FX Daily Strategy: Asia, November 26th

GBP risks on the downside on UK Budget…

…but major losses unlikely with fiscal approach likely to be broadly “responsible”

NZD risks on RBNZ balanced

Little impact likely from delayed US durable goods data

GBP risks on the downside on UK Budget…

…but major losses unlikely with fiscal approach likely to be broadly “responsible”

NZD risks on RBNZ balanced

Little impact likely from delayed US durable goods data

The UK Budget looks like the main event for Wednesday. What is clear is that amid several factors, a marked fiscal tightening is in store. This though now seems as if it will be less sizeable than markets and even the Chancellor was hinting even a week or two ago. The rationale behind this fiscal reassessment (which seemingly allows the government to avoid breaking its electoral tax promises) will be as important as the form and timing of the budget consolidation measures themselves. What the estimated economic impact will be is also keenly awaited, not least as a harsher fiscal picture for the next 2-3 years should make the BoE less divided over the size and speed of Bank Rate cuts.

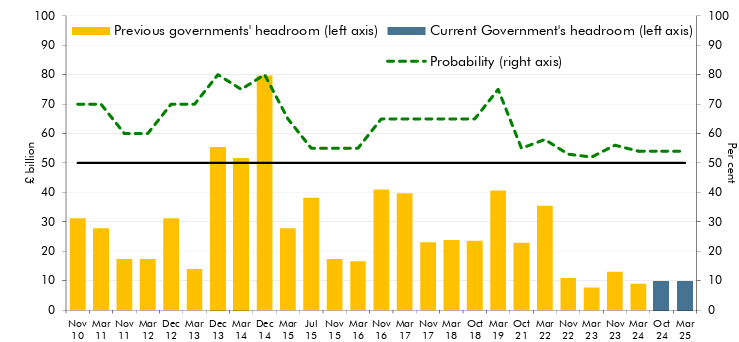

Current Fiscal Headroom Historically Tiny

Source: OBR (March 2025), Probability of hitting the fiscal target & successive headroom forecasts

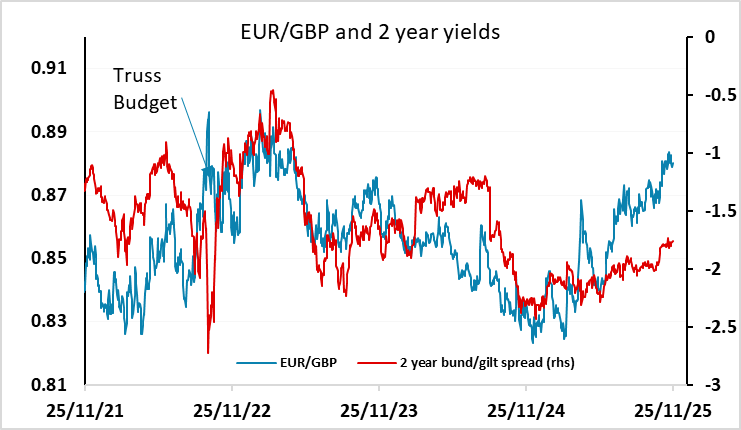

As it stands, the market is pricing a December rate cut from the BoE as an 87% chance, and it’s hard to see how a cut will be avoided if the Budget enacts the expected fiscal tightening, unless that tightening is delayed until the end of the parliament. Such a policy would be an unusually politically short-sighted approach, as end of parliament fiscal tightenings are not usually conducive to re-election. So the Budget is likely to be tight enough to persuade at least one of the five MPC members who voted for no change in rates in November to vote for a cut in December. But given the high probability already attached to a cut, any negative impact on GBP should be modest. More dangerous for the pound would be a Budget that is seen as failing to properly address UK fiscal problems. That sort of Budget led to the simultaneous sharp decline in GBP and sharp rise in UK yields in 2022. An outright failure on these grounds seems unlikely, but the Budget could be seen to be a rather patchwork attempt, with a lot of politically motivated concessions, so we would not expect a particularly positive response. Even so, we doubt any negative impact will be sufficient to propel EUR/GBP back above the recent highs of the year at 0.8865.

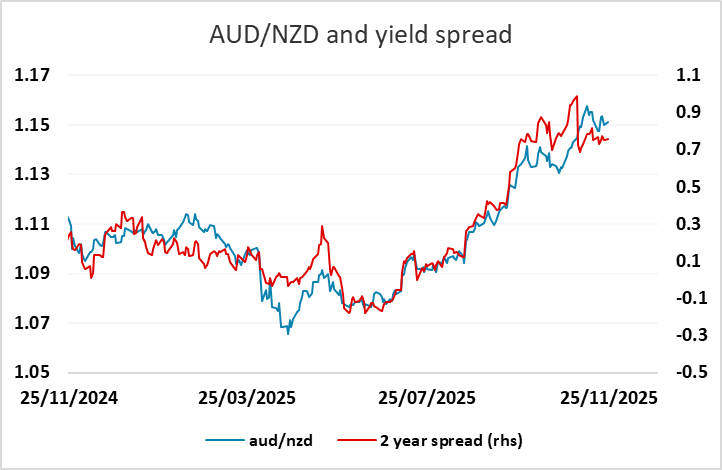

Before the UK budget there is the RBNZ rate decision and Australian October CPI data. A 25bp rate cut is more than fully priced in for the RBNZ, with a minor risk seen of a 50bp cut. A 25bp cut is unlikely to have much impact, given the pricing, with any FX move likely to depend on any signal from the RBNZ about future rate cut prospects. As it stands, the market is priced for a total of 40bps of cuts (including today’s) by mid-2026, so any strong indication that further cuts are likely could be expected to weaken the NZD modestly. A bigger positive impact might be seen if the RBNZ were to suggest that they have finished the easing cycle, although this looks low probability. A 25bp cut with little change to forward guidance would suggest a modest NZD rise, but AUD/NZD would likely hold close to 1.15.

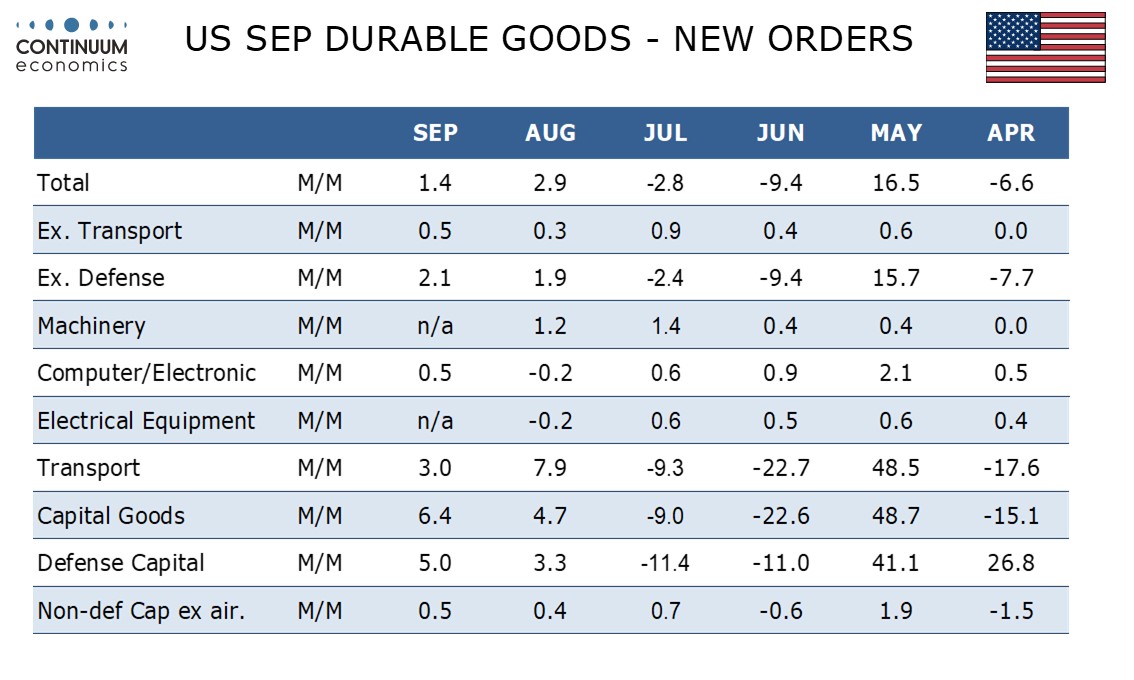

US September durable goods orders data will gain some attention given the dearth of US data in recent weeks, even though it is old and likely boosted by Boing orders that can be expected to fall back in October. We expect an increase of 1.4% with a 0.5% increase ex transport, a fifth straight modest rise in the latter showing a clearly if not strongly positive trend. While market consensus is slightly weaker, we doubt the data will have a notable market impact.