FOMC Minutes - Progress on Inflation, Caution on Easing

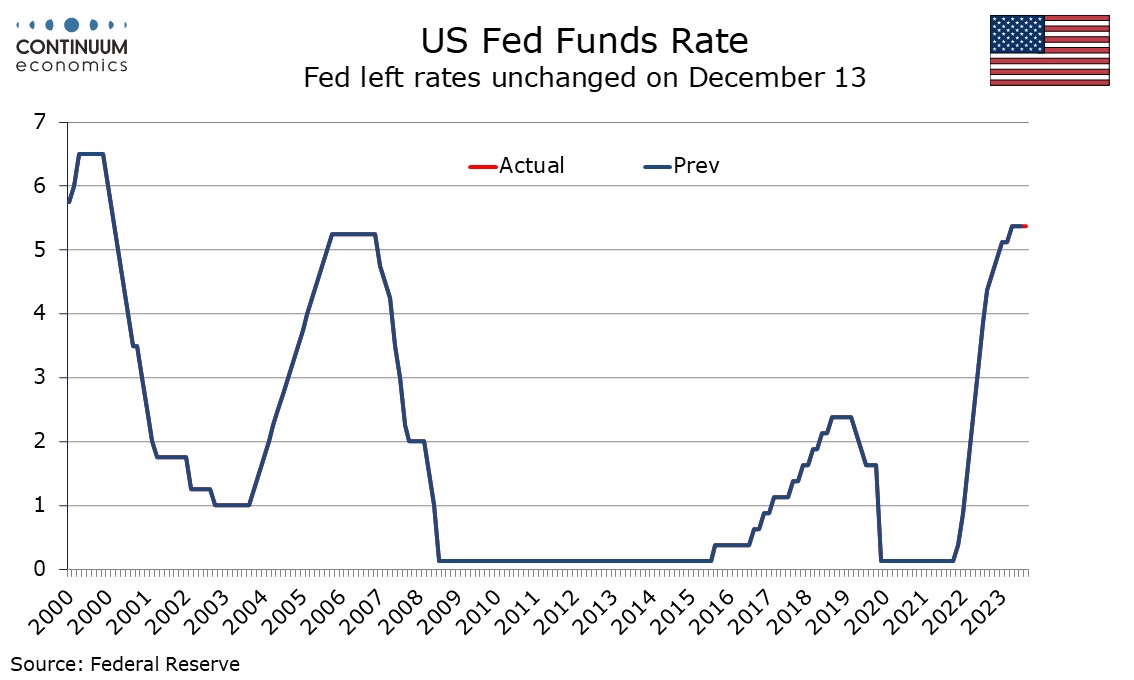

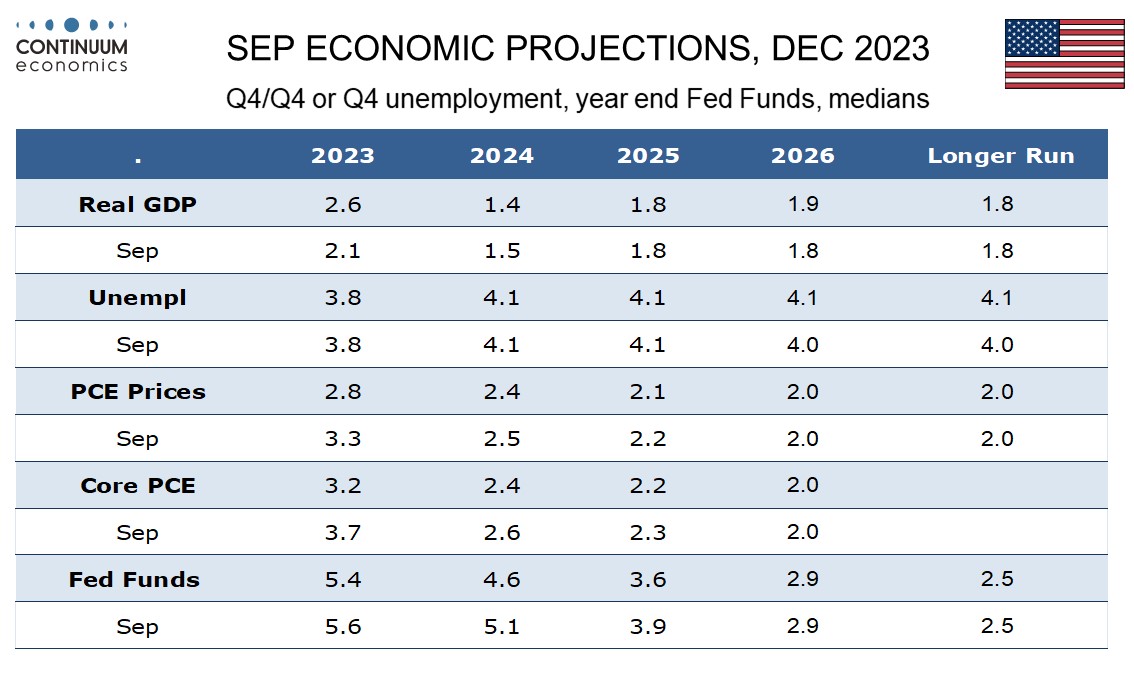

FOMC minutes from December 13 show that while almost all participants expect lower rates to be seen by the end of 2024, they want forecasts to be treated cautiously at this point. Caution over easing and increased confidence that progress is being made on inflation are however both clear in the minutes. If progress on inflation continues, the Fed will start to consider easing, with timing data-dependent.

Participants noted unusually elevated uncertainty and that the economy could evolve in a way that made further tightening appropriate, even though participants agreed rates were likely near or at their peak. Several observed that circumstances might warrant keeping rates at the current level for longer than expected. They reaffirmed the need to keep policy restrictive for some time until inflation was clearly moving down sustainably towards target.

Given that upside risks to inflation were seen as having diminished this gives scope for the FOMC to start contemplating easing should progress on inflation continue, though for now concern that progress on inflation could stall persists. Some did point to downside economic risks associated with potentially overly restrictive policy, though downside economic surprises would not automatically bring easing, with a few concerned with a potential tradeoff between the Fed’s dual mandate goals.

All agreed clear progress had been made on inflation but more evidence was needed before they could feel confident of a return to the 2% target. Uneven progress across components was a concern with core services still elevated, though there was some confidence that a more balanced labor market was easing wage pressures. The minutes reiterate the view seen in the post-meeting statement that Q4 GDP was seen slowing from a strong Q3, but also note uncertainty on the outlook, noting upside risks as well as potential downside ones. Notable were the possibility that momentum may be stronger than assessed and the possibility of easing financial conditions making the inflation goal harder to achieve.

Reducing the balance sheet was seen as an important part of the Fed’s overall approach though several remarked that plans indicated easing and stopping the decline in the balance sheet when reserve balances are somewhat above the level consistent with ample reserves. It was suggested that the FOMC would discuss the technical factors that would guide such a decision well before such a decision is reached.