FX Daily Strategy: Europe, January 12th

Chinese data may set the tone for risk assets

Low risk premia suggest scope for JPY recovery

UK GDP data represents downside risk for GBP

EUR could soften on Lane speech

Chinese data may set the tone for risk assets

Low risk premia suggest scope for JPY recovery

UK GDP data represents downside risk for GBP

EUR could soften on Lane speech

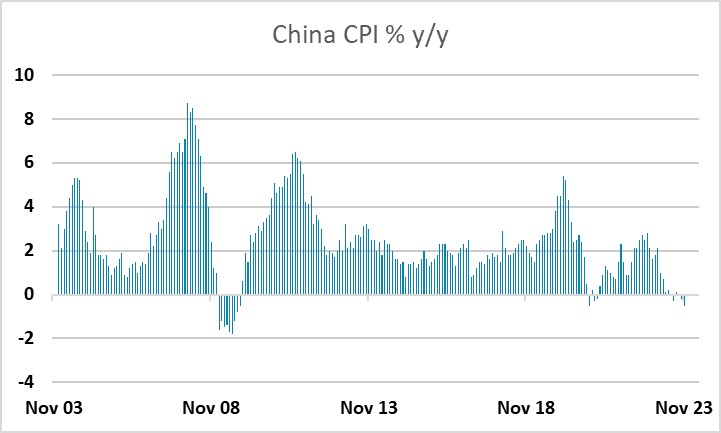

Friday kicks off with Chinese CPI and trade data, which may set the tone for risk sentiment for the day. Chinese CPI has been weak in recent months. The November data equalled the lows seen in the aftermath of the pandemic at the lowest levels since the GFC. A mild recovery in the y/y rate to -0.4% is expected in December, but the low level of inflation does suggest downward pressure on Chinese yields and easy PBOC policy. This might be seen as beneficial for the higher yielders, but only if the low level of Chinese inflation isn’t seen as a signal of a significant downturn. The focus in the trade data is usually the growth in exports and imports rather than the trade balance, although these are volatile month to month and shouldn’t really be seen as a good indicator of activity. However, soft export and import data combined with weak CPI might be seen as telling a story of weakness, and this could undermine risk sentiment.

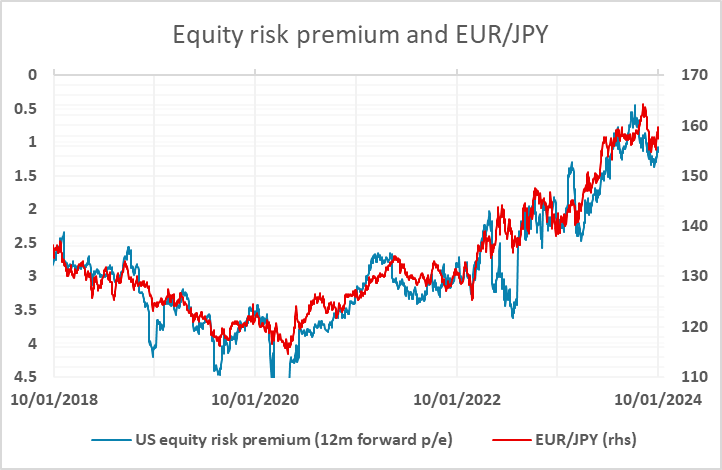

As it stands, US equity risk premia remain quite low, with the S&P500 briefly trading above 4800 on Thursday, getting close to the all time high of 4817 seen at the beginning of 2022. Risk premia have risen a little from the lows as yields have fallen back, but remain at historically low levels. The decline in risk premia has correlated with the decline in the JPY in recent years, and if we see a loss of confidence related to China slowdown the JPY is likely to be the main currency beneficiary. EUR/JPY and CHF/JPY in particular already look extended near 160 and 170 respectively.

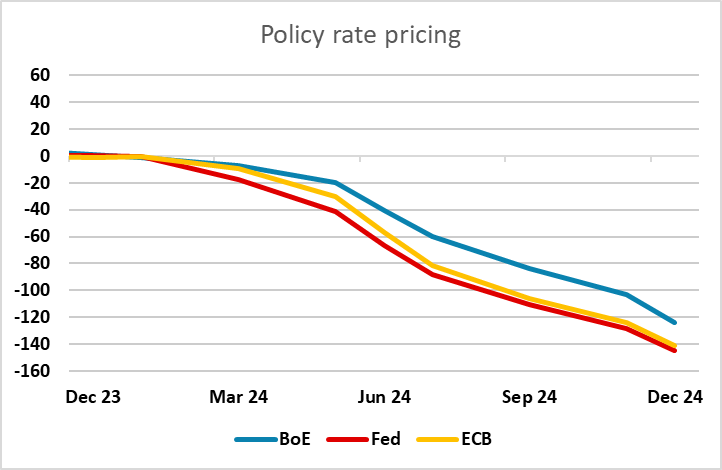

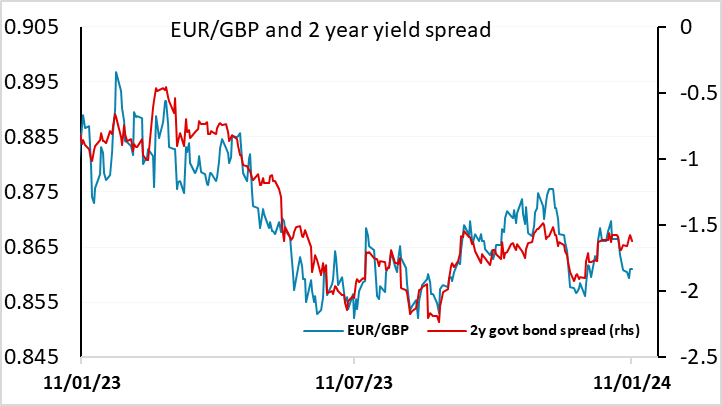

UK GDP data is the most significant data in Europe on Friday, with the market looking for a 0.2% m/m rise in November following the 0.3% decline in October, which was seen to be at least partially weather related. We see downside risk relative to consensus with a 0.1% rise, suggesting downside risks for GBP. Additionally, GBP has outperformed yield spreads of late, and this despite the BoE being priced to ease less sharply than the ECB or the Fed. All in all, the risks looks fairly clearly to the upside in EUR/GBP. However, there should be even more scope for GBP/JPY declines, with GBP/JPY hitting the retracement target above 186 on Thursday.

Otherwise, the US PPI data will be a focus but shouldn’t significantly alter the market interpretation of Thursday’s strongish CPI. This only had a modest positive impact on US yields, with declines in inflation still expected in the coming months, and the high level of US rates justifying expectations of substantial rate cuts. There may be more potential for market reaction to the speech from the ECB chief economist Lane scheduled on Friday. The expected scale of ECB cuts has been pared back a little in recent weeks, but with underlying inflation very subdued in recent months, Lane may indicate a more dovish stance than currently assumed, suggesting some EUR downside risks.