Brazil: Slower Fourth Quarter to Confirm Deceleration

The Brazilian economy experienced marginal growth of 0.2% in 2023, signaling a return to pre-pandemic low-growth trends. Despite a promising agricultural sector, projections show a contraction in 2024. Factors such as consumption push and cautious monetary policy influence future growth prospects. However, immediate effects from industrial and tax reforms are unlikely, placing pressure on Finance Minister Fernando Haddad to raise government revenues.

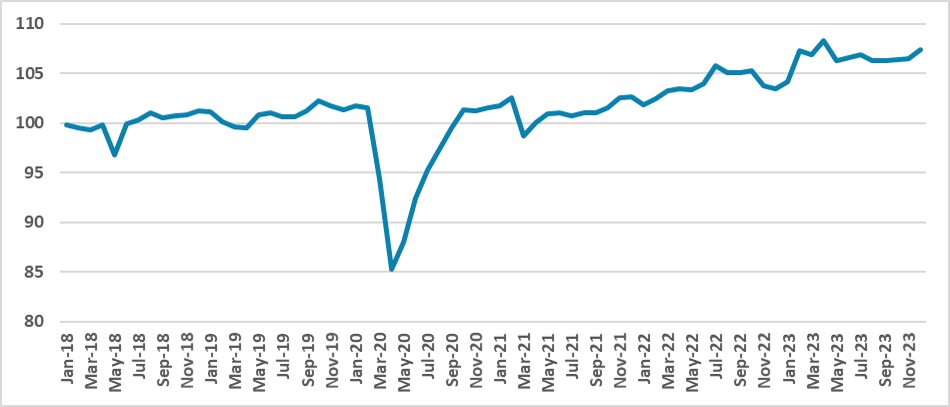

Figure 1: Central Bank Activity Index (Seasonally Adjusted, 2019=100)

Source: BCBThe Brazilian Central Bank has released the latest data on their monthly activity index. The data has shown that the Brazilian economy decelerated during the latest quarter of 2023, exhibiting a marginal growth of 0.2%. It seems increasingly likely that Brazil is actually reverting to its pre-pandemic low-growth trend. One of the biggest supports for growth in 2023 was the remarkable performance of the agricultural sector. However, everything points to the growth of this sector not repeating in 2024, with the latest projections indicating a small contraction of the main Brazilian harvest.

What could support growth for 2024? First, it is possible that consumption will see some push, driven by the higher value of transfers and the employment numbers indicating an increase in the mass of salaries, especially due to an increase in salaries. Export growth tends to be slower this year, especially in a scenario of decelerating Chinese growth. Our growth projection continues to be set at 1.4%, slightly lower than market expectations at 1.6%.

The good news about weaker activity is that monetary policy is proving effective in decelerating the economy and controlling prices. The BCB is cautious about salaries, but unless it translates into rising inflation numbers, the BCB will be quite comfortable continuing the cuts. Whether they will continue to cut at the 50bps pace remains to be seen, but we believe that no pause will be applied at this moment.

Supply and demand factors contribute to a more favorable outlook. Supply chains are finally operating at full capacity, and the higher level of employment supports that view. Additionally, the times of pent-up demand are far behind, and monetary policy is finally able to weaken demand.

We believe the new industrial policy and the approval of the tax reform will not be capable of producing immediate effects on the economy. Slower growth will put more pressure on Finance Minister Fernando Haddad. Firstly, revenue growth will be constrained, and the only way to increase it will be by raising specific tax rates, which will face strong resistance in Congress. Secondly, the government sector will focus on increasing social spending as a form of stimulus.