FX Daily Strategy: N America, Sep 19th

Japanese CPI has little impact

BoJ Kept Rates Unchanged

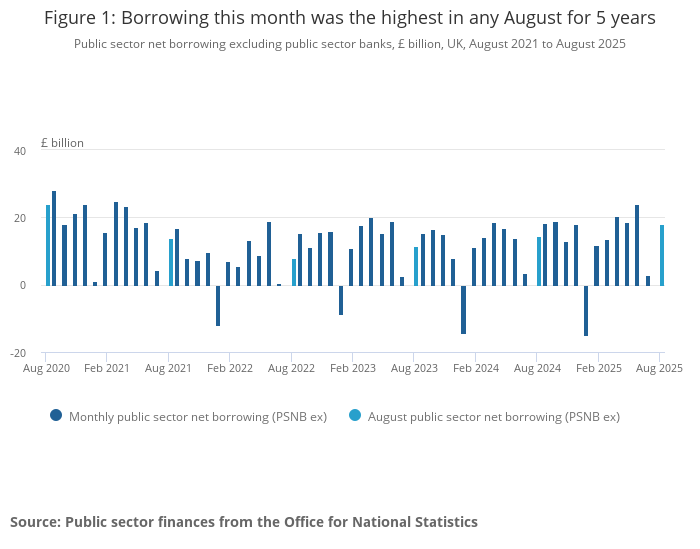

GBP slips on higher than expected public borrowing

CAD may see further weakness

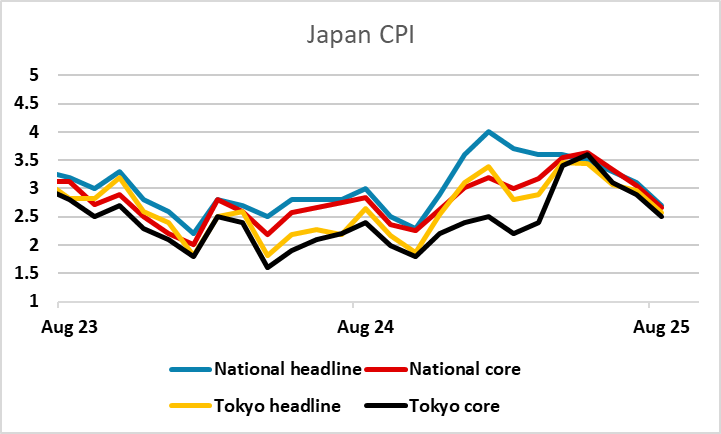

Japanese CPI has little impact

BoJ Kept Rates Unchanged

GBP slips on higher than expected public borrowing

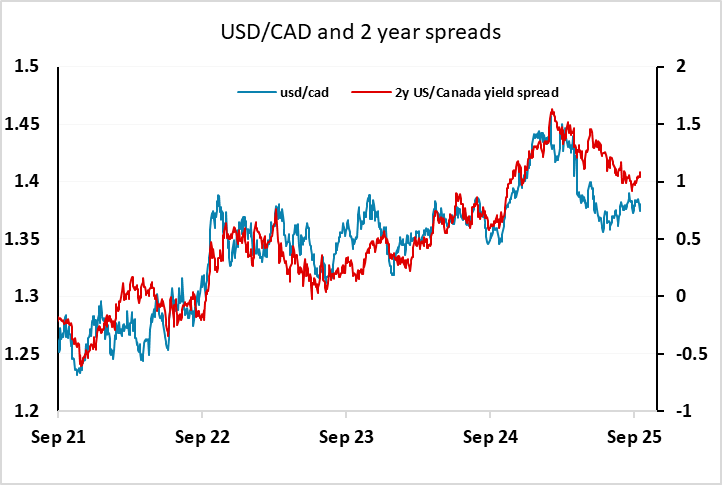

CAD may see further weakness

As usual, Japanese CPI was well trailed by the Tokyo CPI data already released. The national numbers have been generally slightly higher than the Tokyo data, and the market expectation was that they will remain 0.1% above the Tokyo y/y at 2.7% this month, and so it proved with ex fresh food also at 2.7%. However, ex fresh food and energy remain elevated at 3.3%, suggest underlying inflation remains solid. Such data didn't sway the result of the BoJ meeting as they are waiting for the October LDP election.

The BoJ has kept rates unchanged at 0.5% in the September 19th meeting with two votes of dissent. It came as no surprise for the BoJ as there is current political uncertainty until the October 4 LDP election. However, current inflationary dynamics are supportive and the clarity from the U.S.-Japan trade front seems to have freed the BoJ's hand for some indirect tightening. They have announced the "disposal" of ETFs and J-REIT at approximately 0.05% of trading values in the market or equivalent to "stocks purchased from financial institution". While the beginning date is to be announced, it is the first change to BoJ's holding of ETFs and J-REITs since the March 2024 meeting. While it is not as direct tightening as selling JGB, it is still a kind of shrinking of the bank's balance sheet and drains some liquidity.

UK retail sales came in marginally stronger than expected, but GBP has nevertheless weakened in the aftermath, with EUR/GBP pushing above the key 0.87 level, with the much larger than expected public sector borrowing requirement for August at £18.0 bn undermining GBP sentiment. This will put further pressure on Chancellor Reeves to tighten fiscal policy at the November budget (unless we see an improvement in the September and October numbers) so is more significant for GBP than the modest beat in retail sales. EUR/GBP is trading at its highest since August 7th, and should now hold above 0.87 short term, but at this stage we wouldn’t expect progress to test the July 28th high at 0.8763.

There isn’t normally much interest in Canadian retail sales, partly because the data is somewhat out of date, these numbers being for July (although there is an indication for August included). However, the recent weakness of the Canadian data and the data sensitivity of the BoC means there may be more interest than usual. The rise in US yields on Thursday did trigger a general USD recovery after softness in the last week, and this may signal further gains for USD/CAD if the perception of economic weakness persists. Yield spreads suggest scope for a move towards 1.40.