EUR, CHF, JPY flows: Steady market, EZ CPI awaited

EUR unaffected by German retail data. CHF/JPY looks overextended.

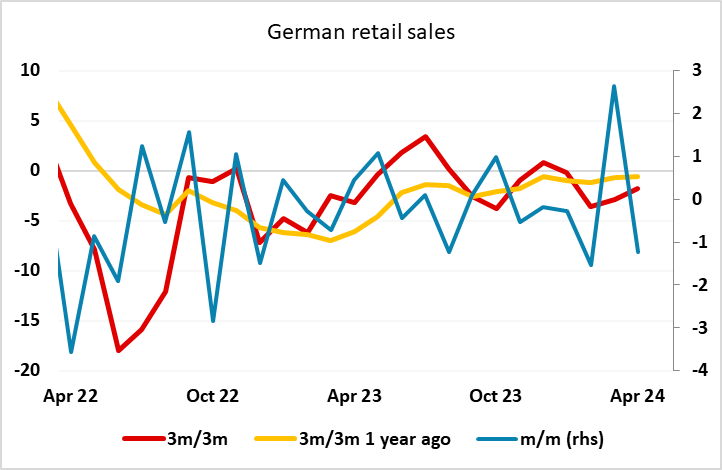

A fairly quiet start to Friday with the Eurozone CPI data later likely to be the main focus for the European morning. The French CPI data at 07:45 will provide something of a lead, but with the German and Spanish numbers coming in close to expectations, we doubt there will be any big impact from today’s CPI data. The German April retail sales numbers already released this morning were weaker than expected, but after the strong rise in March the decline is of little significance, with the underlying trend quite steady, and hasn’t had much impact on the EUR.

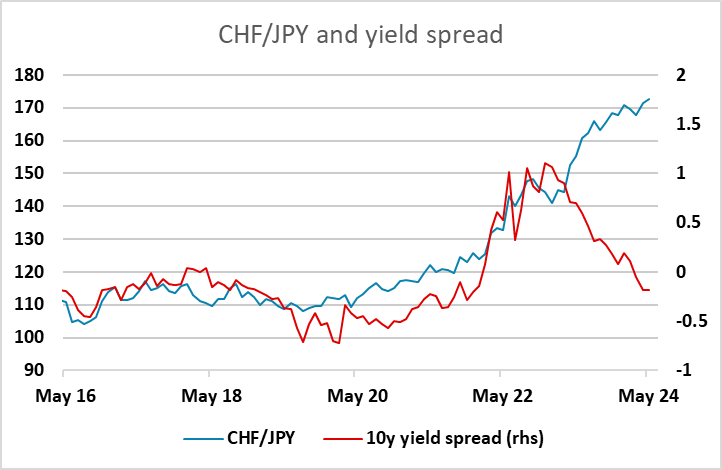

Overnight was also fairly quiet, with Japanese Tokyo CPI as expected and only modest movement in FX. EUR/CHF continued to edge lower in the first part of the session but has recovered in early European trading. We continue to see CHF/JPY as the most obvious example of overvaluation, and with long term yields in Japan above those in Switzerland, the case for a reversal lower is strong.