EUR flows: EUR softer after weak French and Spanish CPI

French and Spanish CPI come in much weaker than expected in September at 1.5% and 1.7% respectively on an HICP basis, firming up expectations of an October ECB rate cut and pushing EUR/USD lower towards 1.11. But further declines will likely require higher US yields.

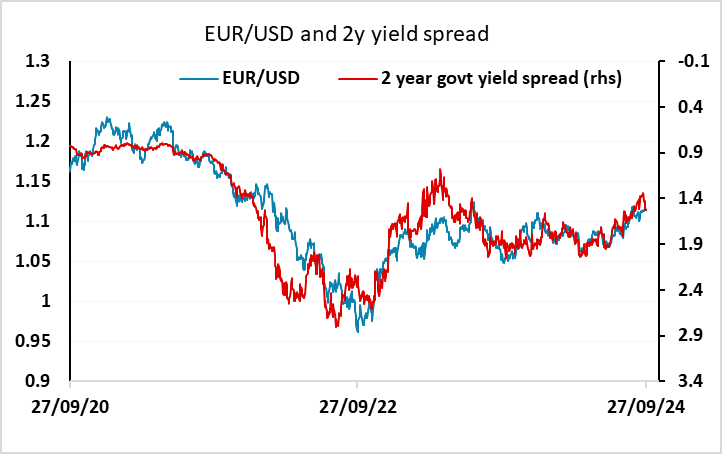

Very soft French and Spanish preliminary CPI data for September strengthen the case for an ECB rate cut in October. This is now priced as a 92% chance from around a 72% chance yesterday. The decline in 2 year yields has been relatively modest, but has now been sufficient to mean there is no longer a yield spread argument for EUR/USD gains. But from here there is now not much more downside in front end EUR yields, so stability close to 1.11 looks like the most likely outcome until or unless we get US data that changes market perceptions of the path of Fed policy. Longer term, we still see some upside scope for EUR/USD since as time goes on front end US yields will fall more than EUR yields if the market is right about the rate cut profiles on both sides of the Atlantic, but it looks like being a slow process.