FX Daily Strategy: Asia, December 19th

BoJ rate hike may not be enough to reverse JPY decline

Forward guidance to be watched, but intervention may be necessary

GBP likely to hold gains as long as retail sales aren’t terrible

AUD may extend recovery on lower US yields

BoJ rate hike may not be enough to reverse JPY decline

Forward guidance to be watched, but intervention may be necessary

GBP likely to hold gains as long as retail sales aren’t terrible

AUD may extend recovery on lower US yields

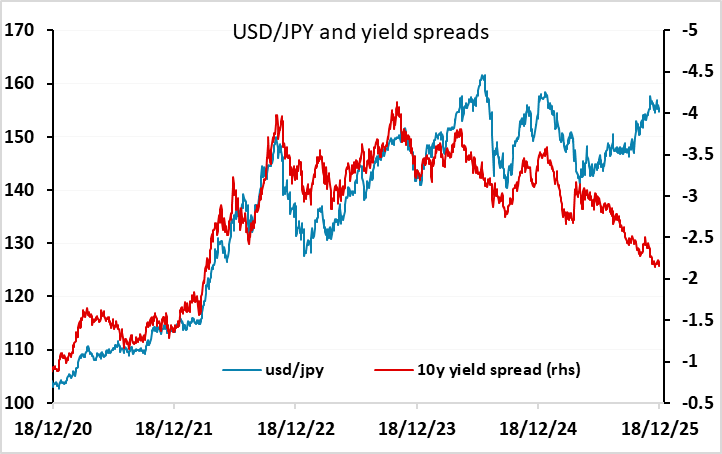

The BoJ rate decision will be the man focus on Friday. A 25bp rate hike is nearly fully priced, so the focus will likely be on any forward guidance that governor Ueda provides. It’s hard to see him deviating much from recent statements suggesting that the BoJ will continue to tighten if the economy develops as expected, but the spring wage round will be important for determining whether the BoJ can continue to tighten policy next year. The market is not fully pricing another hike until October next year, so it looks difficult for Ueda to disappoint too much. But there may be some announcement regarding quantitative tightening which has been a factor pushing up longer term yields in recent months. Ueda has indicated that he may increase the BoJ’s purchases of JGBs to stabilise the market. If so, any drop in JGB yields that results could be JPY negative.

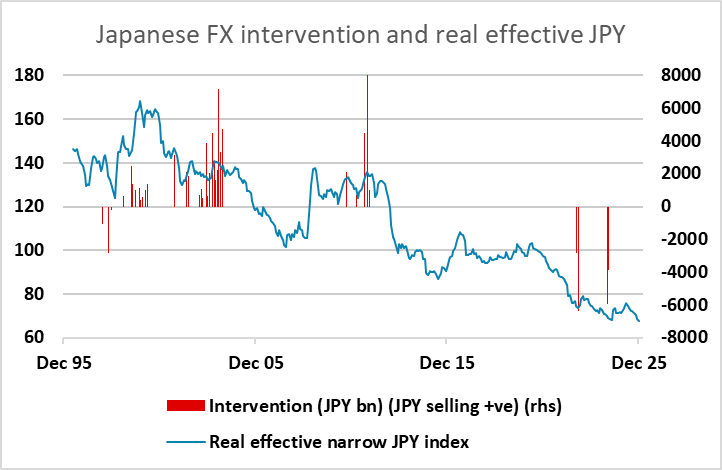

There is a risk that the market treats a rate hike as a “sell on the news” event, with any initial JPY gains seen as a JPY selling opportunity. The trend weakness of the JPY has been resilient to both a sharp narrowing in yield spreads in the JPY’s favour in recent months and corrective pressure in equities, with EUR/JPY hitting another new all time high on Thursday without any obvious rationale. Such trends are hard to oppose and a well anticipated rate hike is unlikely to be sufficient to turn the trend. If the Japanese authorities want to prevent further JPY weakening, they may need to use physical FX intervention in the event of any post-BoJ JPY sell off. If they don’t the market may see it as a green light for further JPY weakness. The JPY is certainly at weak enough levels to justify such action, with the real trade-weighted JPY below the level that triggered intervention last year. History suggests that FX intervention is an effective market of long term highs and lows in the JPY, and may be the only language that JPY bears understand given the continued decline in recent months despite various JPY positive developments.

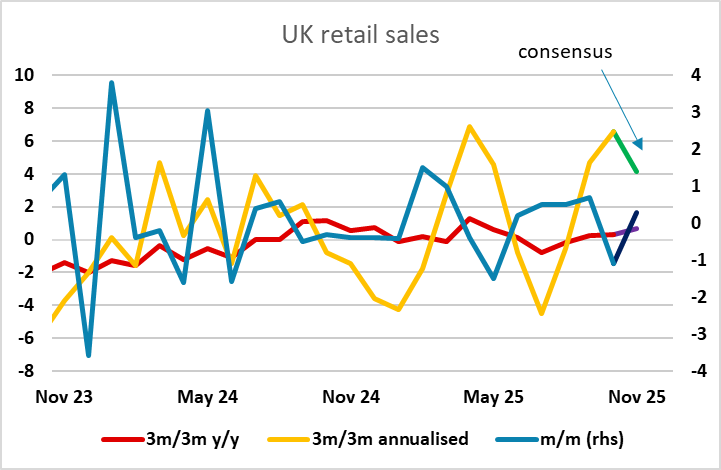

A busy week for UK data and events concludes with the November retail sales data. This is an important month, only second to December in the (non-seasonally adjusted) level of sales. After a sharp 1.1% drop in October the market consensus is anticipating a modest 0.3% increase in November, which would be enough to sustain the mildly positive underlying trend, as the October decline followed four months of solid increases. GBP reacted positively to the BoE rate cut on Thursday, with the 5-4 vote and the indication that the Bank believed that “most labour market data do not suggest a rapid opening of slack” preventing any increase in market expectations of easing, despite a downward revision to the Bank’s forecast for Q4 GDP. Nevertheless we do see this week’s labour market data and last week’s GDP data as significant evidence of slowdown, and expect there will be more easing in 2026 than the market is pricing in. But it would take a significant decline in retail sales to suggest the trend is deteriorating, so we doubt there will be much GBP reaction. Longer term we still see trend GBP weakness, but we are likely to end the year with EUR/GBP in the mid-0.87s.

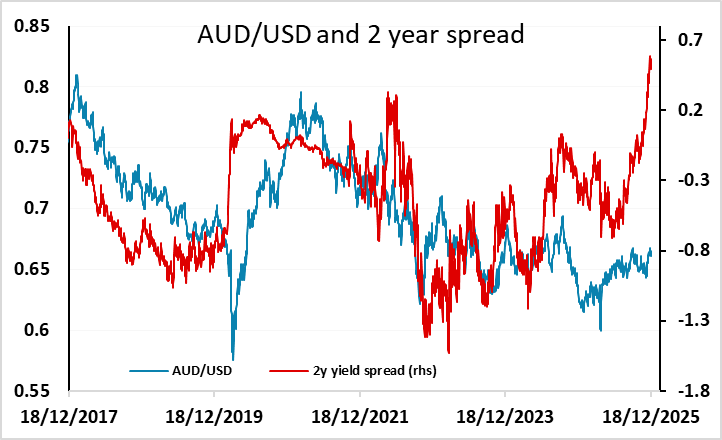

There isn’t much that’s likely to be market moving in the US with just existing home sales and final University of Michigan sentiment data. But the weaker than expected CPI data on Thursday should sustain a more negative USD tone. If it is a sign that the impact of tariffs on prices is fading it may give the Fed more leeway to ease and prove both USD negative and equity supportive. That being the case, the AUD ought to have scope for significant gains, having underperformed in the early part of the week.