FX Daily Strategy: Asia, Oct 9

Central bank speeches to get more attention in data free market

JPY remains under pressure despite weak rationale

Government or BoJ action may be needed to turn the trend

USD generally rangy but risks around equity markets remain

Central bank speeches to get more attention in data free market

JPY remains under pressure despite weak rationale

Government or BoJ action may be needed to turn the trend

USD generally rangy but risks around equity markets remain

The continued lack of significant data will increase the focus on central bank speeches from the Bundesbank’s Balz, BoE’s Mann, the Fed’s Bowman, the BoC’s Rogers and the ECB’s Lane, but it’s hard to see them significantly changing the market tone at the moment. The focus is more political, with the JPY’s weakness since the election of Takaichi as LDP leader the most striking market move, while there is still uncertainty about the French government’s prospects after the resignation of PM Lecornu on Monday.

The JPY continues to be the most likely source of volatility .The JPY weakness since the surprise LDP election result has been variously attributed to a likely increased risk premium on JGBs due to a likely easy fiscal policy, concerns that Takaichi will bring in a new era of easy money due to her adherence to “Abenomics”, and uncertainty around the shape of a new government due to the lack of an LDP majority. None of these reasons are particularly convincing, with the slight decline in short term JGB yields and slight rise in long term yields since the election looking inconsistent with the violence of the JPY’s decline.

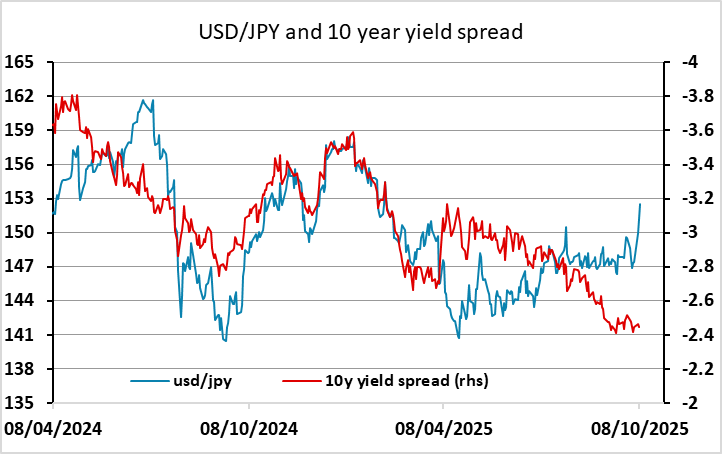

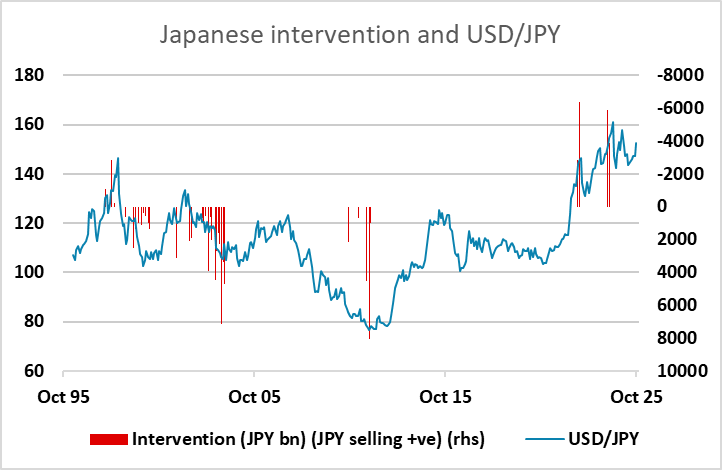

Certainly, it looks like some long JPY positioning has been unwound, but the fundamental rationale for a stronger JPY is still in place. Yield spreads have still moved significantly in the JPY’s favour this year, and are consistent with a lower USD/JPY. If the new government does institute easier fiscal policies, it will eventually lead to tighter monetary policy, even if the BoJ hold off in the short term. New all time highs in EUR/JPY have little justification from yield spreads, valuation metrics or the correlation with risk measures. But having said all this, momentum is one the JPY downside and the lack of protest form the MoF will tend to encourage JPY bears. Conditions are ripe for intervention to discourage speculation, given the fundamental support for a stronger JPY, but its absence will be taken as an indication that the government favours JPY weakness. As it stands, it’s hard to see a turn in the JPY decline without some action from the government or the BoJ, despite the extreme levels.

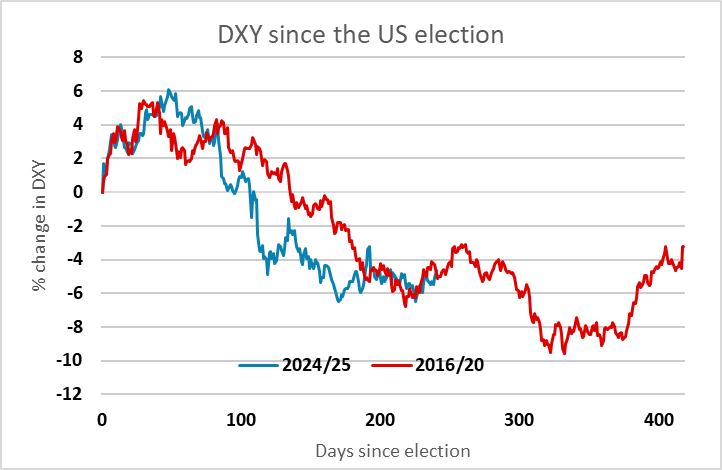

The JPY excluded, the USD is showing some strength against the EUR since the resignation of French PM Lecornu, and EUR/USD may also be suffering a little from the weaker German orders and output data out this week, although some of that looks erratic and seasonal. But after the USD gains of the past few weeks, most currencies are stabilising in ranges. The history of the USD during the first Trump presidency in 2016-2020, which has so far been closely mirrored this time around, suggests the period of stability could continue short term, but we still see risks around the extreme levels of equity prices and the potential for a major correction.