FX Daily Strategy: Europe, January 30th

Eurozone GDP data the main focus on Tuesday

Weak EUR trend to be sustained…

…but market already prices and April ECB rate cut

GBP may start to follow EUR decline against the USD

Eurozone GDP data the main focus on Tuesday

Weak EUR trend to be sustained…

…but market already prices and April ECB rate cut

GBP may start to follow EUR decline against the USD

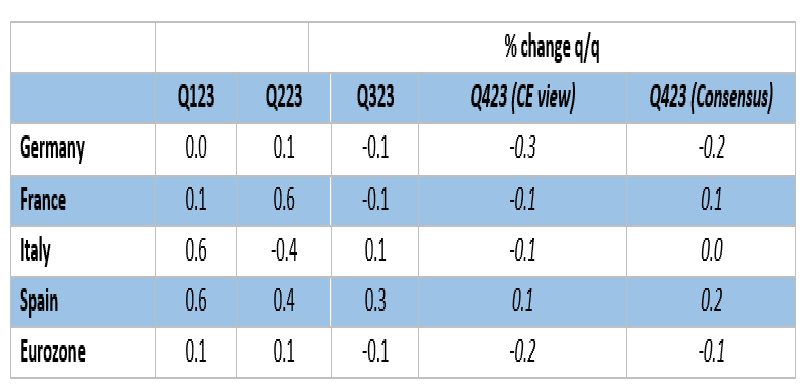

There’s a lot of European data due on Tuesday, with the Q4 Eurozone GDP data the main highlight. The market consensus is for a decline of 0.1%, the same as Q3, which would consequently represent a recession by the standard definition, albeit the shallowest recession possible. However, our forecast is for a slightly weaker 0.2% decline, suggesting some downside risks for the EUR, which is already starting on the back foot after a weak start to the week on Monday.

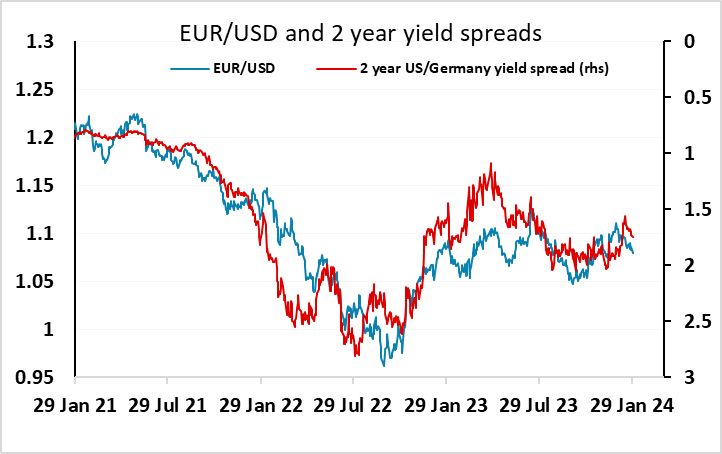

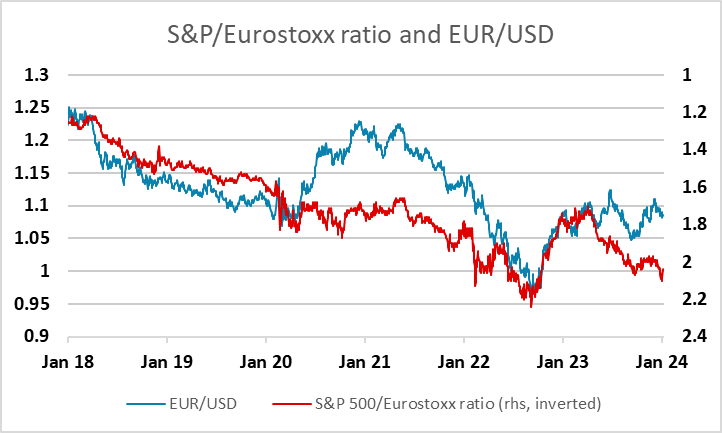

Continuum Forecasts

Yield spreads are part of the story, with spreads moving steadily in the USD’s favour since the middle of the month, but the underperformance of the Eurozone economy is also a more direct negative factor, as the EUR does tend to suffer when European equities underperform. While European equities have done better in the last couple of days, they have underperformed over the month as well as over the last year. Weak growth is either going to lead to weaker equities (if the ECB stay hawkish) or lower yields (if the ECB turn more dovish), so the EUR looks to be caught either way. 1.08 is still slightly on the low side of our current model prediction, but if Eurozone growth is weak, in line with our forecast, the EUR is likely to remain under some downward pressure.

As well as the Eurozone GDP data, there is Spanish HICP data for January and the European Commission survey, as well as a speech from ECB chief economist Lane. The data is unlikely to have much impact, but Lane’s comments could be important as the market took a dovish view after the ECB meeting last week, and Lane could either endorse that or lean against it. We doubt he will fight it too strongly, as it is clear that inflation is essentially back to target pace in recent months, and with the Eurozone in recession, it makes it hard to justify current levels of rates. But while the ECB is still not admitting to the risk of an April cut, but the market has it fully priced in, and so it’s hard to see European rates dropping much further on Lane’s comments. The downside risks to the EUR is therefore mostly on the GDP data.

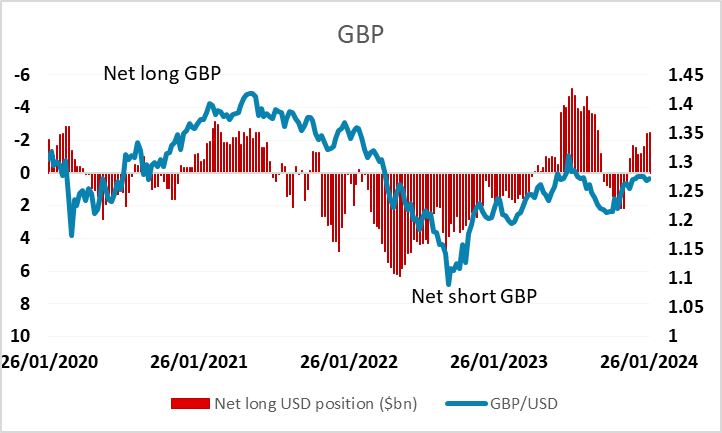

We also have UK money and credit data, which will inform the BoE MPC decisions later this week. The latest money data was slightly less weak than the previous numbers, but we still see expect to see lagged impact from the weakening of the money data over the last couple of years. So while there might be some influence on MPC members’ decisions form this week’s data, this reflects the fact that it could be a guide to what is happening 2 years down the road rather than in the coming months. In practice, there is unlikely to be much impact on GBP. GBP has made gains against the EUR in recent weeks, helped by some better UK surveys and expectations of a relatively less dovish path from the MPC. But positioning in GBP may now be getting a little stretched, and the UK is unlikely to b able to buck the impact of weakness in its largest trading partner, so we are wary of current GBP strength and see some risks that GBP catches up with EUR losses against the USD.