FX Daily Strategy: APAC, December 13th

GBP may correct lower as GDP data flattens

Current GBP strength supported by yield spreads, but GBP overvalued longer term

EUR/USD likely to stay stuck close to 1.05

CHF weakness could extend against the JPY

GBP may correct lower as GDP data flattens

Current GBP strength supported by yield spreads, but GBP overvalued longer term

EUR/USD likely to stay stuck close to 1.05

CHF weakness could extend against the JPY

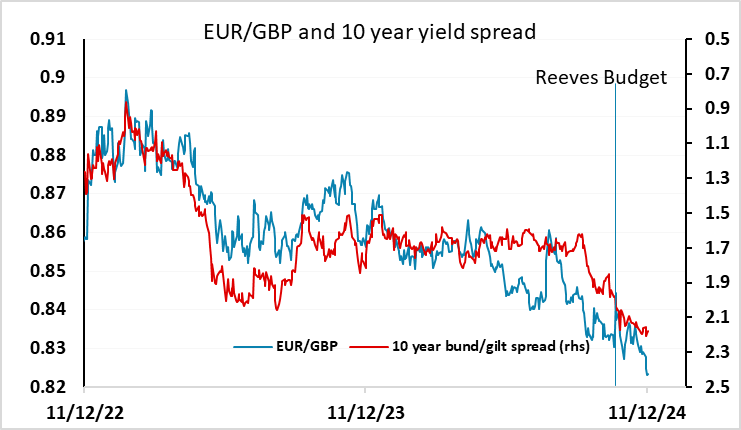

After a week of central bank meetings, Friday looks like a quieter day. UK October GDP looks like the data of most interest, with the market looking for a 0.1% m/m gain after the 0.1% m/m decline seen in September. This flattening trend in GDP might take the edge off GBP strength, which has been significant in recent weeks. EUR/GBP hit its lowest since March 2022 this week, which itself is the lowest since the Brexit referendum. The pound has been one of the best performing currencies this year, reflecting relatively high UK yields, which are partly due to relatively strong UK growth in H1, partly due to weak UK labour supply and consequently relatively high wage and CPI growth. But if we see UK growth flattening off at the end of the year, it may revive hopes of UK rate cuts next year.

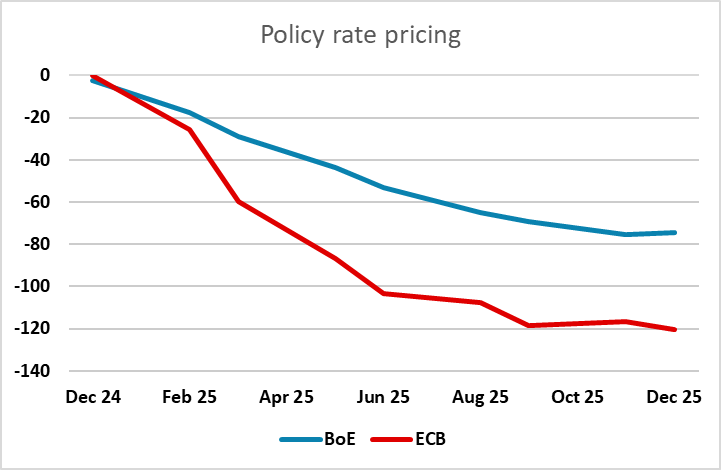

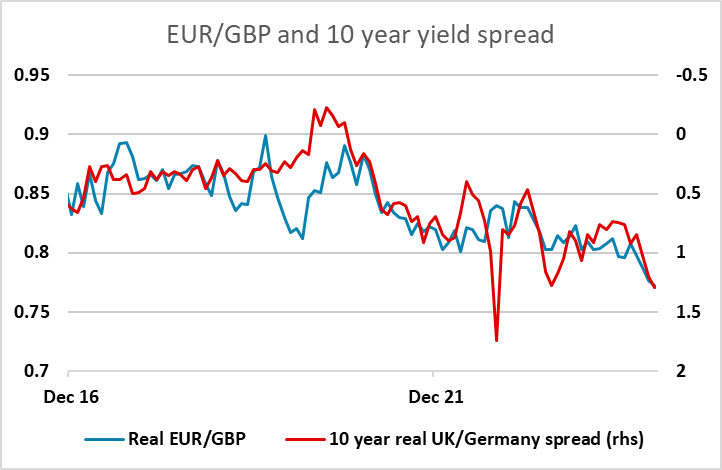

Currently, UK rate cut expectations are quite modest, with 75bps of easing priced over the next year, compared to a further 125bps from the ECB. This projected widening of spreads is supportive for GBP but it is likely that UK rates will fall more significantly over the longer run. As it stands, relatively high UK yields justify the current level of GBP, although from a long run perspective GBP is expensive at these levels. When real values are taken into account, it’s hard to argue for GBP rising much further, so while there may be some more short-term upside, most of the longer term risks are on the GBP downside.

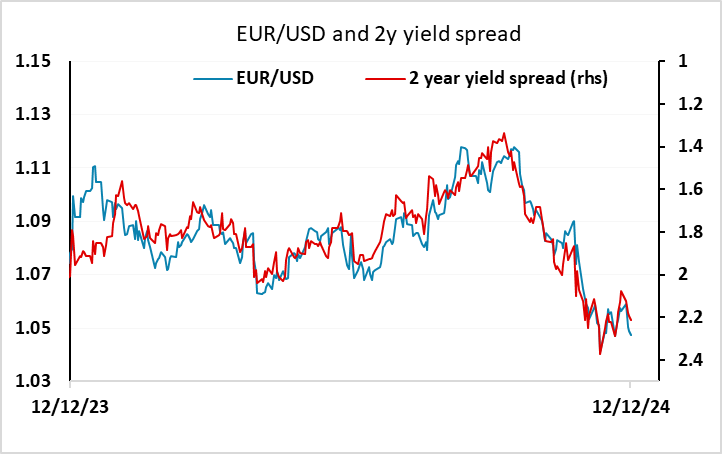

Otherwise, there isn’t a great deal of interest on Friday’s calendar. The ECB didn’t provide any major surprises, and it looks like EUR/USD will hold close to 1.05, sticking close to the correlation with short term yield spreads. The focus is now shifting to the Fed next week and Trump’s policies longer term. The Fed is priced to ease, so the risks may now be more towards the USD upside, as recent Fed comments have suggested that the market shouldn’t expect consecutive cuts.

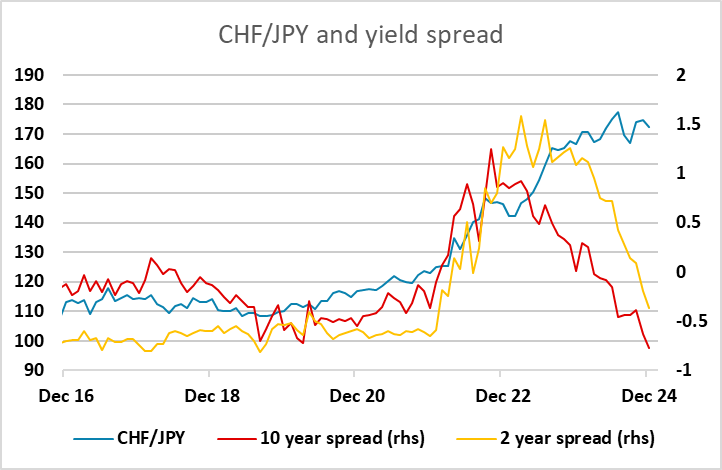

The 50bp cut from the SNB on Thursday did trigger a sharp rise in EUR/CHF, but it ran out of steam fairly quickly. EUR/CHF doesn’t have much correlation with yield spreads, and looks unlikely to rise a great deal without some improvement in perceptions of Eurozone budgetary stability, notably in France. However, the SNB rate cut, combined with the SNB indication that they are prepared to oppose renewed CHF strength with intervention, suggests the CHF may no longer be the best choice of safe haven. So while EUR/CHF may not rise too much, CHF/JPY looks to have a lot of potential to decline.