FX Daily Strategy: Europe, January 5th

US employment risks slightly on the strong side

USD to remain well supported

EUR may fall back as core inflation continues to ease

CHF strength looks overdone

US employment risks slightly on the strong side

USD to remain well supported

EUR may fall back as core inflation continues to ease

CHF strength looks overdone

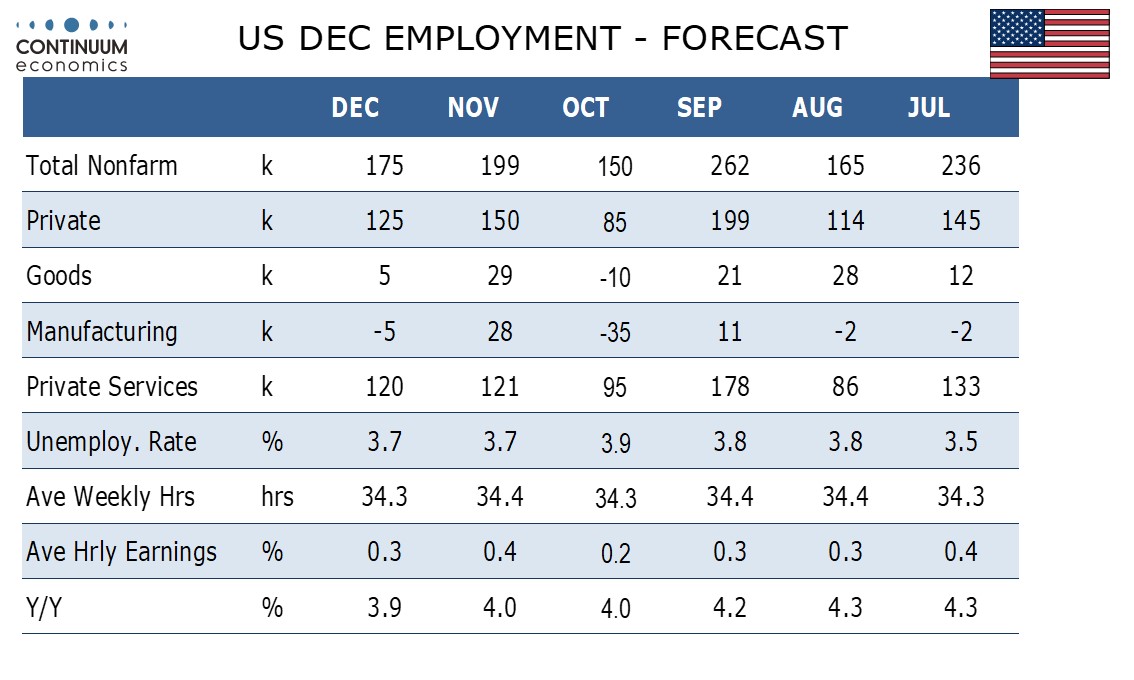

The US employment report dominates Friday’s calendar. We expect a 175k increase in December’s non-farm payroll, with private payrolls up by 125k, which would be consistent with recent trend, though risk may lean to the upside. We expect an unchanged unemployment rate of 3.7% and a 0.3% increase in average hourly earnings. These numbers are essentially in line with market consensus, although the consensus expected the unemployment rate to rise slightly to 3.8%. The stronger than expected ADP data doesn’t lead us to make any change to our forecast, given the lack of predictive power from ADP in recent months, but it does support our view that the risks are towards a stronger number.

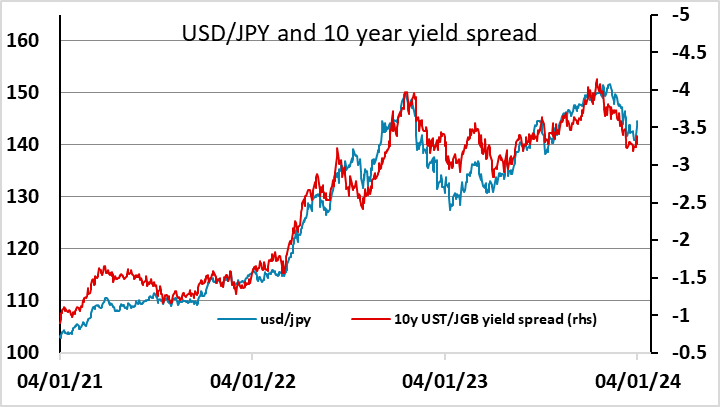

The USD has had a strong week, particularly against the JPY, and has been buoyed by higher yields along the curve. As was the case last year, this has led to widening spreads versus the JPY, but less widening against the European currencies; hence the JPY underperformance. But JPY weakness looks a bit overdone relative to yield spreads, so strong data may be required to sustain USD/JPY strength, particularly now USD/JPY has hit a technical target at 144.70.

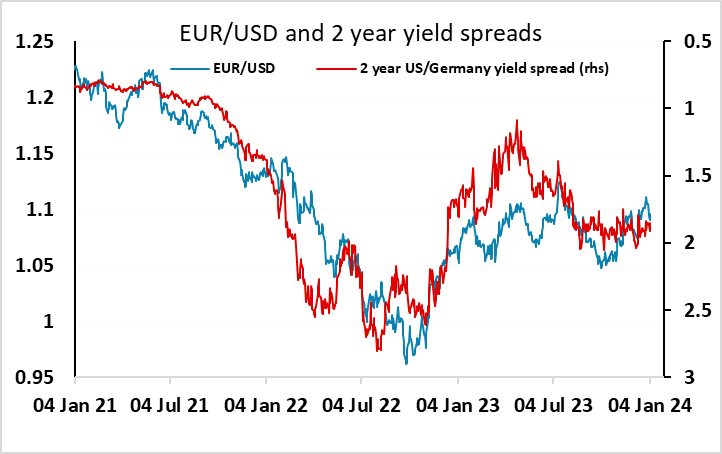

For EUR/USD, yield spreads have only moved modestly, with the data over the last week supporting a rise in EUR yields. Some evidence of stabilisation in the money data, an upward revision in PMIs and a bounce (albeit expected) in German and French CPI have all helped to ensure that EUR yields broadly kept pace with the rise in US yields. There is preliminary December CPI data for the Eurozone as a whole due on Friday, and the headline number should show a similar bounce to the German and French numbers, but we would expect the core rate to ease slightly y/y. This should limit the EUR upside for now, and given the risks being towards a strong employment report the bias may be towards a break back below 1.09 rather than a move above 1.10.

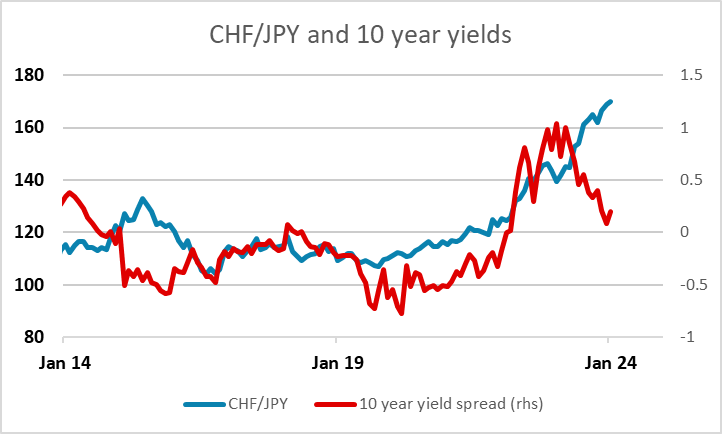

Perhaps most surprising so far this year has been the strength of the Swiss franc. EUR/CHF has hit its all time low (excluding the 2015 spike), and even USD/CHF is at 10 year lows (excluding the 2015 spike). Some of this can be justified by the relatively low level of Swiss inflation in the last few years, which has justified CHF appreciation to maintain purchasing power. But the SNB has been more dovish than others in their latest statement, and was in any case less aggressive in tightening, and Swiss yields have fallen back sharply so that they are now only slightly above Japanese yields. CHF/JPY is testing the all time high above 170, without any real justification from either yield spreads or value, as Japanese inflation has been similarly low. Momentum is in the CHF’s favour, but the SNB has also indicated that it is stopping its selling of FX reserves so it isn’t clear where the support will come from going forward unless there is a major risk negative event.