JPY, AUD flows: JPY limited by verbal intervention, weak equities weigh on AUD

JPY reverses early decline in increased verbal intervention, AUD under pressure as equities slide

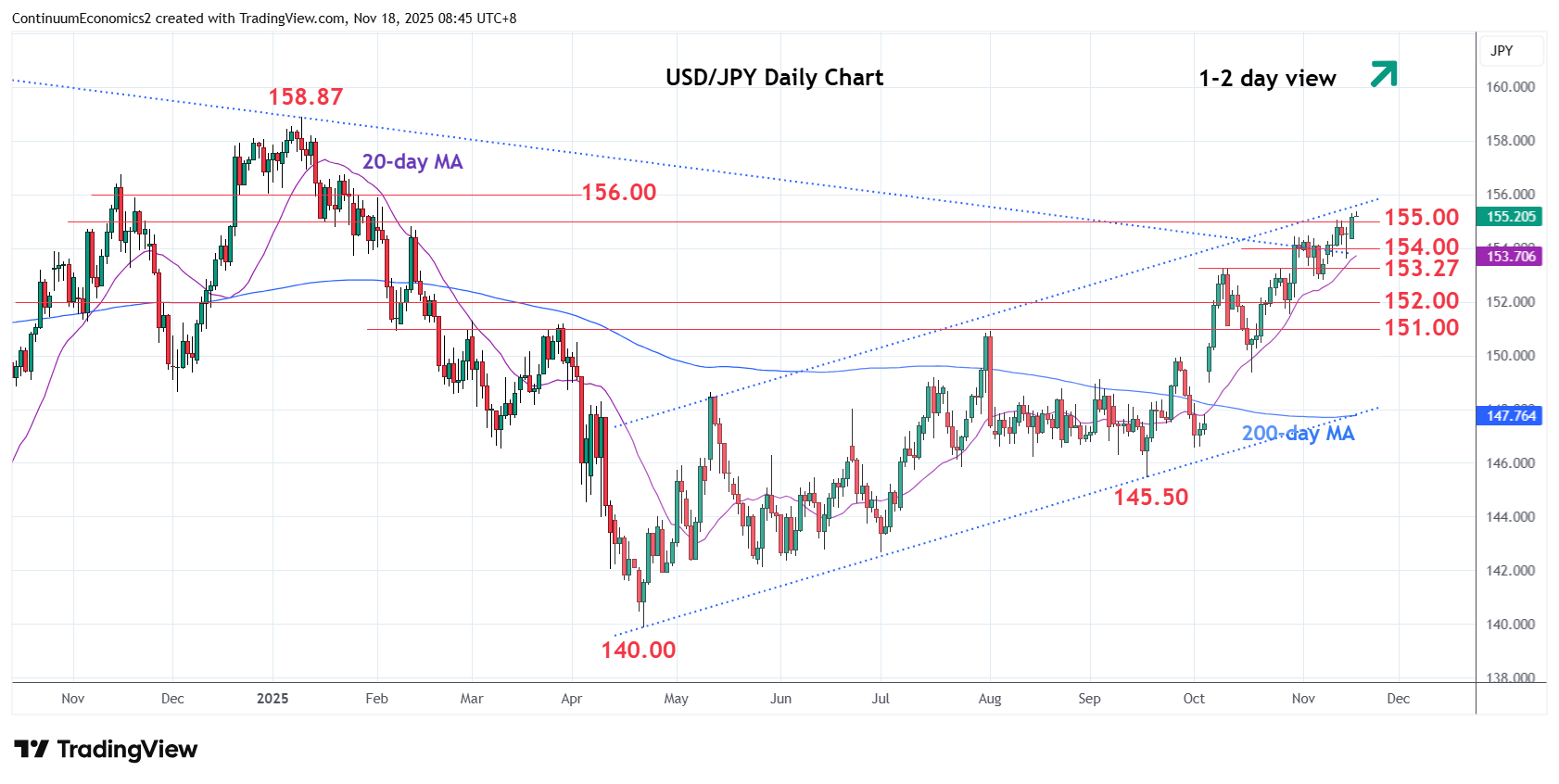

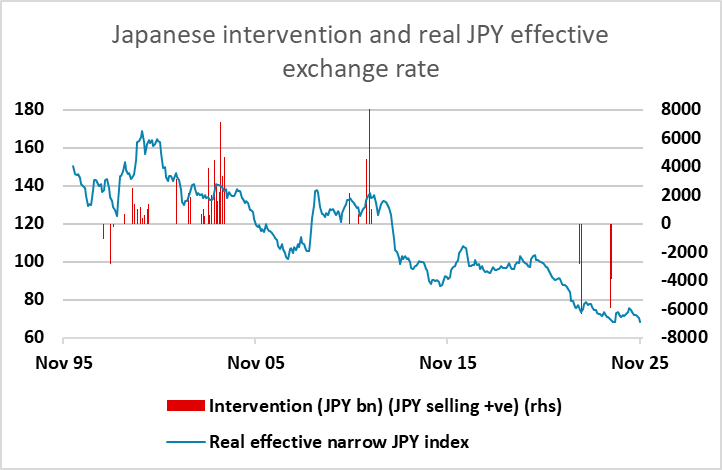

USD/JPY hit a new 9 month high at 155.38 at the open in Asia. More aggressive verbal intervention from Finance minister Katayama, who said she was “alarmed” at JPY volatility, helped to bring USD/JPY off the highs, but the retreat was modest. Katayama held talks with BoJ governor Ueda but there was little of significance to come out of the meeting, although Ueda did note that FX was discussed and said it was desirable for currencies to move stably and reflect fundamentals.

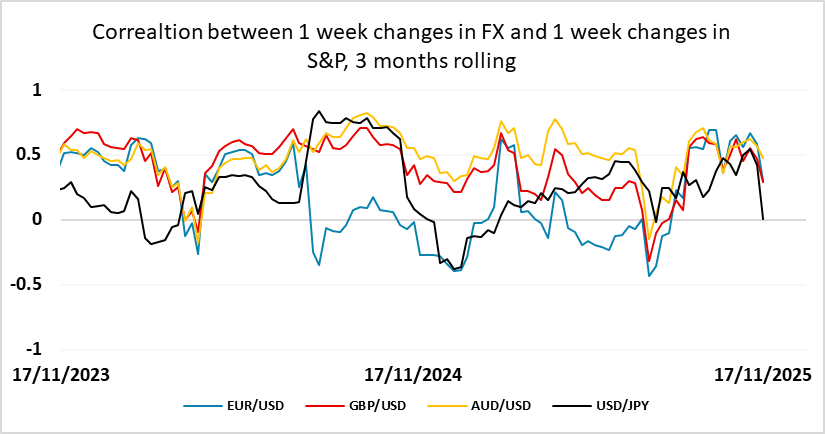

Otherwise, risk currencies were under pressure as equity markets weakened. There is little of significance on Tuesday’s calendar, so the focus may remain on equity markets. Worries about inflated valuations and declining expectations of Fed easing, along with nerves about upcoming US data releases all served to weigh on prices. The AUD and NOK continue to be the most vulnerable to equity declines, but the usual positive impact on the CHF and JPY is less apparent, with EUR/CHF looking limited by the 0.92 support area and negative sentiment around Takaichi policies and the potential for BoJ rate hikes preventing JPY gains. The market consequently looks a little stuck near current levels short term, with the Nvidia results on Wednesday and the September US employment report on Thursday looking like the most likely triggers for volatility.