GBP flows: GBP little changed after marginally softer than expected CPI

UK CPI marginally softer than expected as air fares reverse July gains. GBP little changed but EUR/GBP close to the top of the range

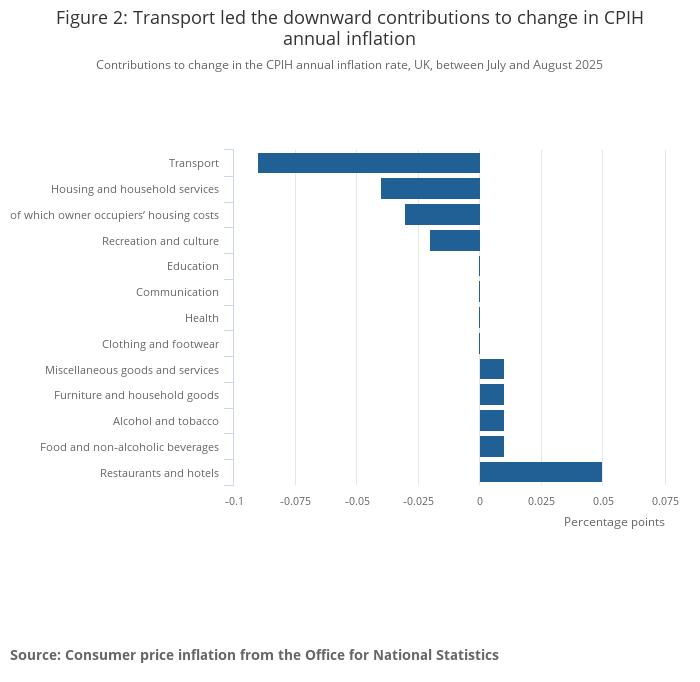

UK August CPI data has come in slightly softer than expected, with the core rate down to 3.6% y/y from 3.8% in July, against a market consensus of 3.7%. Air fares, which boosted the index in July, fell back in August and were the main reason for the lower than expected number. However, the headline CPI was in line with consensus at 3.8% y/y.

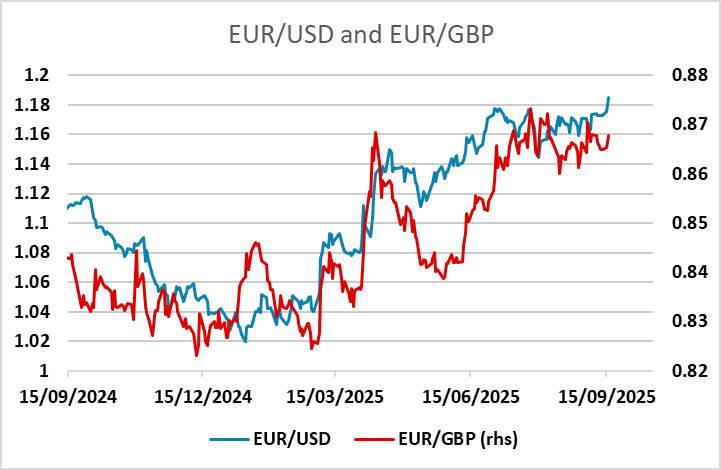

GBP is little changed in response to the data. EUR/GBP firmed up in the North American session yesterday, challenging the top of the range at 0.87, but there has been only a marginal reaction to the UK data, which certainly won’t make any real difference to Bank of England thinking. There is still next to no chance of any rate cut at tomorrow’s MPC meeting. There is therefore no clear rationale for a break of the 0.86-0.87 range, but the gains yesterday came on the back of general EUR strength, itself related to underlying USD weakness. If we see more USD weakness following today’s FOMC, there is scope for EUR/GBP to break higher, but as we note in today’s daily, the risks on the FOMC may be on the USD upside, as there is a lot of easing priced in and the Fed dots are likely to fall short of market pricing.