USD flows: USD softer on downgrade

Moody's downgrade puts the USD under pressure

The USD is starting the European session soft after the Moody’s downgrade of the US at the weekend. The USD generally gapped lower after the decision was announced, and this makes us a little wary of chasing the USD weakness, as gaps are often closed before any new trend can get underway. US yields are higher after the decision, particularly at the long end, but Moody’s are the last rating agency to downgrade the US so the impact on demand for US paper is unlikely to be dramatic.

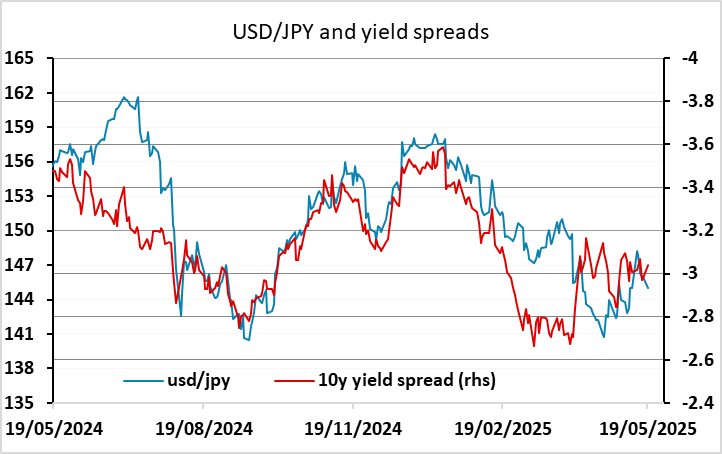

There isn’t a great deal else on today’s calendar to move markets, but the negative equity response to the Moody’s decision may favour the JPY and CHF, with somewhat weaker than expected Chinese retail sales data overnight also suggesting a mild negative tone. However, Japan PM Ishiba saying Japan’s financial situation is worse than Greece and refusing to contemplate debt financed tax cuts may limit enthusiasm for the JPY for now, and we may see a fairly neutral market ahead of the PMI data later in the week.