FX Weekly Strategy: January 19th-23rd

Data may take a back seat

Equity correction needed to extend JPY recovery

AUD favoured over EUR if markets stay risk positive

GBP could suffer on UK labour market data

Strategy for the week ahead

Data may take a back seat

Equity correction needed to extend JPY recovery

AUD favoured over EUR if markets stay risk positive

GBP could suffer on UK labour market data

While there will be some focus on the US jobless claims data on Thursday, which cover the survey week for the January employment report, and on the preliminary S&P PMIs for January on Friday, it seems unlikely that the week’s data will significantly change the impression of a solid US economy and a weaker but still satisfactory performance from Europe. This is the story that is priced into markets, and has led to a strong USD in the first half of January. But there are risks to the current status quo in potential geopolitical news and a ruling from the Supreme Court on tariffs. While it seems unlikely that the data will disturb the underlying economic view, there could be an impact on equity markets, which continue to price a very optimistic scenario both for AI and for growth in general.

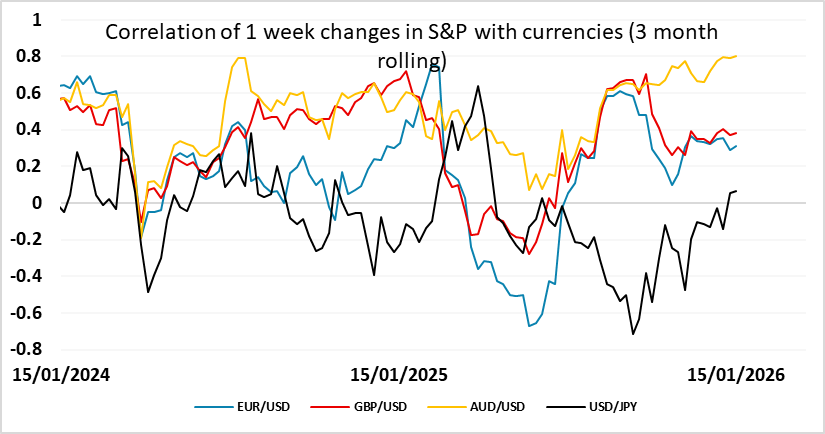

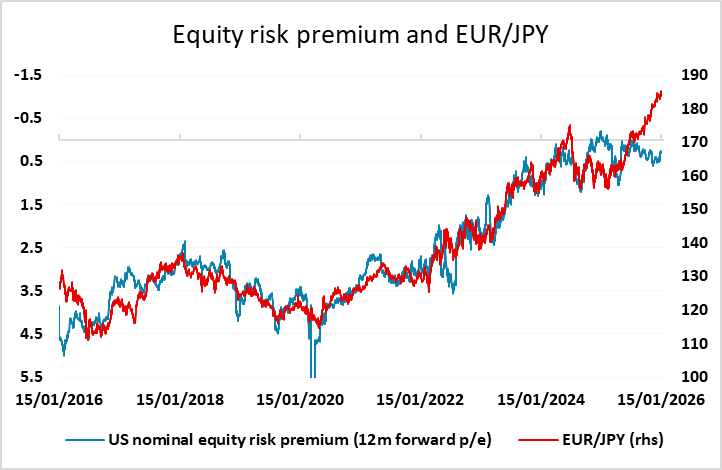

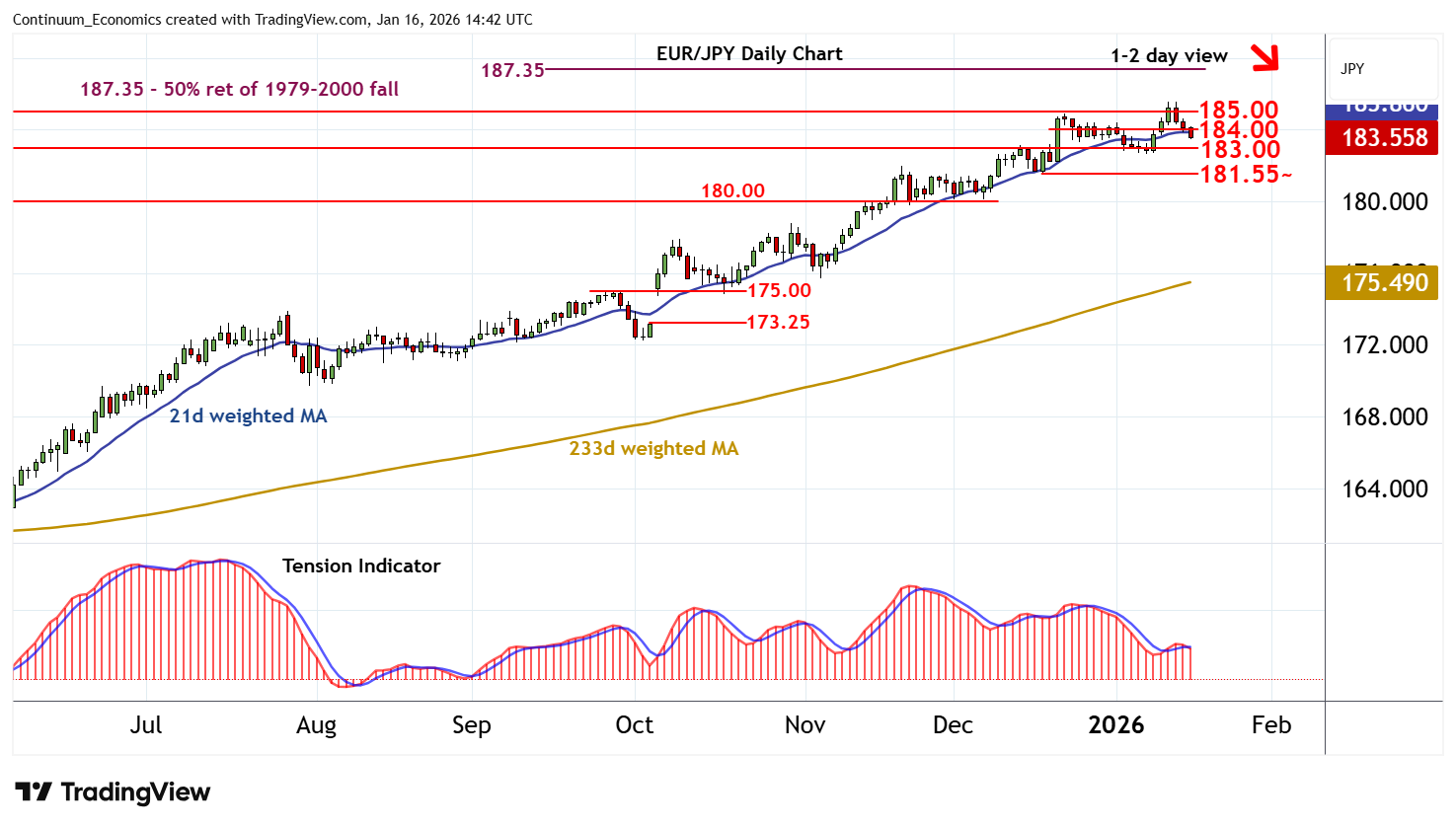

It isn’t clear what impact a correction in equities would have on the USD or the FX market in general. Usually, equity weakness is favourable for the JPY, CHF and USD and undermines the commodity currencies and GBP. Correlations show that this is still broadly the case. But the strength of equities has been US focused, so in this case it is less clear that the USD would benefit from any drop. Probably the clearest implication would be gains for the JPY on the crosses. The JPY has typically benefited on the crosses in recent years from any rise in risk premia, and while this relationship faded through last year, there has still been a tendency for the JPY to weaken with any rise in equity indices. Last week saw some evidence that the strong uptrend in EUR/JPY is under threat, with JPY bears reluctant to push their luck against the threat of Japanese (and possibly even US) intervention. So far, the JPY recovery is just a correction, and may well be another false dawn for JPY bulls. But any equity market correction could trigger an acceleration if we break key supports in EUR/JPY near 182.50.

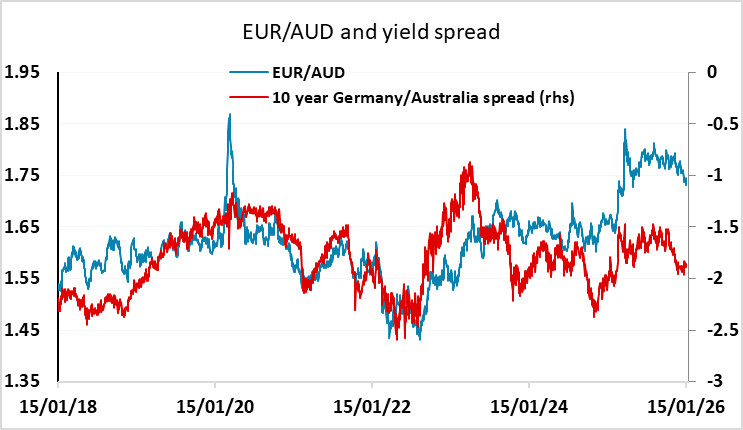

Since April, EUR/USD has outperformed its normal relationship with yield spreads, while the JPY and AUD have both substantially underperformed their historic correction. If equity markets stay strong, the AUD has potential to renew gains above 0.67 and outperform the EUR, which has been slipping back towards its usual relationship with yield spreads in the first couple of weeks of the year. But if risk sentiment turns sour, the AUD and EUR can both be expected to struggle against the JPY, even if their performance against the USD is less certainly negative than it would normally be.

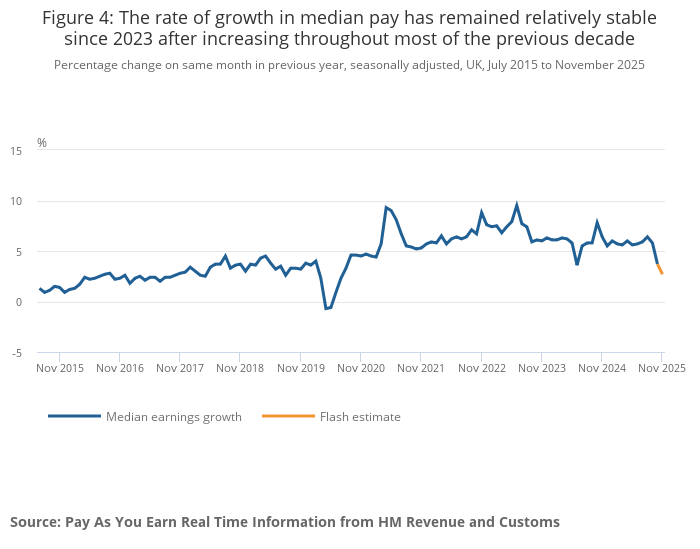

The data that looks potentially most interesting this week is the UK labour market and CPI data. Stronger than expected November GDP data from the UK last week failed to extend GBP’s recent gains against the EUR, suggesting that the pound might now be vulnerable if there is further evidence of weakening in wage and price growth. The labour market data has certainly show a significant decline in both employment and wage growth of late. GBP is already trading above levels consistent with real yield spreads against the EUR, so any increase in rate cut expectations as a result of the UK data ma be enough to propel EUR/GBP back above 0.87.

Data and events for the week ahead

USA

The US week starts quietly and there will be little Fed talk ahead of the January 28 rates decision. Wednesday sees December pending home sales, where trend has recently been picking up, and construction spending data for September and October. The latter could impact Thursday’s Q3 GDP revision, which we currently expect to be revised marginally higher to 4.4% from 4.3%, with no revisions to the price indices.

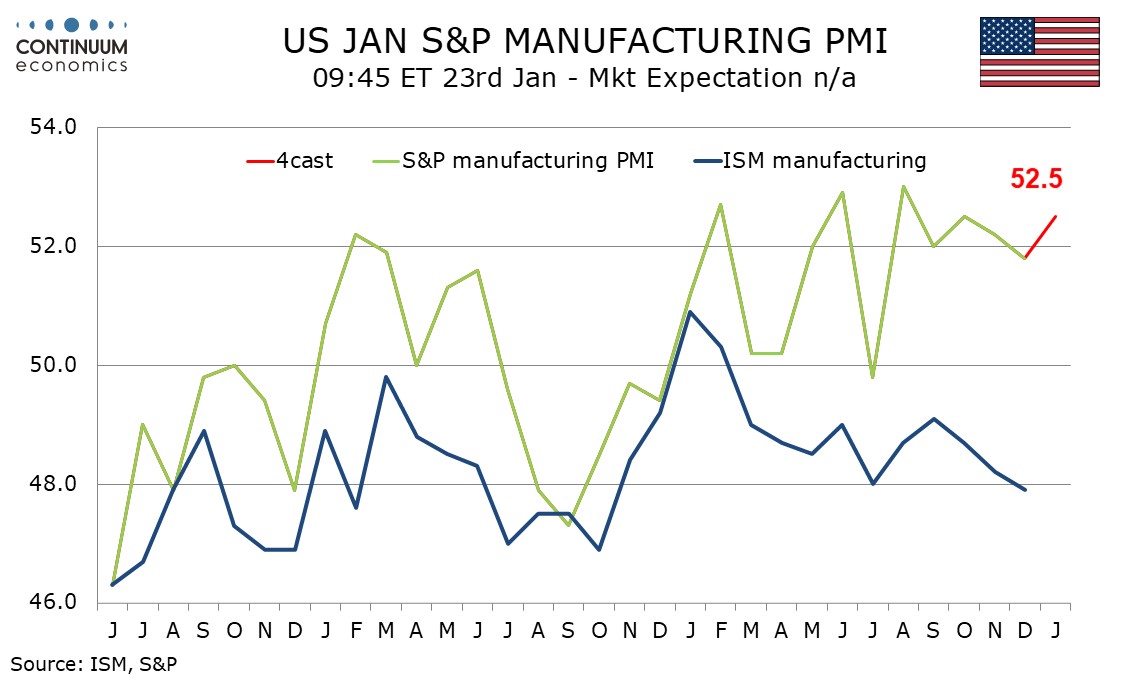

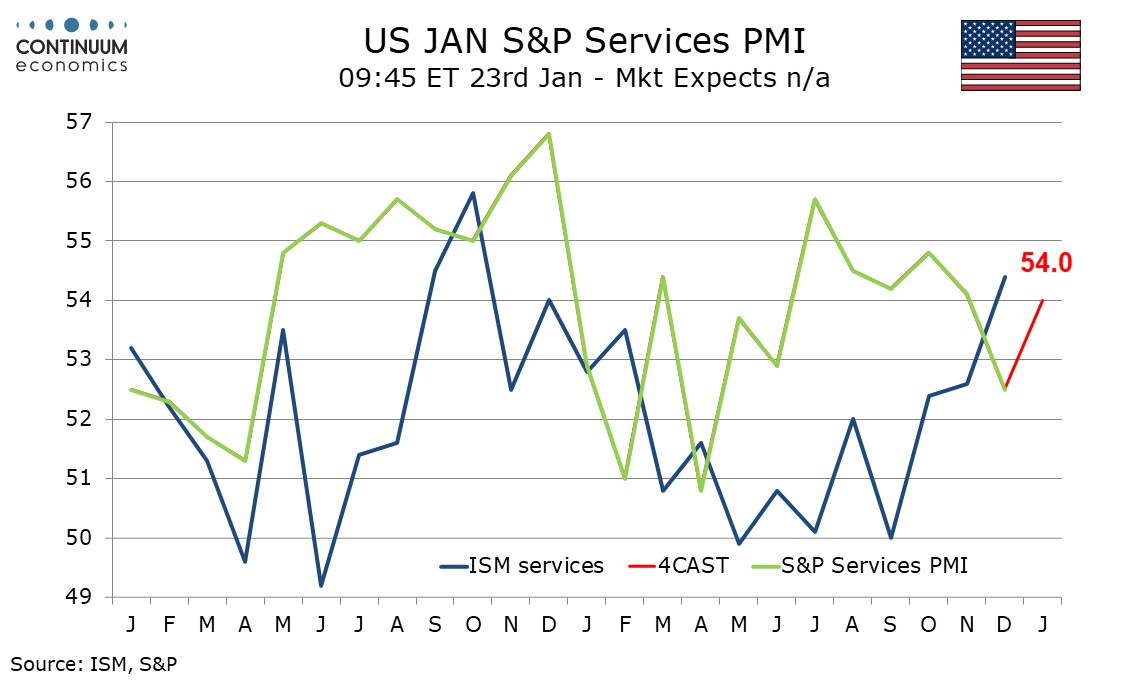

Also on Thursday are weekly initial claims, which will cover the survey week for January’s non-farm payroll, and personal income and spending data for both October and November. We expect October to show a 0.2% gain in income with spending up by 0.4%, and both series to rise by 0.5% in November. We expect October to show a 0.1% increase in PCE prices with a 0.2% rise in the core rate, with November to show overall PCE prices up by 0.2% but the core rate up by only 0.1%. On Friday we expect January S and P PMIs to rebound after dips in December, manufacturing to 52.5 from 51.8 and services to 54.0 from 52.5. Final January Michigan CSI data is also due.

Canada

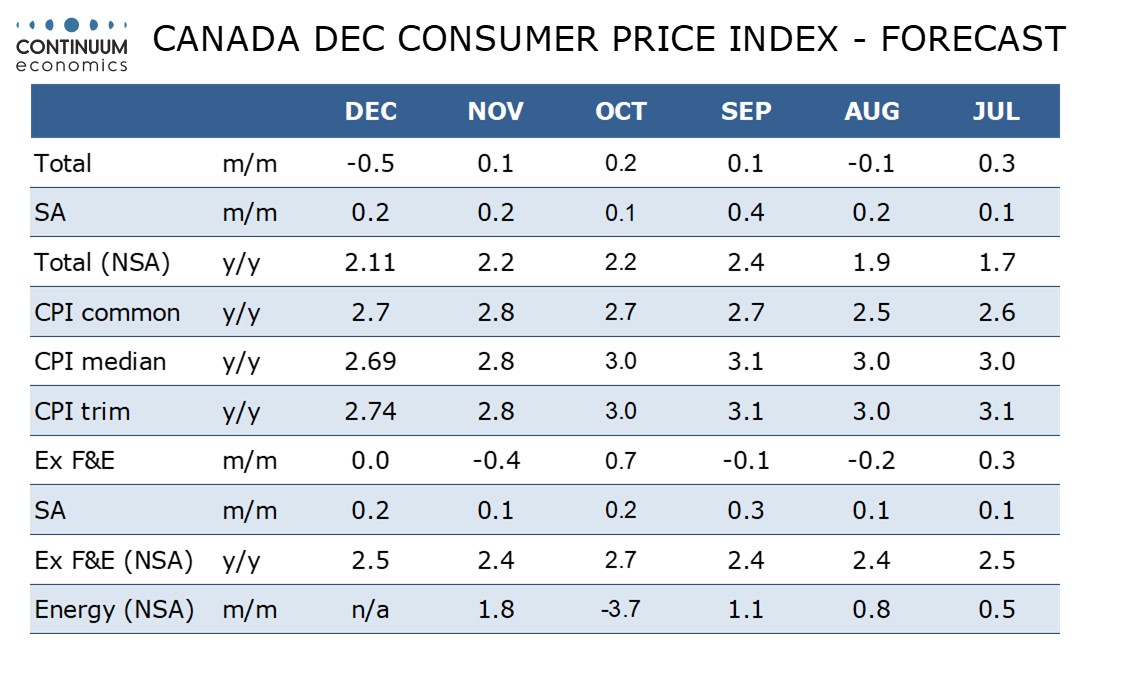

Canada’s most significant release comes on Monday, where we expect a slowing in December CPI to 2.1% yr/yr from 2.2%, with underlying slowing outweighing upward pressure from a sales tax holiday depressing the year ago base. We expect all three of the Bank of Canada’s core rates to slow to 2.7% from 2.8%. Monday also sees the Bank of Canada’s quarterly business outlook survey. December’s IPPI and RMPI on Wednesday will give further insight on inflation. Friday sees November retail sales, for which a preliminary estimate for a 1.2% increase was made with October’s report.

Japan

The all important National CPI will be released on Friday. While it should shows signs of moderation, the magnitude will likely be minimal given the solid underlying inflation. We expect the figure to arrive circa 3%. We also have the BoJ outlook report and the press conference on the same day, which arguably will be more important a they directly reflect the view from the central bank. However, the mostly likely outcome is copy and paste rhetoric. They have emphasized positive outcome of wage/price dynamic lately, that could see an upward revision in their inflation forecast.

Australia

Private inflation survey starts the week for Australia and is expected to show a figure still above target range. Then we have Westpac leading index and employment data on Thursday. The last figure has been a disappointment with a headline miss. With a healthy labor market, we could see a rebound in the headline employment change and little change in unemployment rate. The PMIs released later in the same day would carry less weight.

NZ

We also have the Q4 CPI for NZ on late Thursday. It does not seem like we would see a moderating read nor a hot read. The figure will likely be slightly above the target range as RBNZ has previewed. It will be a hawkish surprise if we see something closer to 4%.