FX Daily Strategy: Europe, October 29th

USD still supported by rising expectations of a Trump victory

JPY remains the biggest victim…

…but downside may now be more limited

USD still supported by rising expectations of a Trump victory

JPY remains the biggest victim…

…but downside may now be more limited

There’s nothing major on the calendar on Tuesday, with all the significant data coming out from Wednesday onwards. But the USD continues to be well underpinned by expectations of solid data combined with rising expectations of a Trump victory. If this also includes a Republican victory in the race for the House, and consequently a Republican clean sweep, it could mean significant policy changes going forward, almost all of which would be expected to add to US inflationary pressure. While higher tariffs might also be growth negative, growth would be hit everywhere, and the US is likely more able to take the hit than Europe. So rising expectations of a Trump victory are likely to continue to be USD positive.

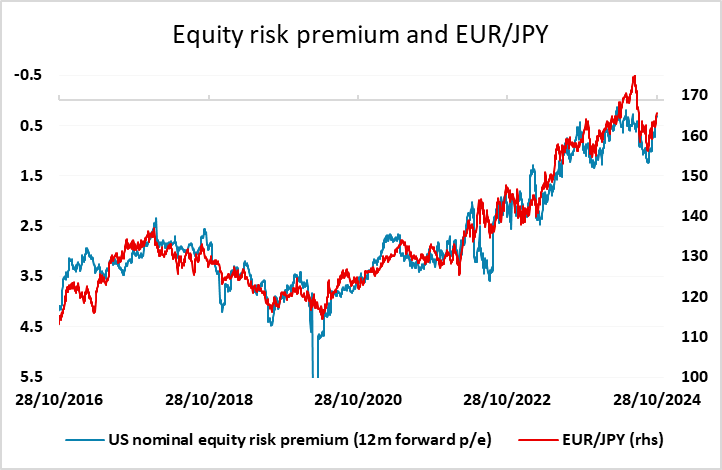

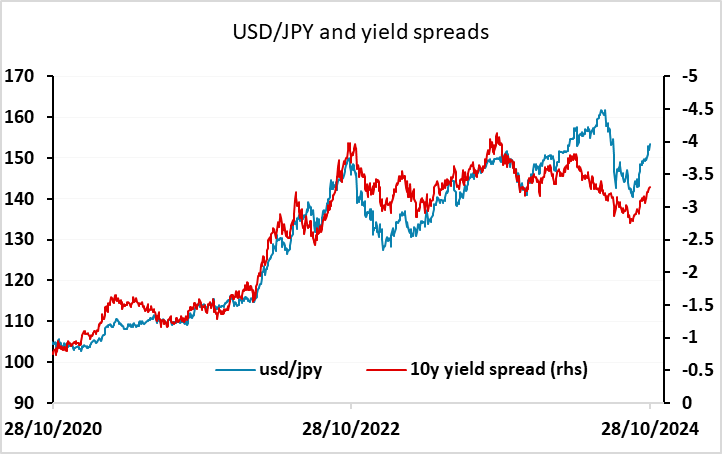

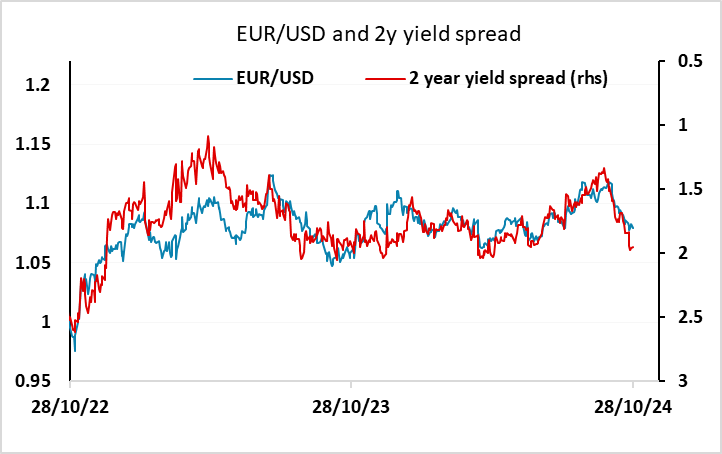

As it stands, the JPY has been much the biggest victim of the rise in the USD in the last few months. The is not really because Japanese yields have been pulled up less than yields elsewhere by the rise in US yields, as was the case in he early 20202. The bund/JGB spread has actually been fairly steady. But EUR/USD has tended to correlate with short term US/Eurozone spreads, while USD/JPY has tended to move with longer term spreads. Additionally, and crucially, EUR/JPY has tended to rise as US yields rise due to the EUR/JPY negative correlation with the US equity risk premium, which is back down to late July levels.

However, we suspect that any further USD strength might now be more pronounced against European currencies. Firstly, the Japanese authorities are likely to start to get more concerned about JPY weakness at these levels, and intervention becomes much more likely as we approach 155. Secondly, while Trump’s policy of raising tariffs may lead to higher yields, it may also be negative for growth and equities, perhaps significantly so given the high starting point. But short term JPY weakness has become harder to oppose in the wake of the weekend Japanese election which left the ruling coalition without a majority. For today, expect more downward pressure on the JPY, with EUR/JPY looking at a retracement target at 167.40. But these may well be the last throes of EUR/JPY strength and general JPY weakness.