FX Daily Strategy: N America, March 26th

Once again little to drive FX markets on Tuesday

Increasing risk of BoJ intervention and sharp USD/JPY correction

EUR/USD range remains intact

Swedish data to inform market expectations of Riksbank

Once again little to drive FX markets on Tuesday

Increasing risk of BoJ intervention and sharp USD/JPY correction

EUR/USD range remains intact

Swedish data to inform market expectations of Riksbank

Tuesday looks like being another fairly quiet day for FX. The is second division US data in the form of durable goods orders, house price data and the Conference Board consumer confidence index, but these seem unlikely to affect the key question of whether inflation is falling fast enough to allow the Fed to ease in June, which is currently priced as around an 80% chance. Yields edged up a little on Monday, providing the USD with a little support against the JPY, but not against the European currencies with European yields rising as much if not more. With equities holding their own, this ensured a further decline in equity risk premia, also supporting a softer JPY on the crosses.

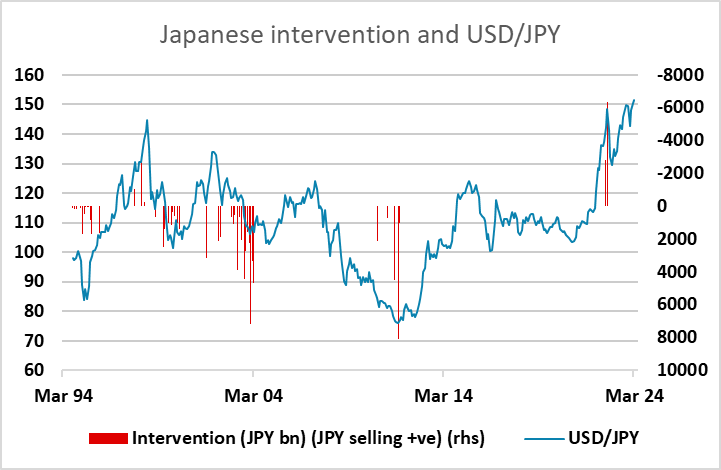

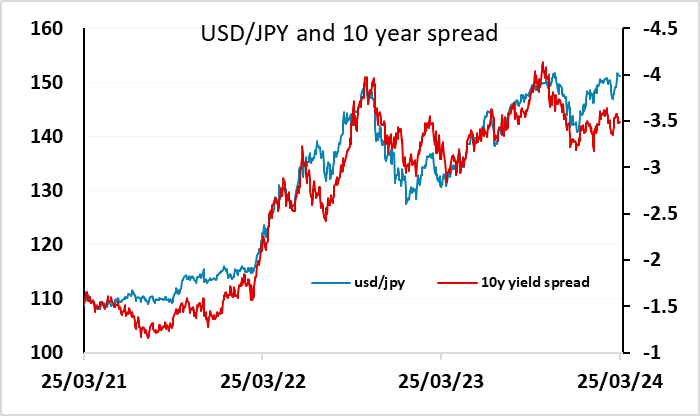

USD/JPY continues to eye the 151.94 high from October 2022 – a 24 year high - which was tested in November last year when a high of 151.92 was reached, while Friday saw a high of 151.86. The approach to this level triggered a response form the MoF’s Kanda on Monday, who said he was “closely watching FX moves with high sense of urgency”. Certainly, FX intervention has to be a significant risk here, with the October 2022 high having triggered significant intervention that helped start a decline of 23 figures in the subsequent 3 months to 128. This decline was accompanied by a significant decline in yield spreads, but the current UST/JGB spread is already at levels seen in mid-November 2022 when USD/JPY traded below 140. The MoF are more likely to conduct intervention when they have the support of market spreads, so we would be very wary of holding short JPY positions here. While there is potential for a break to new highs, with option dynamics potentially helping to trigger a break, we would expect any such break to be short lived and potentially being followed by sharp JPY gains with or without intervention.

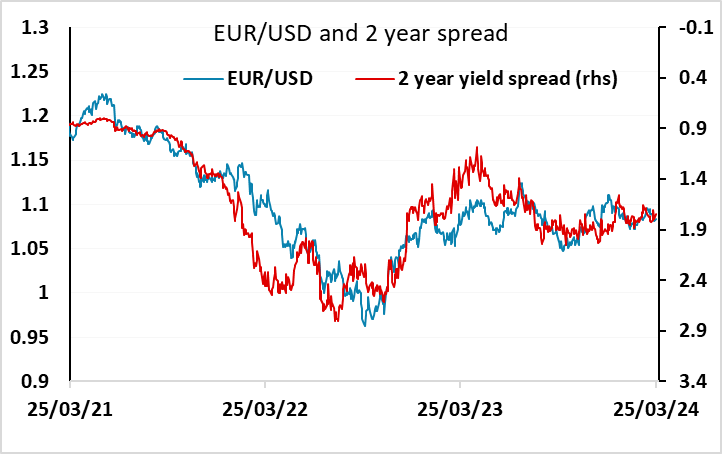

In contrasts, the chances of a sharp move in EUR/USD look very slim. While the USD has managed a slightly firmer tone in the last few weeks, EUR/USD is still in the centre of the narrow 1.07-1.10 range seen this year, while the 1.0450-1.1275 range has held since the beginning of 2023. This is largely a consequence of the inflation dynamics in recent years having been determined by similar global supply factors rather than demand factors idiosyncratic to particular economies. But his is likely to change going forward, and the risk is that the relative strength of the US economy means the Fed is less comfortable easing than the ECB. If so ,the risks will be on the downside for EUR/USD, but we will need to see more strong S CPI data and the Fed signalling fewer rate cuts this year for this to happen. In the meantime, the range is likely to hold, with if anything a risk to the upside if equities remain solid due to the USD’s negative equity market correlation.

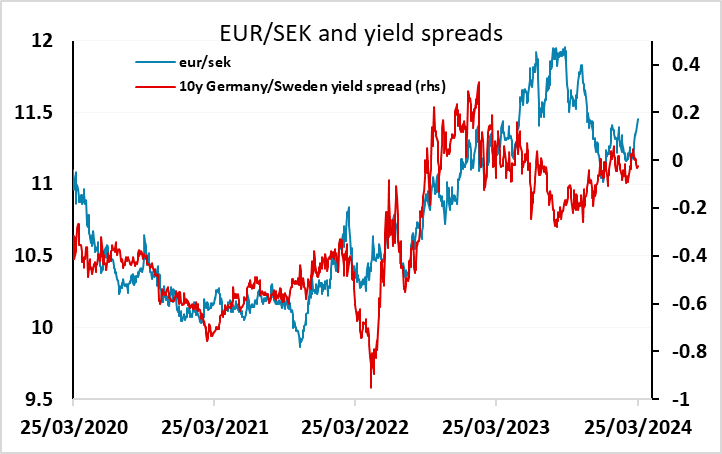

EUR/SEK isn’t much changed after this morning’s Swedish data, but the numbers do not provide any new support for a more dovish Riksbank stance. The Economic Tendency Indicator climbed 2.4 points in March from 90.7 to 93.1. The consumer and service indicators improved most, while only the construction indicator fell. The share of firms anticipating a rise in selling prices was largely unchanged from February across the business sector as a whole, but increased again in the service sector after dropping back to normal levels in February, which may be a factor weighing against early easing. Of course, the Riksbank aren’t expected to ease at tomorrow’s meeting, but the stronger data and the evidence of some inflation pressure persisting in services suggests that the May meeting, which is currently seen as offering a slightly better than 50-50 chance of a cut, might also prove too early. It’s far from being conclusive, and EUR/SEK is not much changed while front end Swedish yields are just a tad higher, but given the starting point of EUR/SEK being on the high side of the levels suggested by yield spreads, there ought to be some downside risks form here.