FX Daily Strategy: Asia, February 6th

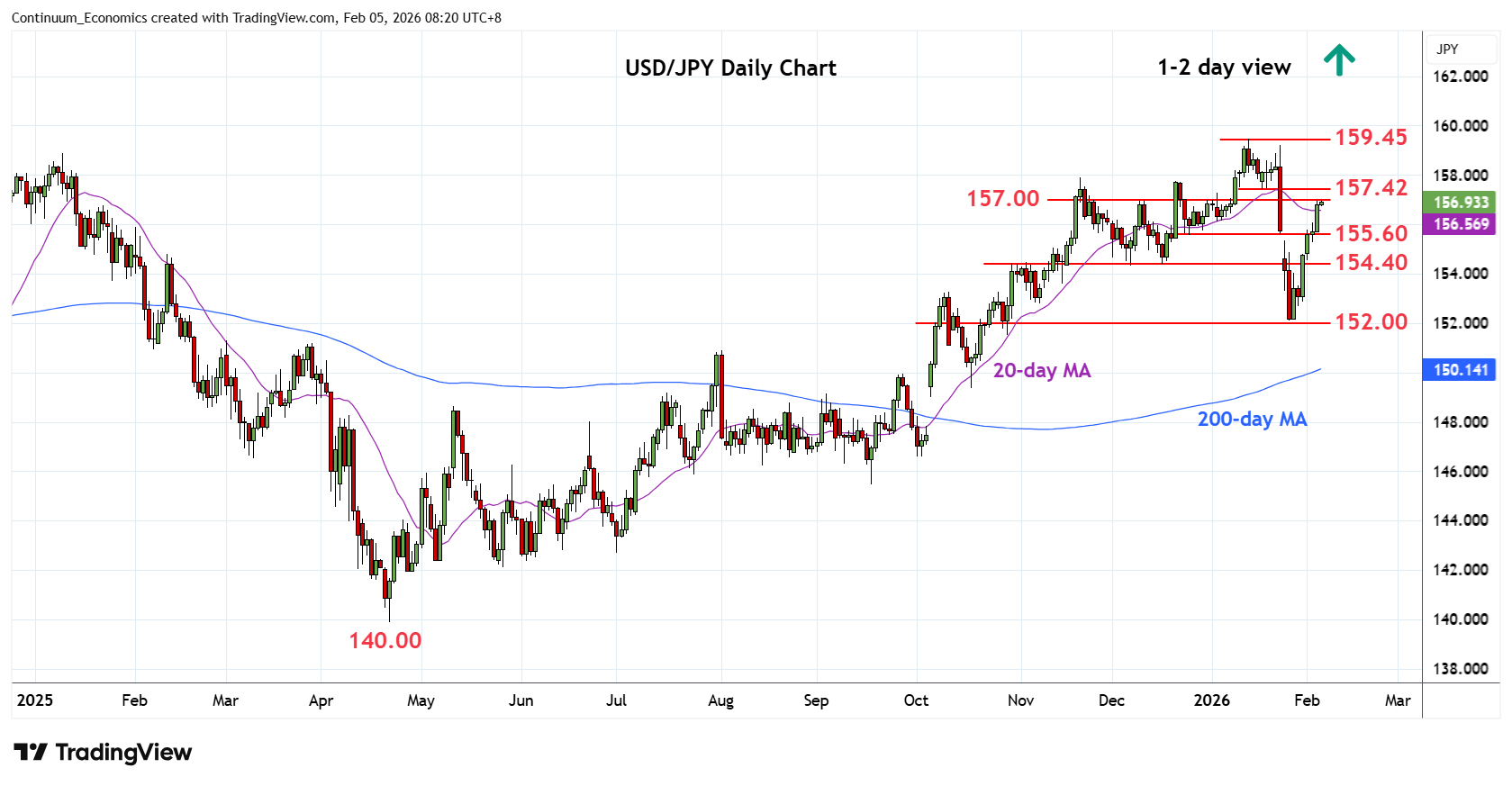

USD/JPY Remain Undecided Until Election Result

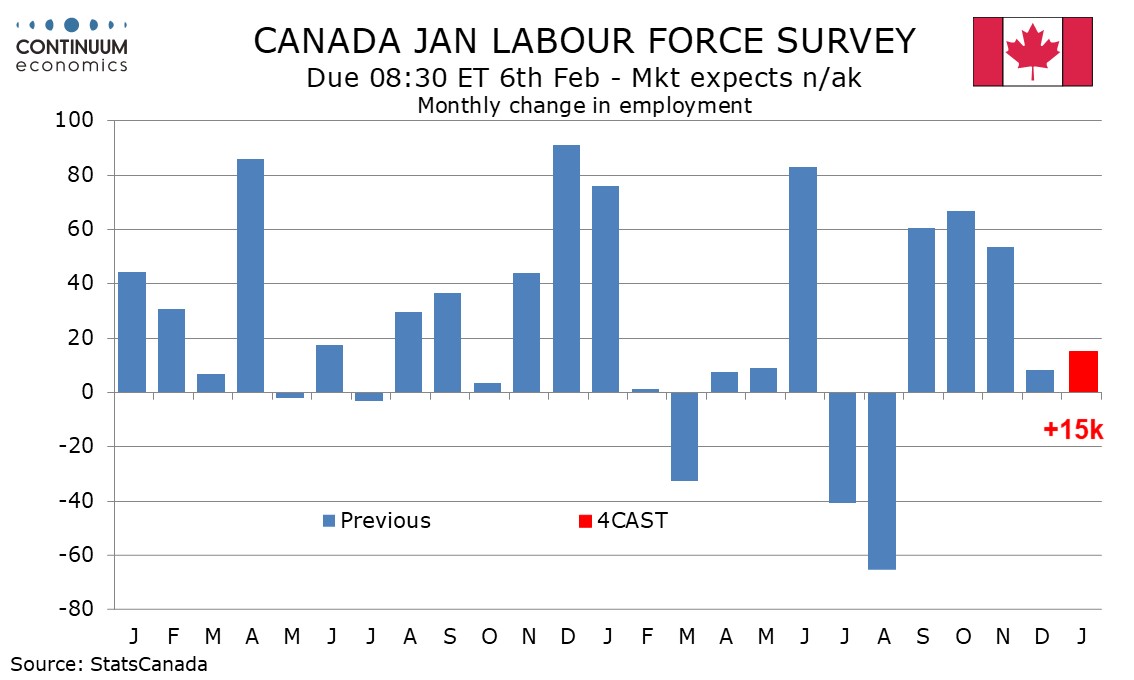

Canada January Employment A second straight subdued month after three strong ones

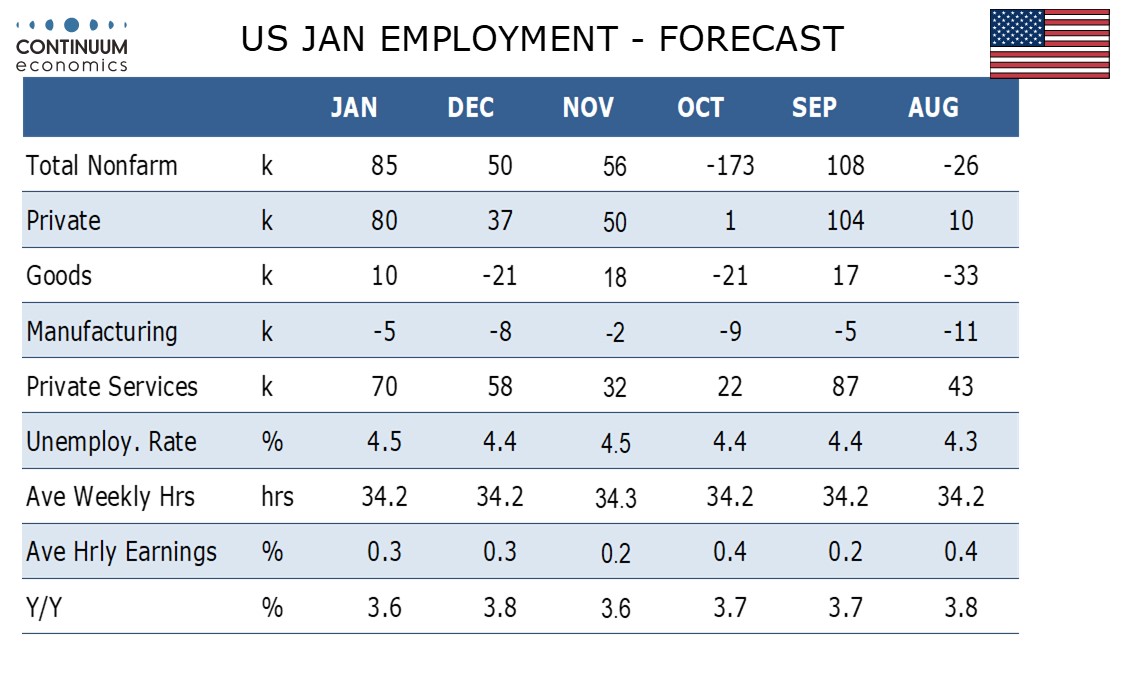

U.S. January NFP To Be Delayed

USD/JPY has once again pick up north bound momentum as market participants. The recent renewed weakness remain on political uncertainty and fiscal burden from the Japanese government. While latest polls are suggest the LDP could regain majority in the Lower House, it does not ease the concern of market participants who are wary of the indebtedness of Japan. They will likely to keep doing so as BoJ hike rates and if without intervention in the bond market. In a short run, most will likely be sidelined unitl the result of election is clear.

On the chart, the pair is extending strong gains from the 152.10 January low to reach the 157.00 level. Positive daily studies keep pressure firmly on the upside and suggest scope for break here to open up room to resistance at the 157.42 congestion and strong resistance at 157.90/158.00 area where reaction is expected. Clearance, if seen, will open up the 159.22/45 highs to retest. Meanwhile, support is raised to the 156.00/155.60 area which should underpin. Would take break here to fade the upside pressure and open up room to 154.40/154.00 support and lower.

We expect Canadian employment to increase by 15k in January, a second straight moderate increase following December’s 8.2k that followed three straight strong gains averaging close to 60k. We expect unemployment to remain at December’s rate of 6.8%, but to fall before rounding. Three strong gains in employment followed steep declines in July and August, and with Q4 GDP shaping up to be significantly slower than Q3’s 2.6% annualized gain we would expect employment growth to enter 2026 with limited momentum. December’s breakdown contained no standouts by industry that imply significant corrections in January.

We expect full-time employment to rise by 10k in January with part-time rising by 5k. December saw full time employment leading as do the six month and twelve month averages, though on a three month average part time is ahead, suggesting it is not due for a bounce despite December’s dip. Unemployment has been volatile in recent months though only November’s 6.5% looks erratic. The rate appears to have peaked at 7.1% in August and September with December’s 6.8% below October’s 6.9%. Before rounding we expect January’s rate to slip to 6.77% from 6.83%, with a flat labor force marking a pause after a surge of 81k in December than more than compensated for a 25.7k dip in November.

The January NFP data will be delayed to Wednesday January 11 due to the brief government shutdown.

We expect January’s non-farm payroll to rise by 85k overall and by 80k in the private sector, which would be on the firm side of trend and could be even more so after what could be substantial negative historical revisions. However, we expect unemployment to rise to 4.5% from 4.4%. We expect average hourly earnings to rise by 0.3%, in line with recent trend. Initial claims remained low in January’s payroll survey week, suggesting layoffs remain limited too. While signals on hiring are also weak January is a month in which before seasonal adjustment payrolls fall sharply, meaning that a low level of layoffs could be more significant than a low level of hirings in seasonally adjusted data.

A sector to watch this month is retail. We have seen three straight declines of near 20k in this sector, despite retail sales holding up well. Limited seasonal hiring before Christmas may mean fewer layoffs than the seasonals assume in January. We expect private services to rise by 70k in January, the strongest since September, the last month in which retail employment increased. An improvement from a 58k increase in December private services will be more than fully explained by the swing in retail. We expect a modest 10k rise in goods employment after a 21k decline in December and this would be a fourth straight month in which goods change direction, construction leading the volatility. Bad weather in late January came too late to be captured in January’s payroll. We expect a marginal 5k rise in government, fully in state and local. Federal is however stabilizing after a sharp drop in October as DOGE payoffs came through.