FX Weekly Strategy: November 3rd-7th

GBP has scope to recover after the BoE MPC meeting

USD strength may start to fade with most of the good news now in

JPY weakness needs official action or a turn in equities if it is to reverse

Strategy for the week ahead

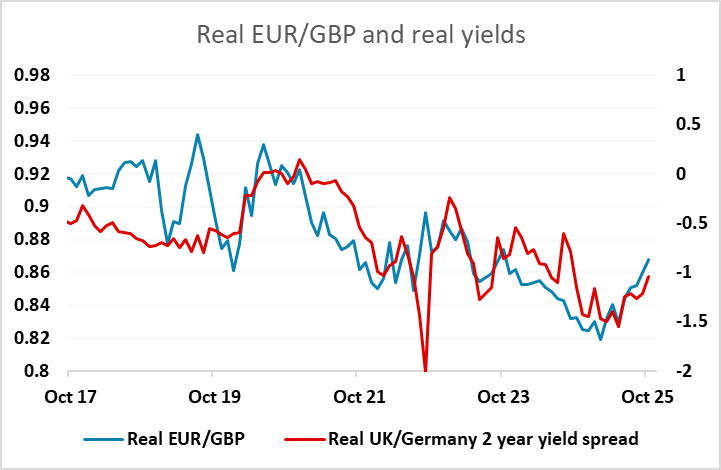

The BoE meeting looks like the most interesting event of the week, with the market now pricing a rate cut as around a 30% chance, with recent softer than expected CPI and wage data and the expected downward revision to productivity projections from the OBR all suggesting easier monetary policy might be necessary. However, the BoE can’t react to the OBR projections until after the Budget on November 26th, so we would still expect no change in rates this time around, although a split vote seems on the cards. This might trigger a modest GBP rally. EUR/GBP hit a 2 year high at 0.8818 last week, and while we still see scope for further GBP losses longer term, we would expect them to require UK real yields to decline further from here, and that only seems likely after the Budget.

Given the continued lack of official US data, there will be more focus on Fed speakers this week, particularly since Powell indicated significant differences of opinion at the FOMC, and the reaction to the FOMC saw US yields rise significantly as the chances of a December cut were reduced. A December cut is now only a priced as a 67% chance, although a cut is fully priced by the January meeting. In the absence of official data, it seems hard for FOMC members to show too much conviction, so we wouldn’t expect any major changes of mind to be expressed. The USD continued to trade positively through the last week, making a new high for the month against the EUR on the 31st, and momentum still favours further USD gain, although there is significant technical support in the 1.14-1.15 area.

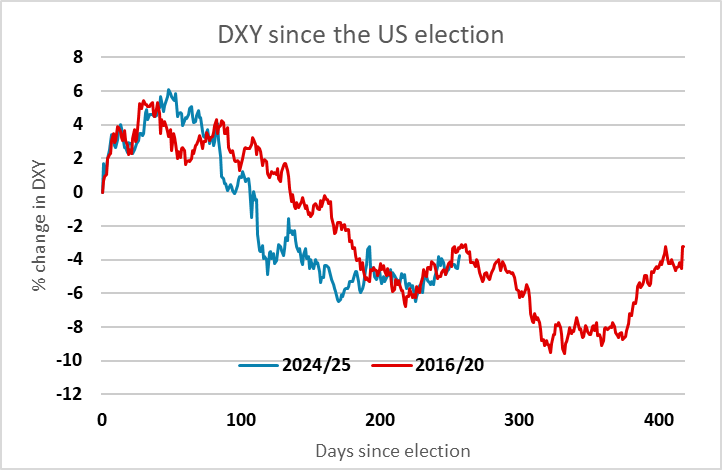

However, we are now reaching the equivalent of the peak in the USD seen in Trump’s first term, which came 258 days after the election. The USD’s path has been similar this time around, and we do now have a lot of positive sentiment on the economy priced in, with the equity market once again reaching all time highs last week. In the absence of data, it’s hard to argue for even more equity gains and more optimism on the economy. There is no reason to see an exact duplication of Trump’s first term, but there is some sense in the idea that economic sentiment may follow a similar path. We would consequently be wary of looking for further USD gains from here, as there is still likely to be some impact form tariffs to come through, and the government shutdown is also damaging to growth in the short run.

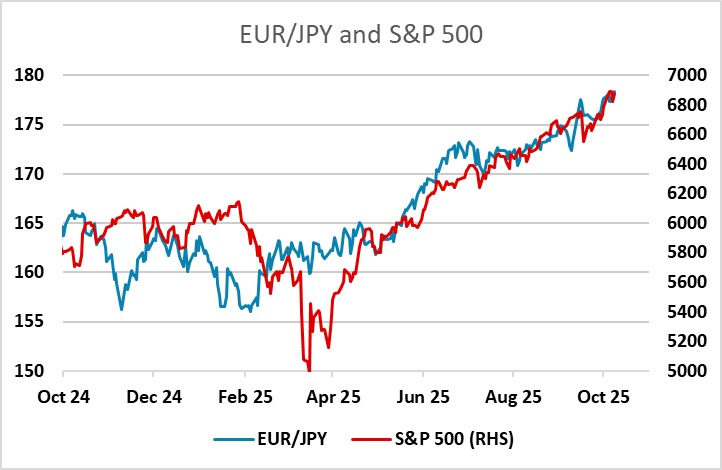

USD strength has been particularly marked against the JPY in recent weeks, with the market taking a negative view of the likely JPY impact of the new PM Takaichi. But we remain sceptical that such a view is justified. While the market assumes that the BoJ will be pressured into easier monetary policy, we see no reason to believe that they will move away from their planned tightening path if the economy progresses as expected. The hold in October made sense given the lack of clear wage pressure in recent months, but subsequent comments from Ueda suggest a December hike remains possible, although this is only priced as a 25% chance. But while tighter policy and higher Japanese yields might be JPY supportive, it’s clear that JPY weakness in recent weeks hasn’t been primarily about yields or yield spreads, as spreads have moved substantially in the JPY’s favour in recent months without helping the JPY. JPY weakness correlates more with the strength of the equity market in recent weeks, particularly on the crosses, and we may need to see a turn in equities to prevent further JPY losses.

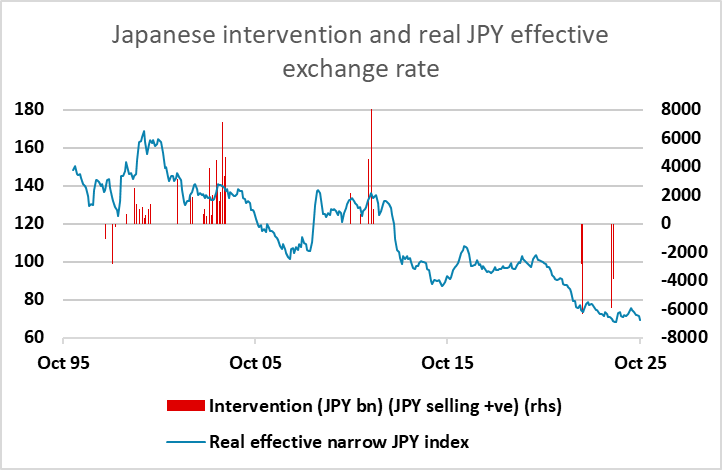

However, the statement from new Finance minister Katayama last week indicating that she saw recent JPY moves as one-sided and rapid, and from cabinet secretary Kihara saying that FX moves should reflect fundamentals, suggest the new administration might be prepared to intervene in the FX market to prevent further significant JPY losses. This might be enough to turn things near term, with short term positioning likely vulnerable to a squeeze.

Data and events for the week ahead

USA

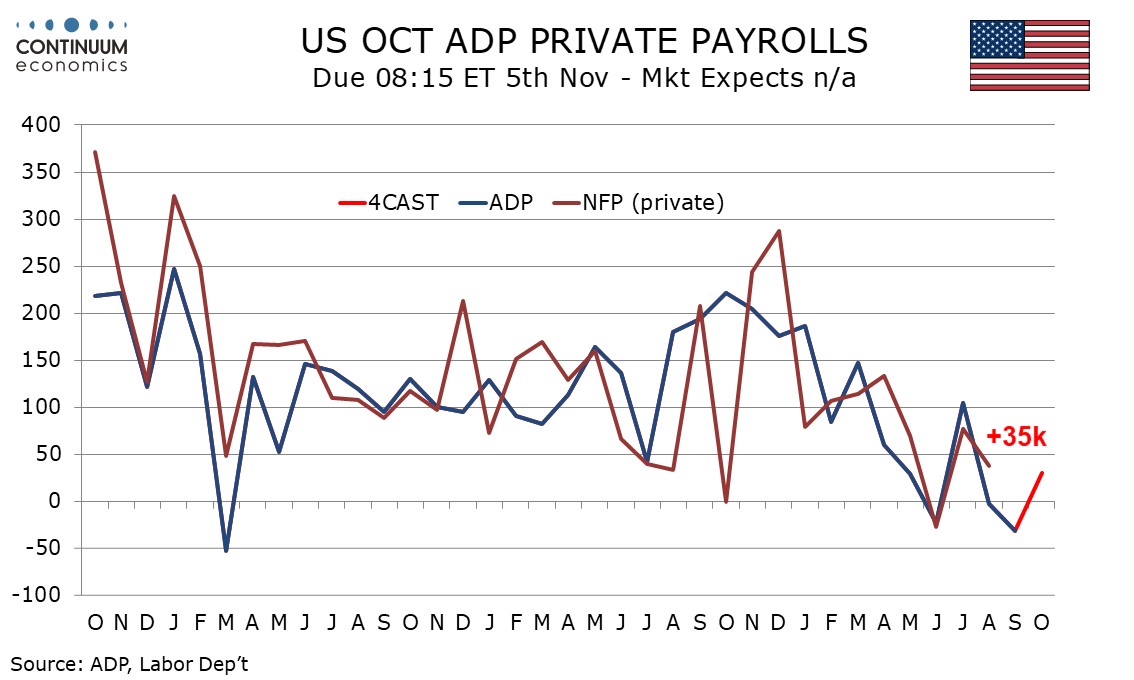

US data that will be released even if the shutdown continues include October’s ISM reports and ADP employment. We expect the ISM data to show manufacturing on Monday rising to 49.5 from 49.1 and services on Wednesday rising to 51.0 from 50.0. ADP’s private sector employment data for October is also due on Wednesday. Recent weekly ADP data suggest a modest increase, we expect by 30k, to correct a 32k decline seen in September. The Fed is also set to release September consumer credit on Friday. Should the government shutdown be resolved one of the first delayed releases likely to appear will be September’s non-farm payroll, which we expect to rise by 45k. There is little prospect of October’s employment report being released as scheduled on Friday even with a swift resolution.

Fed speakers will be closely watched after Powell’s comment that there are strong differences of opinion at the FOMC. Of particular interest for December’s decision will be if any dovish or moderate voters express a more hawkish view. Dovish non-voter Daly will speak on Monday. Thursday sees moderate voter Williams, hawkish 2026 voter Hammack, still relatively unknown 2026 voter Paulson on Thursday, and hawkish 2025 voter Musalem. Williams speaks again on Friday.

Canada

It is a busy week in Canada. Bank of Canada governor Macklem will speak on Monday when October’s S and P manufacturing PMI will also be released. Tuesday’s trade balance for September looks set to be postponed with inputs from the United States absent due to the government shutdown there. Tuesday will see Canada’s budget, which is likely to see forecasts for the deficit revised higher due to impact of US tariffs on growth, despite measures to contain the deficit likely to be announced.

Wednesday sees October’s S and P services PMI, and Thursday October’s Ivey manufacturing PMI. The most significant release of the week will be October employment on Friday, which is likely to show that September’s strong rise was corrective from recent weakness rather than signaling that the economy is regaining momentum.

UK

The week is dominated by the BoE verdict on Thursday, this coming alongside more BoE survey data useful for gauging the labor market (DMP). Given slightly better inflation data and more worrying labor market numbers the door is opening for a fresh rate cut, albeit with it likely that any move at the Nov 6 verdict, (while far from improbable) would be too soon, as the MPC may very well want both more data (amid some conflicting signs and the fiscal details from the Nov 24 Budget to gauge just how restrictive the fiscal picture may become. But there will be more dissents this time around, whatever the verdict and with some update likely to come from Chief Economist Pill (Fri). Otherwise, no appreciable revisions are expected in final PMI numbers (Mon, Wed) but perhaps with more interest into the first insight into the Construction PMI (Thu).

Eurozone

Several albeit less important updates are due this week, the question for Germany being the extent to which Thursday’s industrial production (and orders – Wed) will recover from what were probably holiday distorted falls in August. As fir survey data, no appreciable revisions are expected in final PMI numbers (Mon, Wed) but perhaps with more interest into the first insight into the Construction PMI (Thu). ECB wage Tracker (probably Wed) should show more soft cost pressures while EZ retail sales (Thu) should continue to move sideways

Rest of Western Europe

There are a key events in Sweden, most notably the Riksbank decision (Wed). Having delivered what was described as a final rate cut last time around (ie Sep 23), the Riksbank Board will be pleased with the data flow since. Still, it would be hard for anyone to suggest that the Board will not keep to its promise of no change, most definitely at Wednesday’s decision with the lack of any scheduled updated projections making the policy outlook beyond still uncertain. The question is whether the Riksbank will have early access to flash October CPI data (Thu) where a clear fall in the y/y rates is likely for both CPIF and the ex energy counterpart.

In Norway, after what was to some a surprise move in September, in which the Norges Bank cut is policy rate by a further 25 bp to 4.0%, we see no change for Thursday’s verdict. After all, there will be no fresh forecasts, albeit with the Board likely to reinforce existing hints of a further 25 bp move at the Dec 18 decision. That December meeting will have both new forecasts and data for the Board to peruse, not least inflation and lending numbers, the latter possibly becoming a worry given the fresh slowing in corporate credit growth.

Switzerland sees CPI data (Mon), likely to be little changed and then labor market and consumer confidence on each of the last two days of the week.

Japan

Only two important release for Japan next week as we have labor cash earning on Thursday and overall household spending on Friday. The momentum in labor cash earning has slowed in the past month and would be critical for the BoJ to closely monitor, given Ueda’s remark on caution before signs of good spring wage negotiation. Household spending., on the other hand, has been doing well and should remain in a healthy growth pace.

Australia

The RBA interest rate decision will be announced on Tuesday. While we favor another cut in previous forecast, the latest strong Q3 CPI has delayed our expectation to Q1 2026. Market pricing for an imminent cut has also significantly scaled back in the past week, so it would be a dovish surprise if the RBA did cut in the November meeting. Apart from trade balance on Thursday, there are just tier two data on Wednesday.

NZ

Throughout the slate of data to be release next week, employment change and related data maybe the most important to watch on Wednesday. The RBNZ has been tilted dovish, citing spare capacity but warrants short term spike in CPI. A hawkish surprise in labor cost may slow but not stop the RBNZ from further cutting.