USD flows: USD up on upward revision to Q2 GDP

USD firmer on upward revision to GDP, particularly against the JPY

The USD is firmer after a stronger than expected Q2 GDP number from the US, revised up to 3.8% annualised from 3.3% due to stronger consumer spending and weaker imports than previously published. The annual GDP revisions didn’t lead to a significant change in back data, so the numbers are clearly on the strong side of expectations, even thoughQ1 was revised down marginally to -0.6%. Even so, the first half of the year remains somewhat below trend, so we doubt the data will change the Fed stance significantly.

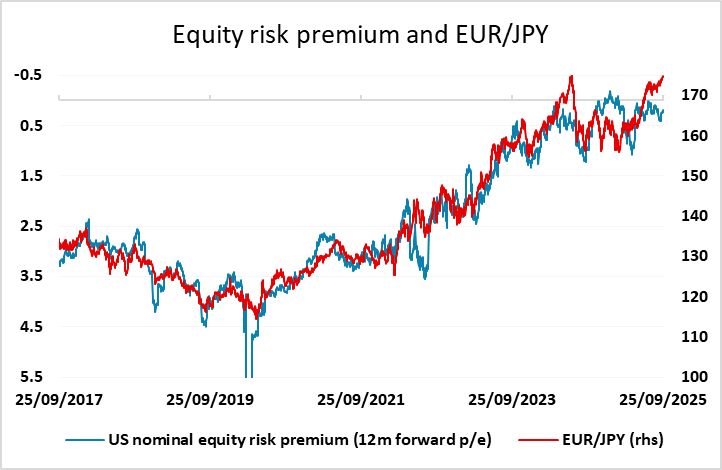

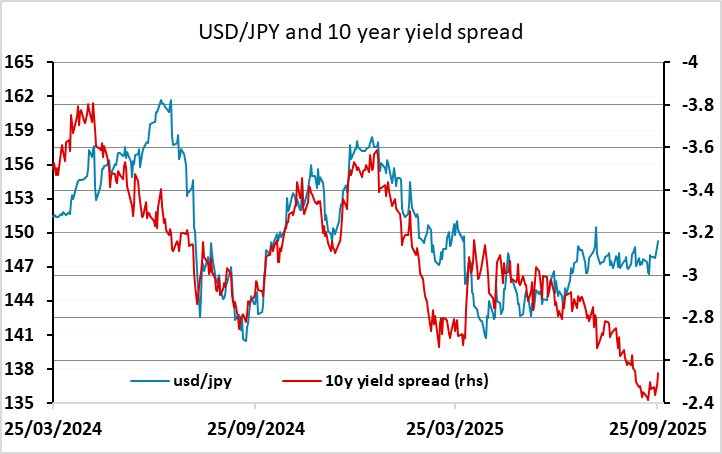

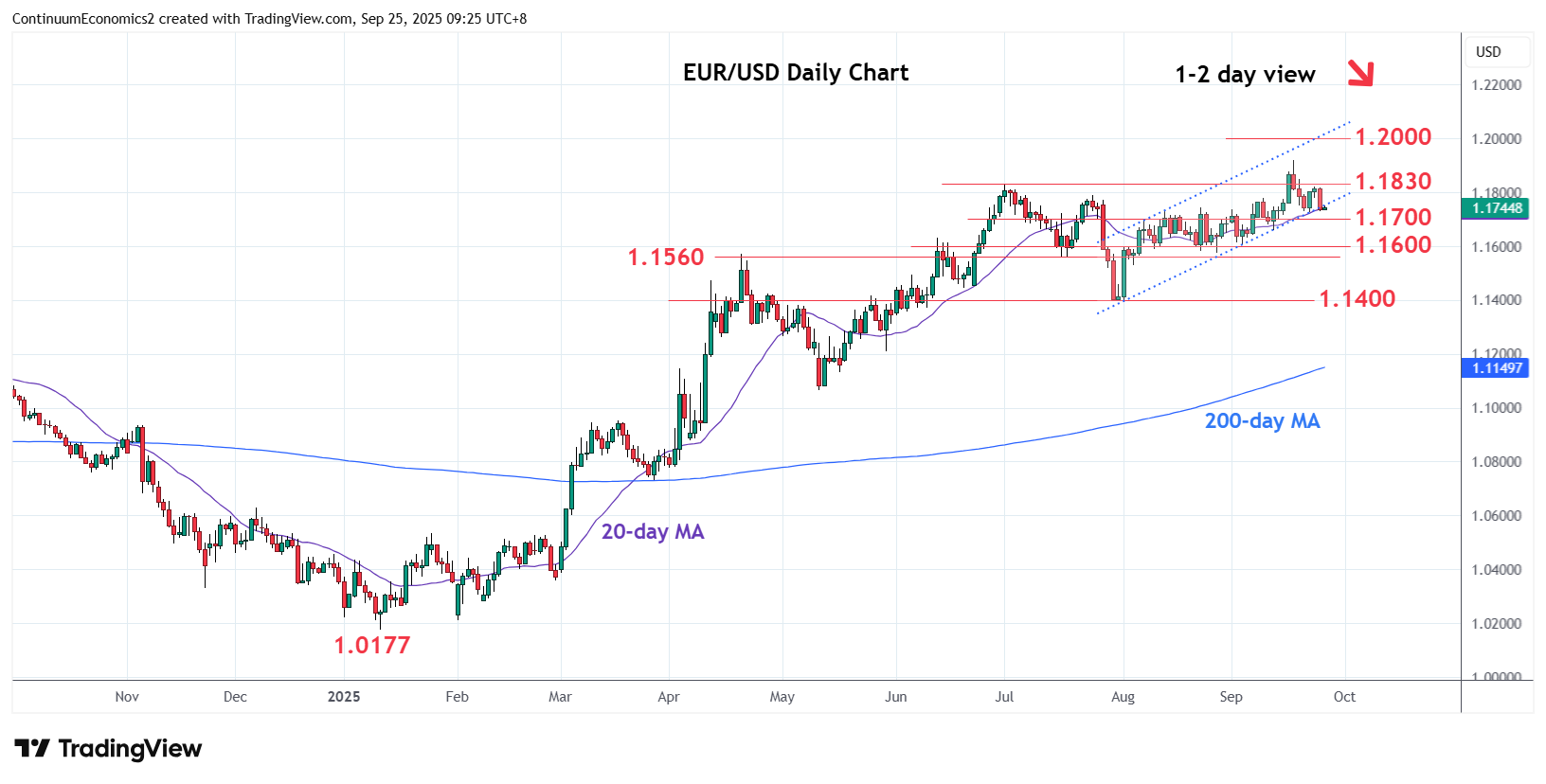

US yields are nevertheless higher and USD/JPY is leading the way up, hitting its highest level since August 1st. Yield spreads still don’t support this gain, but higher US yields mean a lower implied equity risk premium, despite lower equities, maintaining downward pressure on the JPY on the crosses. EUR/USD testing the bottom end of its range at 1.17, but we wouldn’t expect any break to extend far.