FX Daily Strategy: Asia, June 4th

CAD could bounce slightly on BoC leaving rates unchanged…

…but remains vulnerable on the crosses in USD negative environment

ADP and ISM could both be mildly USD negative

Major break in USD ranges still unlikely near term

CAD could bounce slightly on BoC leaving rates unchanged…

…but remains vulnerable on the crosses in USD negative environment

ADP and ISM could both be mildly USD negative

Major break in USD ranges still unlikely near term

Wednesday sees the Bank of Canada rate decision, which is a little more finely balanced in the wake of the latest Trump tariff hike. It is a close call between leaving rates unchanged at 2.75% and a 25bps easing to 2.5%, though we lean to the former. The statement is unlikely to give any forward guidance and we still expect further easing this year as the economy weakens in response to US tariffs.

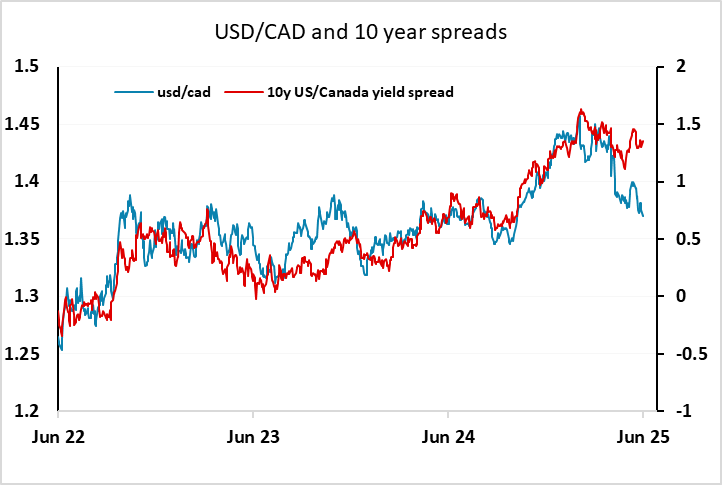

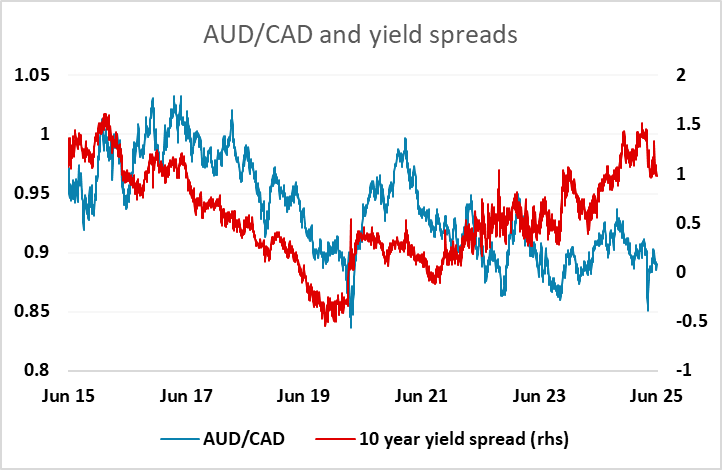

As it stands, the market prices a rate cut as a 27% chance, so the risks of a CAD reaction are greater if we see a cut than if rates are left unchanged. However, USD/CAD, like EUR/USD, has had a much less close correlation with moves in yield spreads since the April tariff announcement than it did beforehand, so even if we do see BoC cut, the reaction may not be dramatic. Having said that, we still see the CAD as vulnerable on the crosses, as it is always likely to struggle on the crosses in a USD negative environment, since declines against the USD have a much bigger impact on the CAD trade-weighted index than on the TWIs of other majors, due to the high proportion of Canadian trade with the US. Additionally, yield spreads suggest scope for substantial gains in AUD/CAD after spreads moved significantly in the AUD’s favour in the last year without much response from the currency. Of course, if the BoC leave rates unchanged as we expect, the CAD may initially edge higher, but we see it as a sell on rallies on crosses, notably versus the AUD.

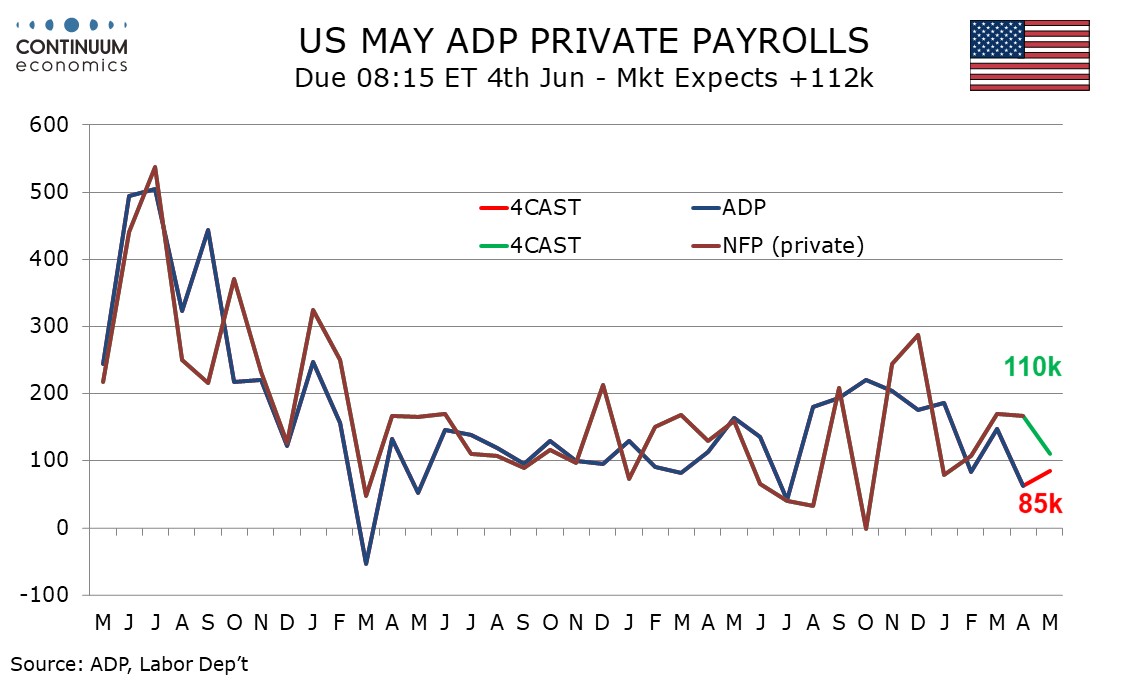

Otherwise, the US ADP employment data will be of interest, even though it isn’t a trustworthy guide to Friday’s BLS employment data. We expect a rise of 85k in May’s ADP estimate for private sector employment growth. This would be stronger than April’s 62k but closer to April than to March’s 147k and thus consistent with a further slowing in trend. We expect ADP data to underperform a 110k rise in May’s private sector non-farm payroll, with overall payrolls to rise by 120k. Our forecast is a little below the consensus so should maintain some mild downward pressure on the USD.

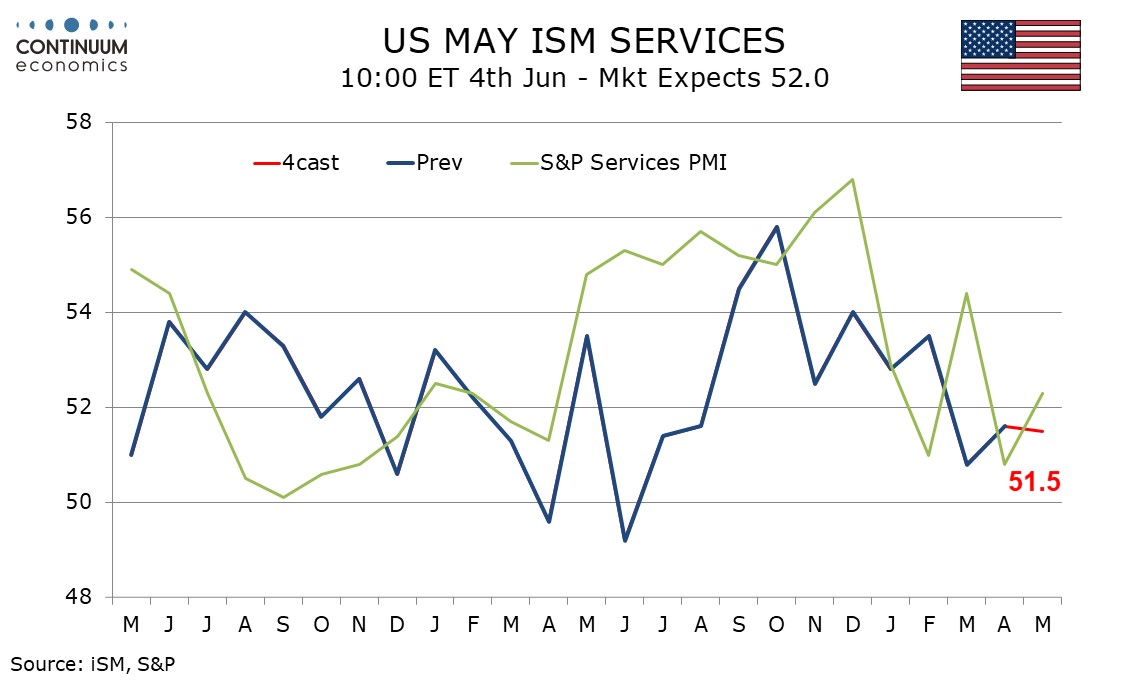

The ISM services data may also weigh on the USD. We expect a May ISM services index of 51.5, almost unchanged from April’s 51.6 that saw a modest recovery from a weaker though still marginally positive 50.8 in March. Market consensus is for a rise to 52.1. The underlying trend has slowed in recent months. While May’s S and P services PMI did correct higher after a weaker April, it too has slowed significantly in recent months and is not a reliable guide to the ISM services index. Most Fed regional service sector surveys remained negative in May, though the Kansas City Fed services index did see a bounce.

In general, the USD remains slightly on the back foot, even though it managed something of a recovery on Tuesday. The data this week could be significant, but we doubt that it will be sufficiently weak to trigger a break of the recent ranges, or sufficiently strong to change the underlying negative USD tone. Tariff news remains the most likely trigger for a significant market reaction, with the real sector data still not likely to show much impact from tariffs in the immediate future.