Preview: Due December 13 - U.S. November PPI - Weak, but less so than October

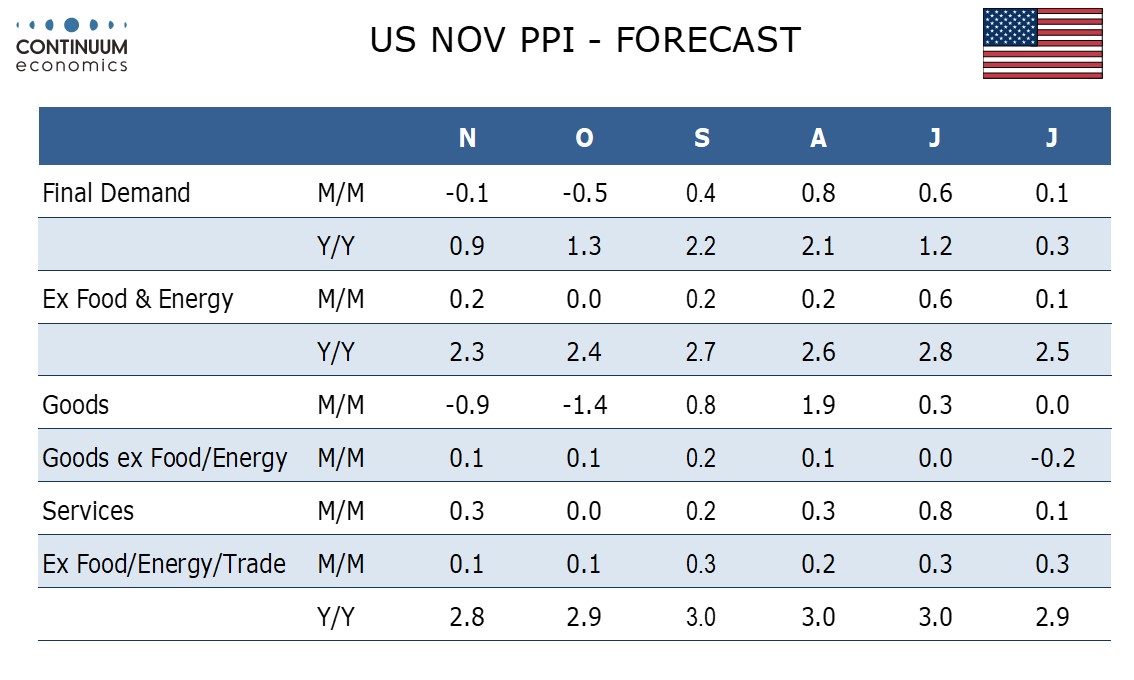

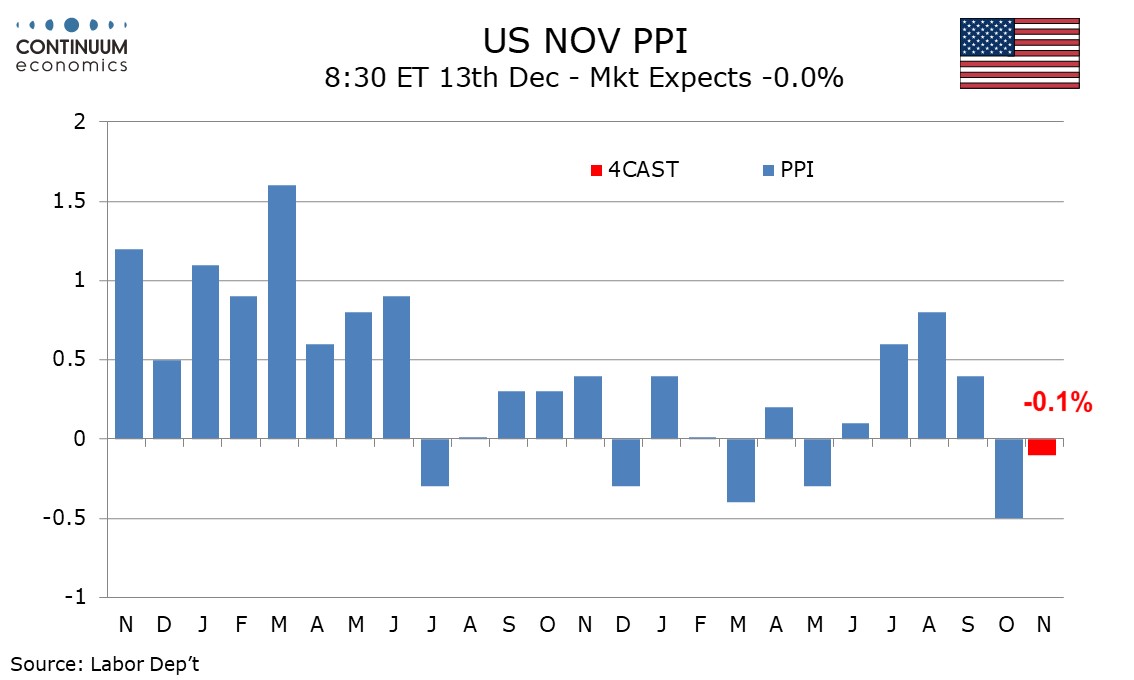

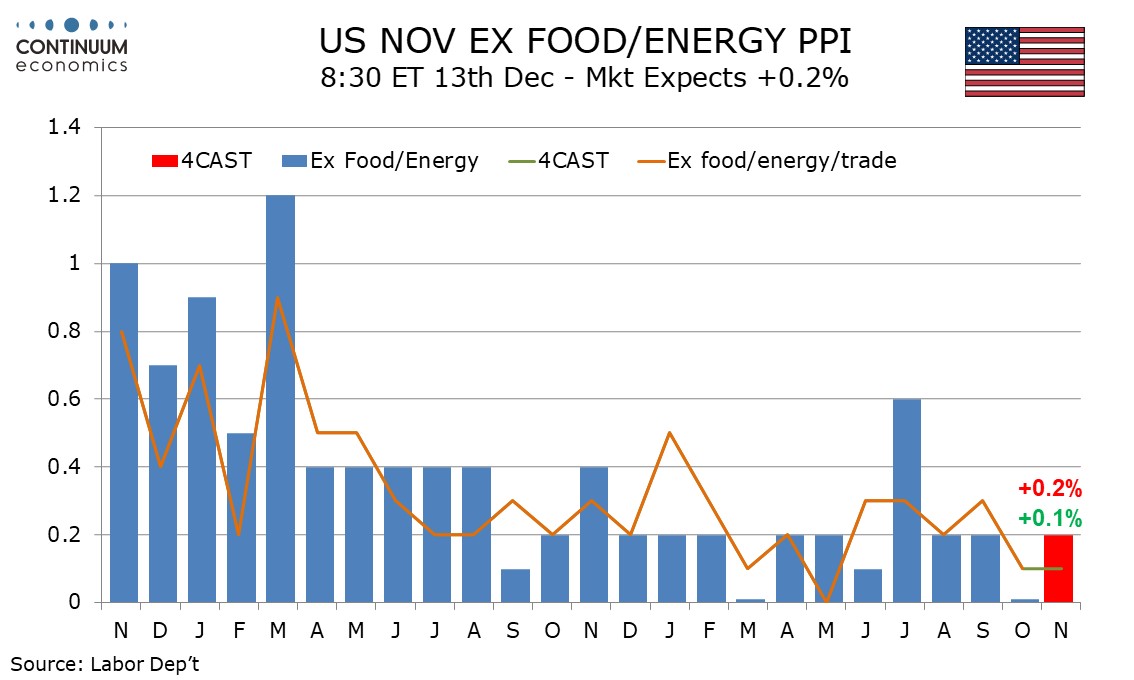

We expect a weak November PPI with a decline of 0.1%, if less steep than October's 0.5% fall, while ex food and energy we expect a 0.2% increase to follow an unchanged October. Ex food, energy and trade we expect a second straight 0.1% increase to confirm a subdued underlying picture.

Gasoline prices continued to decline in October but we doubt November's decline will be quite as steep as October's surprisingly steep fall, while we expect a modest increase in food to follow an October decline. Trend in the core rates has been subdued for the past year and a second straight 0.1% rise ex food, energy and trade would suggest it is becoming increasingly so. However we expect some reversal from a 0.7% October decline in trade prices to lift the ex food and energy rate.

Yr/yr PPI under our forecast would slip to 0.9% from 1.3%. The ex food and energy pace would slip marginally to 2.3% from 2.4% while ex food, energy and trade would slip to 2.8% from 2.9%. The core rates would be the lowest since January 2021 ex food and energy and February 2021 ex food, energy and trade.