FX Weekly Strategy: APAC, February 12th-16th

USD downside risks on US CPI

Riskier currencies may benefit most initially, but JPY has more upside potential

GBP vulnerable to weak GDP

USD downside risks on US CPI

Riskier currencies may benefit most initially, but JPY has more upside potential

GBP vulnerable to weak GDP

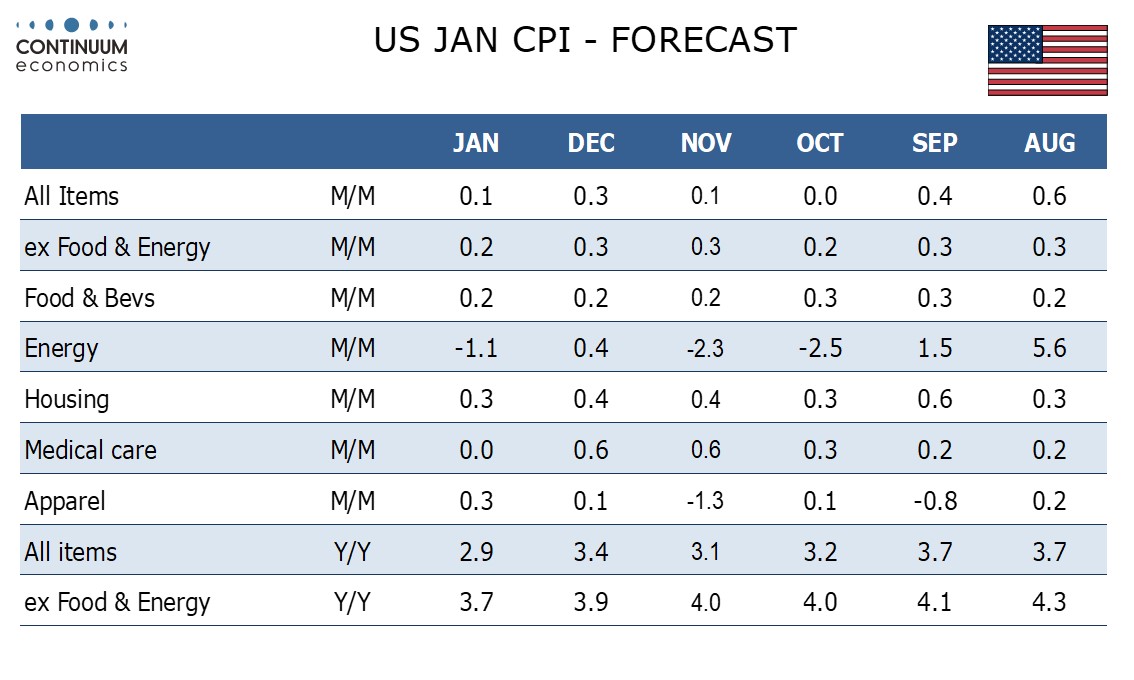

US CPI data will be the main focus of the week. As it stands, the market is pricing in 112bps or around 4 ½ Fed rate cuts this year, reduced by around 25bps since the strong January employment report. However, this is still significantly more than implied by the dots from the December FOMC, so any strength in inflation could be expected to lead to a further reduction in market expectations of easing. But we expect January CPI to increase by 0.1% overall and 0.2% ex food and energy, with our forecasts before rounding being 0.13% overall and 0.23% ex food and energy. Our forecasts are still clearly below the market consensus of 0.2% headline and 0.3% core, but may not be weak enough to induce any significant rise in expectations of Fed easing. The implication should be modestly USD negative, but only modestly.

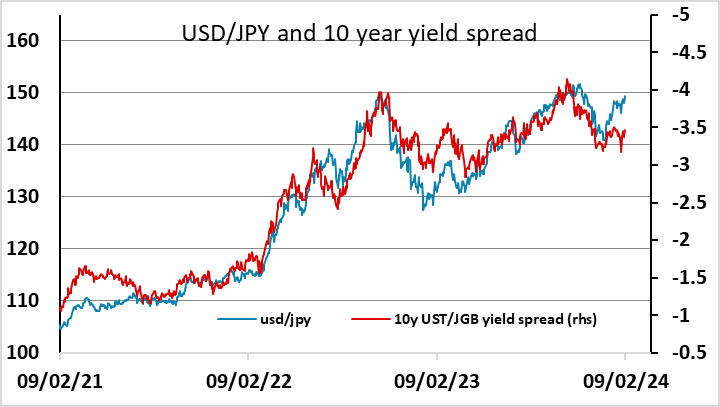

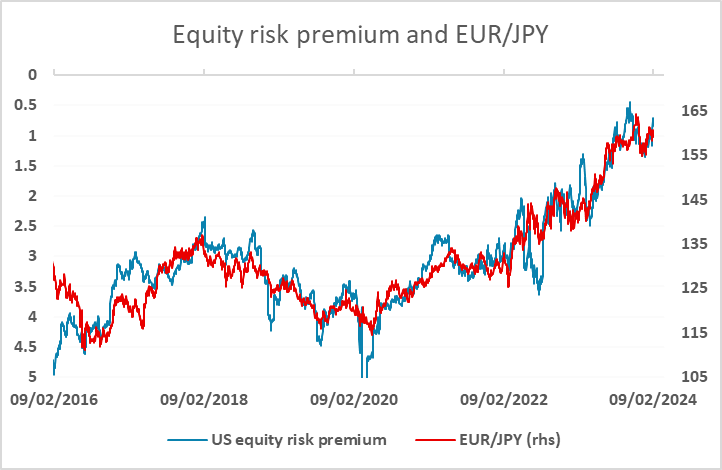

The riskier currencies have been holding up well in the last week as US equity indices, notably the S&P 500, have made new all time highs, without any support from lower yields. A softish CPI number could be expected to maintain the strength in equities via slightly softer yields, and the riskier currencies may well be the main initial beneficiaries. In the last week or two, the USD has been gaining against the lower yielders even without much widening in yield spreads, helped by the risk positive tone. But it is starting to look vulnerable here against the JPY, as longer term correlations with yield spreads suggests USD/JPY should be closer to 140 than 150. While lower US yields might initially support riskier currencies, lower yields are less likely to lead to lower equity risk premia, and it has been the decline in equity risk premia that has been correlated with the weakness of the JPY on the crosses. So our slightly softer US CPI numbers might end up being more negative for USD/JPY than positive for EUR/USD, with EUR yields tending to move in tandem with US yields in any case.

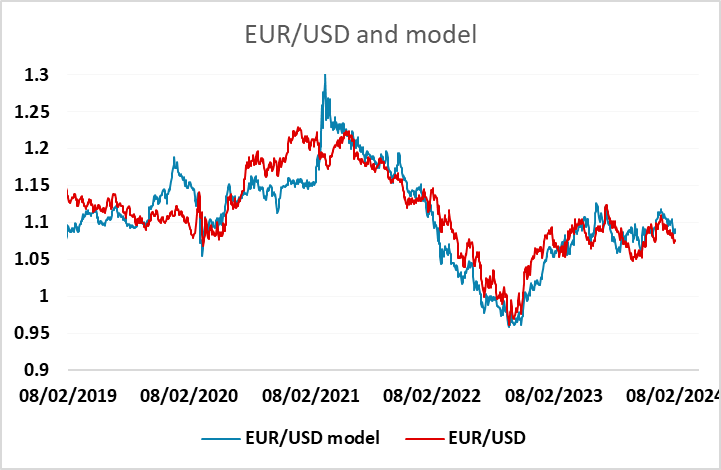

EUR/USD still looks likely to benefit from any softening in US yields, as it remains positively correlated with equities as well as benefiting from any decline in US yields spread advantage. Our short term model suggests the recent decline may be slightly overdone, but has been exacerbated by US equity market outperformance. Any catch-up in equities elsewhere would suggests EUR/USD scope back towards 1.09 if the US CPI data was on the soft side.

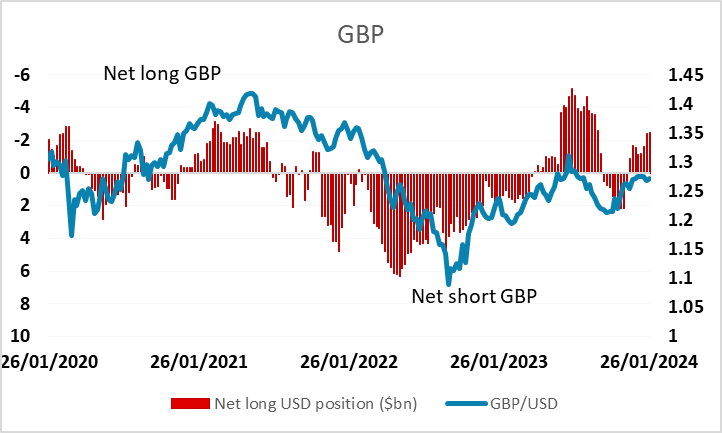

There is also UK CPI, labour market data, retail sales and UK Q4 GDP data this week. This could be significant for GBP, which has been the best performing non-USD G10 currency this year, helped by the perception of relatively hawkish BoE policy and better UK PMIs relative to the Eurozone. We don’t expect any further decline in y/y CPI rates in January, but we do expect slightly lower rates than the market consensus which envisages a modest rise in CPI from December. However, the UK GDP data could potentially be the biggest market mover, as we anticipate a sharp decline in December monthly GDP of 0.4%, well below market consensus, and a q/q decline of 0.2%, confirming an H2 recession. GBP could be vulnerable to these numbers given the less aggressive market pricing of BoE easing, the strength of the pound this year and the more extended long GBP positioning evident in the CFTC data. EUR/GBP has in any case traded some way below the normal yield spread relationship this year, so upside risks dominate.

Data and events for the week ahead

USA

Monday sees January budget data released. Tuesday’s January CPI will be the most significant release of the week. We expect a subdued start to the year, 0.1% overall and a 0.2% increase ex food and energy. Tuesday also sees January’s NFIB survey on small business optimism. Wednesday sees annual PPI revisions while Fed’s Goolsbee and Barr will speak.

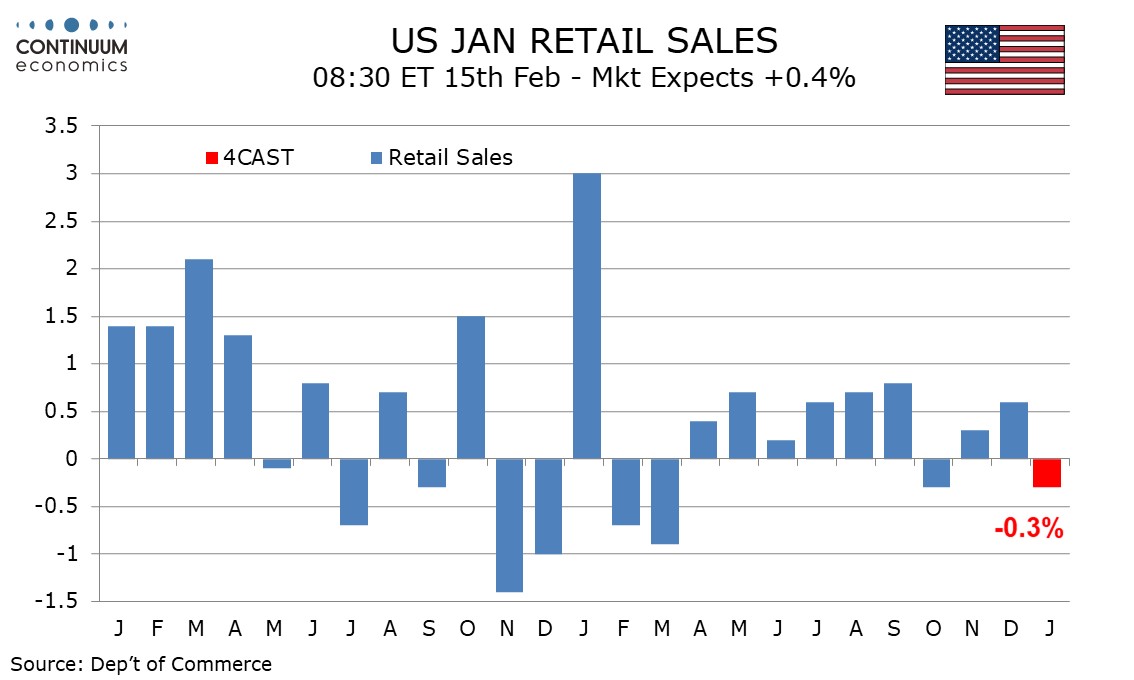

Thursday sees a heavy data calendar. We expect a softer January retail sales outcome, -0.3% overall, -0.1% ex autos and unchanged ex autos and gasoline. Weekly initial claims, February’s Empire State manufacturing survey and January import prices are due at the same time. January industrial production follows where we expect utilities to lead a 0.4% increase, but we expect a 0.1% decline in manufacturing. December business inventories and February’s NAHB homebuilders index are also due.

On Friday we expect January PPI to look similar to January’s CPI, unchanged overall with a 0.2% increase ex food and energy. We also expect January housing starts to fall by 1.4% to 1440k while permits rise by 1.8% to 1520k. Preliminary February Michigan CSI data follows, which will be of interest after a strong January gain. Fed’s Bostic and Daly are due to speak on Friday.

Canada

On Thursday Canada sees December manufacturing shipments, where the preliminary estimate was for a 0.6% decline, as well as January housing starts and existing home sales. December wholesale sales are due on Friday. Here the preliminary estimate was for a 0.8% increase.

UK

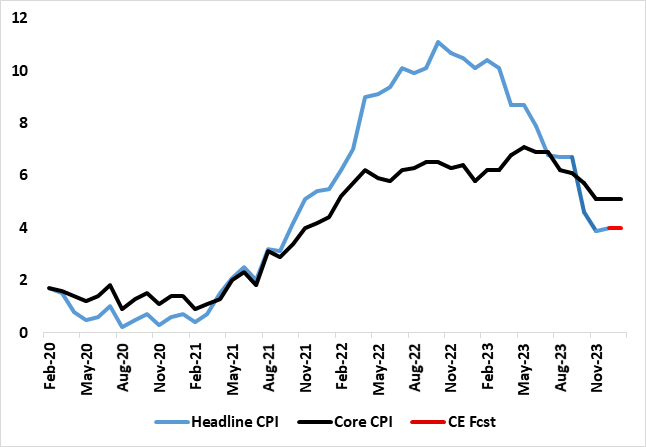

The week kicks off with a speech from BoE Governor Bailey on Monday evening. But this prefaces a series of important data releases. Most high profile are the CPI figures (Wed). A previous clear disinflation surprisingly stalled in December as the headline rate rose a notch to 4.0%, up from a 27-month low of 3.9%, the first rise in 10 months and where the core rate remained at 5.1%, still a 23-month low. We see both the headline and core being unchanged in the January data with services inflation boosted by adverse base effects around airfares. PPI data, released alongside may be softer, however.

As for perhaps even more important labour market data, this time to be presented on a more wholemeal basis albeit amid continuing concerns over the accuracy of figures, these arrive next Tuesday. The revised numbers may show a softer than thought jobless rate and higher inactivity, but there will me as much weight on HMRC numbers regarding job dynamics. However, the average earnings figures will be the most closely watched and where we see regular pay growth (3 mth mov avg) slowing clearly towards 6% but the headline rate down around to just under 6%. Regardless, with even the BoE (belatedly) casting doubt on the validity of these numbers, more attention may be paid to the PAYE pay data where a clear(er) slowing has already been seen.

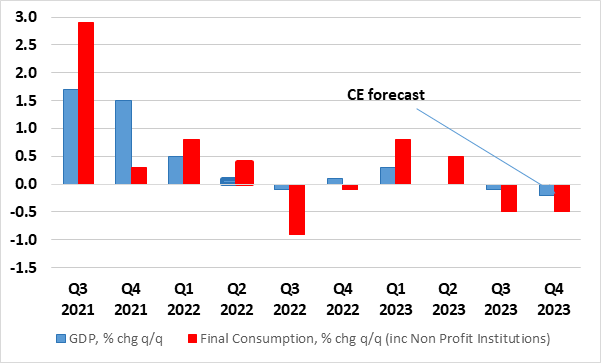

Thursday sees monthly and quarterly GDP figures. We see a 0.4% m/m drop in December and with downside risks, not least on account of the plunge in retail sales and abnormal weather. Admittedly some upside risks are posed by some survey data, but where the likes of PMI numbers have been very poor guides to GDP swings). As for those swings, we see the December result resulting in a 0.2% q/q Q4 drop, both below the BoE’s flat projection and meaning that, after the Q3 decline, the economy may be in formal recession, with a further drop in consumer spending alongside. Finally, Friday sees fresh retail sales data and a clear recovery in excess of 1% m/m is on the cards, albeit without suggesting fresh underlying momentum.

Eurozone

Data are a little more the focus this week, although speeches from ECB Chief Economist Lane (Mon) may help shape market thinking. German ZEW survey data may show fresh weakness (Tue) while EZ visible trade figures (Thu) may show continued import weakness. The latter may be a key factor in having prevented a clear GDP weakness backdrop, although revised Q4 national account data (Wed) may actually see a downgrade, pulling the EZ into actual recession. Regardless EZ industrial production (Wed) will show more weakness despite improved energy output.

Rest of Western Europe

There are key events in Sweden, with the focus on the labor market (Fri) which has been eroding of late. More insight into Riksbank thinking comes from a keynote speech from Governor Thedeen (Thu) In Norway, GDP data (Wed) should see a further m/m fall in these December numbers, but not enough to stop a small q/q rise for Q4. Swiss CPI data (Tue) should see no appreciable change with both headline and core y/y rates staying below target, albeit with some possible upside risk due to administrative price rises.

Japan

We will have the Q4 GDP data on Wednesday, Feb 14. We forecast economics growth from Japan to return closer to positive after a dismal Q3, yet the growth continues to be restrained by negative real wage. The door are open to more disappointment as the Japanese resident may choose to save rather than spend with such inflationary pressure. It would put the BoJ at a difficult spot but will not see their policy steps be derailed for inflation remains the key factor.

Australia

Labor data on Wednesday, Feb 14 would be an important release after the huge miss in December. The huge miss in December data has led to the weakness in Aussie but we do not think such would persist. The Australian labor market should remain healthy. We also have consumer inflation expectation in the same day .There are some tier 2 data on Monday.

NZ

RBNZ Inflation Expectations on Monday, Feb 12 is critical for market participants have been speculating a potential further tightening from the RBNZ. A high read may confirm the speculation and drive the Kiwi higher.