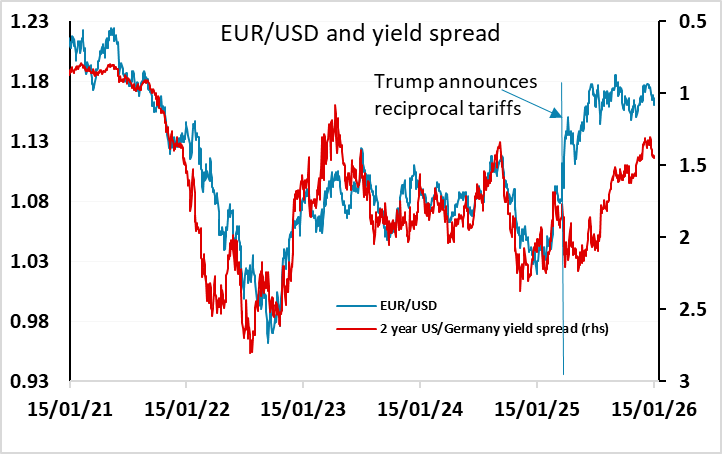

There isn’t much of significance due on Friday, with US industrial production data rarely market moving. The underlying firm USD tone consequently looks likely to persist. EUR strength that started last April on the declaration of reciprocal tariffs is starting to fade, and a reconnection with the historic yield spread relationship would suggest scope for a decline to the 1.13 region for EUR/USD. We don’t expect this to happen quickly, but the latest US data is confounding expectations of US slowdown and may make it hard for the market to continue to price in two US rate cuts next year, in which case the recent USD strength is likely to extend.

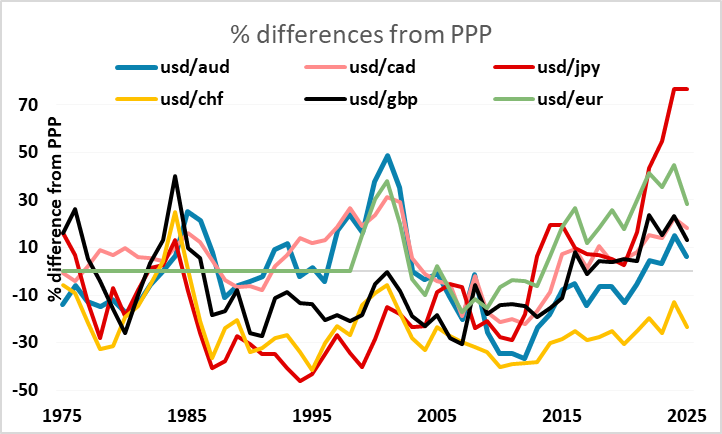

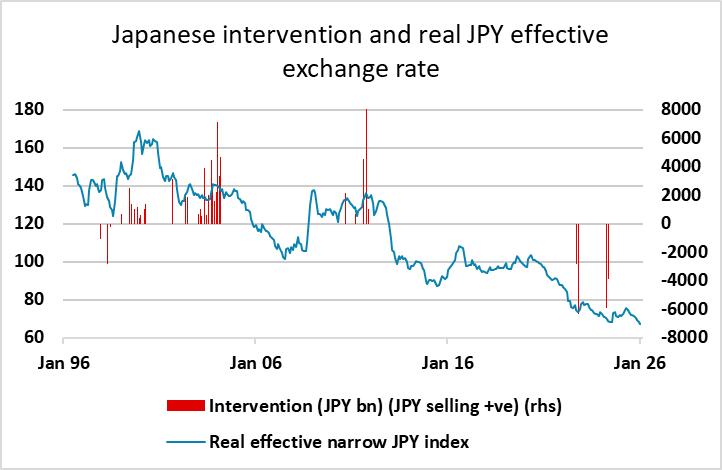

The scope for USD gains against the JPY looks more restricted due to opposition from the Japanese authorities and, perhaps more importantly, opposition from US Treasury Secretary Bessent. The JPY is already not only at record lows on a real trade-weighted basis, but is weaker than any of the major currencies have ever been against the USD. This despite Japan still running a substantial current account surplus and holding the world’s largest net international investment surplus. The Japanese authorities still seem reluctant to use physical FX intervention, and this may be more the case in the run up to what looks likely to be a February election. But the previous administration intervened close to these levels in 2022 and 2024, and it would be surprising if the current government were to allow further weakness given both their own concern about the impact on the cost of living and the concerns from the US.

There may therefore be substantial downside risks for EUR/JPY, which hit all time highs once again this week but recorded a reversal day on Wednesday. EUR/JPY has broken away from the relationship with equity risk premia that it followed for much of the last 10 years, but we see scope for a fall back towards the 170 area which would be consistent with this relationship. However, this is a longer term target, and we continue to expect BoJ intervention to be required to turn JPY sentiment.

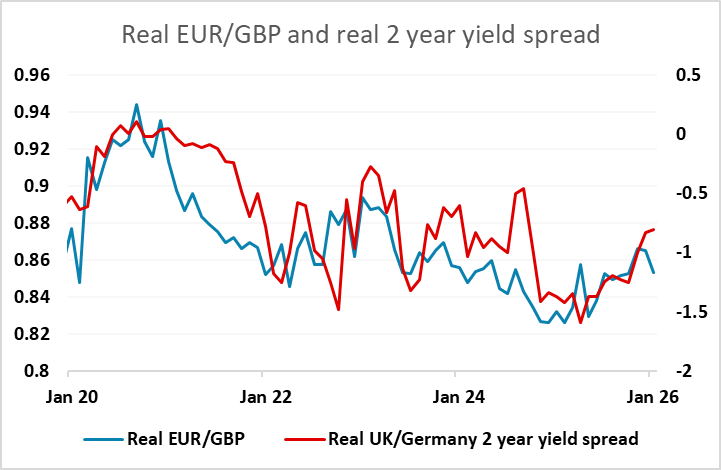

Despite stronger than expected UK November GDP data on Thursday, GBP actually slipped lower against the EUR on the day, suggesting that levels below 0.8650 in EUR/GBP will be hard to achieve. Some of the softness in GBP may have been due to the larger than expected UK November trade deficit, but the relationship between real EUR/GBP and real yields suggests the risks for EUR/GBP are on the upside.