FX Daily Strategy: APAC, March 6th

ECB to cut rates again

Limited scope for the ECB to provide much guidance given fiscal policy uncertainty

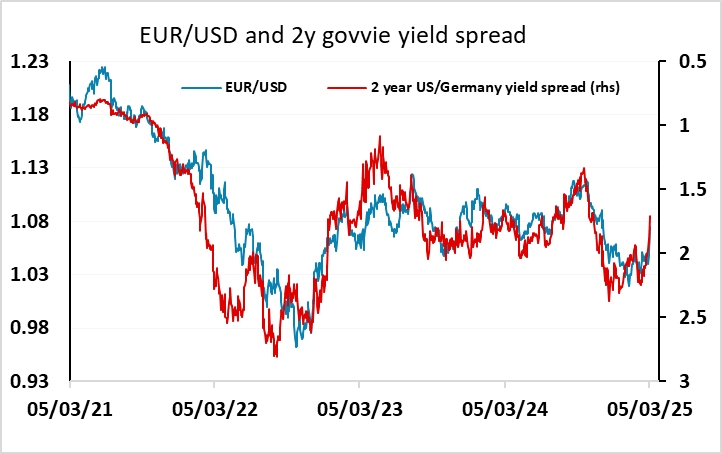

Risk may be towards a lower EUR after the sharp gains of recent days

SEK strength may be bolstered by CPI data but is starting to look overdone

ECB to cut rates again

Limited scope for the ECB to provide much guidance given fiscal policy uncertainty

Risk may be towards a lower EUR after the sharp gains of recent days

SEK strength may be bolstered by CPI data but is starting to look overdone

The ECB meeting will be the main focus on Thursday. As has been the case at most recent Council meetings, the ECB verdict is less important that the rhetoric. A sixth 25 bp discount rate is widely expected, to 2.5%, but how wide the door is left open for further cuts may depend on how near to neutral policy the Council feels they are. Last time around, the ECB stressed monetary policy remained restrictive albeit with differences on the degree and the debate on this issue may be more intense this time around. It is unclear also how vocal the Council wishes to advertise any shift as it may wish to keep options for further easing in April should US tariffs materialise as has been flagged.

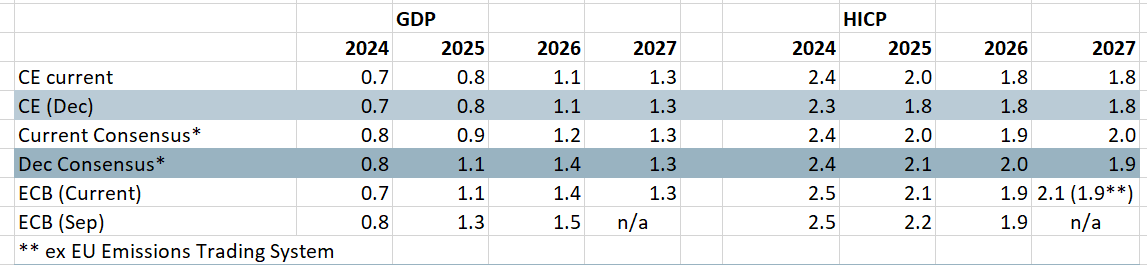

ECB Likely to Remain Above Consensus?

Source: ECB, Bloomberg, CE

As for growth risks, little was made of the weaker real economy last time, and before the latest news of the likely boost to German defence and infrastructure spending, some downward revision to growth forecasts seemed likely. Now this is less clear, and even though the ECB won’t want to assume too much about spending decisions that are yet to be finalised, they will probably leave their growth assumptions alone for now. The likely reluctance of the ECB to commit to anything without a clearer read on the fiscal policy picture means it will be hard to draw too many conclusions from the decision.

As it stands, the market is pricing 69bps of easing by the end of the year, including 25bps at this meeting, and December is seen as the low point for the policy rate. The April meeting is currently priced as representing a 50-50 chance of a rate cut, but the next cut is fully priced in by June. The large moves higher in EUR yields in the last few days have not yet moves front end yields above the highs seen in November and January, and we doubt that he ECB will provide a reason to extend the gains given the uncertainties around policy, as well as the fragile current momentum of the economy. The risks may therefore be slightly to the downside for yields and the EUR, but we wouldn’t expect a sharp reaction, with the market’s perception of European fiscal policy still the dominant factor for now.

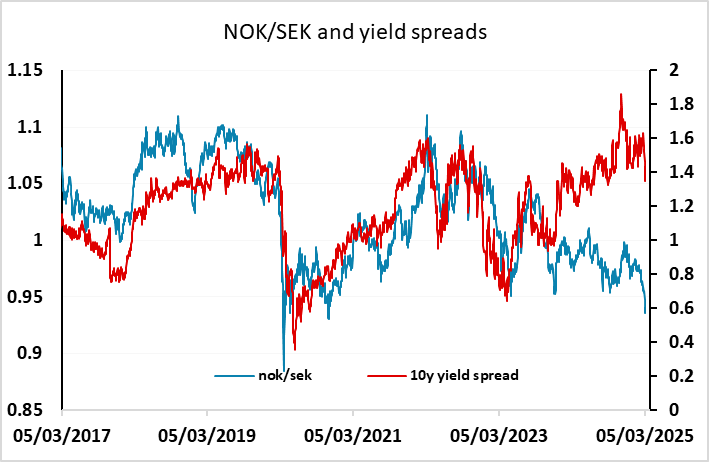

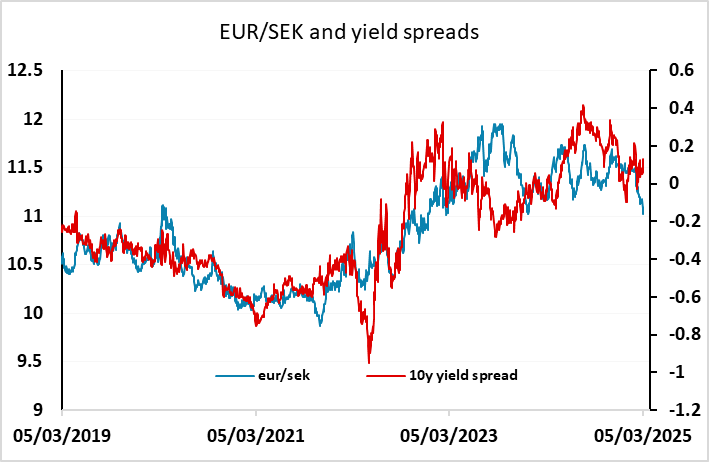

Before the ECB meeting there is flash Swedish CPI data, which looks more interesting in view of the exceptional strength of the SEK in recent days. The targeted CPIF measure of inflation is expected to rise to 2.7% y/y in February from 2.2% in January, which should tend to support the current market expectation that the Riksbank easing cycle is over. There is some residual risk of a further cut priced in later in the year, but it is seen as a less that 50% chance. The stronger than expected Swedish Q4 GDP data reported last week and the expected boost to growth that is now expected to come from Eurozone defence spending may mean the risks are now that the market starts to price in the first hike later this year rather than look for a further cut. The SEK tends to benefit from any positive view of European growth, and to that extent the SEK strength this week is not a surprise. But EUR/SEK has fallen further than might have been expected given the yield spread moves, and NOK/SEK remains particularly weak, perhaps also helped by softer oil and gas prices. It’s hard to oppose SEK strength if we see a stronger CPI numbers, but the level against the NOK in particular is starting to look overstretched.