USD, EUR flows: EUR down on French PM resignation

EUR down across the board as French PM resigns after less than a month in office

The EUR has fallen back across the board after the resignation of French PM Sébastien Lecornu, less than a day after his cabinet was unveiled. The cabinet was little changed from that of his predecessor Bayrou, and parties across the board in the National Assembly had fiercely criticised the composition. Several parties are now clamouring for early elections, which are looking increasingly likely with Lecornu France's fifth prime minister in under two years, and problems with getting budgets through parliament.

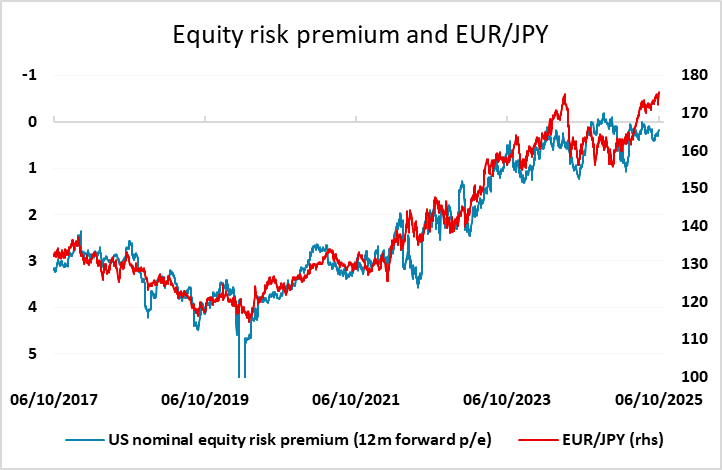

The EUR is lower across the board, although the USD is also slightly higher against other European currencies. French equities are sharply lower against a background of modest rises elsewhere. While this may prove to be a short term problem, it looks as if the market is moving into reactive mode as is often the case in Q4. The USD now looks generally well bid and may have scope to extend gains against the EUR sub 1.16, with EUR/JPY also looking vulnerable after the sharp overnight gains following the LDP election.