FX Daily Strategy: N America, February 29th

European CPI data broadly in line with consensus

US PCE price data also a focus

CHF still has downside risks

JPY may benefit from softer US/Europe inflation picture

European CPI data broadly in line with consensus

US PCE price data also a focus

CHF still has downside risks

JPY may benefit from softer US/Europe inflation picture

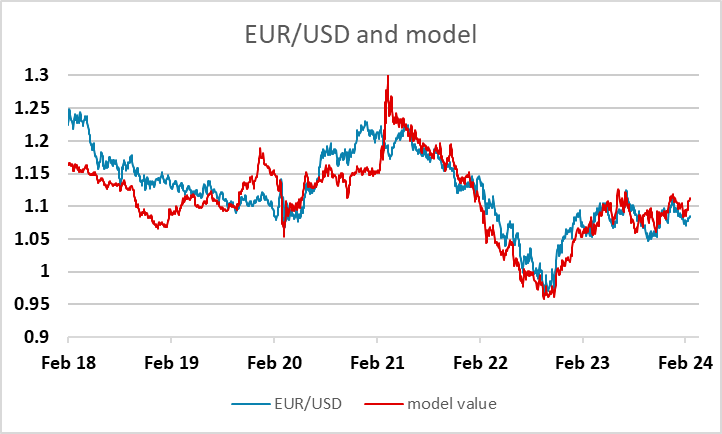

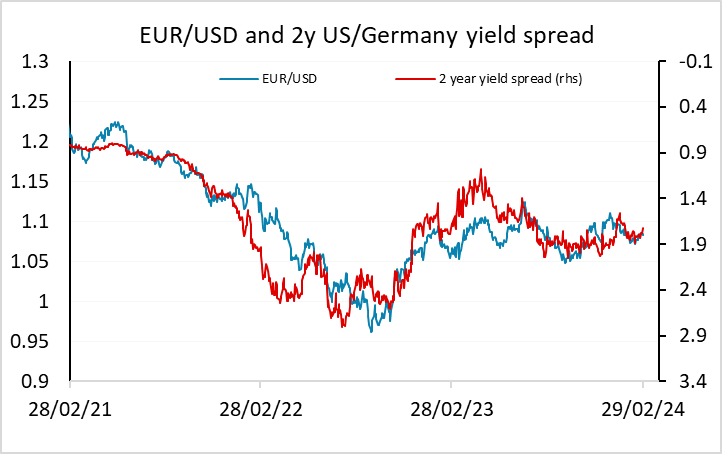

German state CPIs came in broadly in line with expectations, although the NRW data looks to be slightly on the low side. Nevertheless, national CPI later seems likely to come in essentially in line, and with Spanish data also in line and French data slightly on the high side, the Eurozone inflation numbers tomorrow look unlikely to deviate sufficiently from ECB expectations to change anything. Even so, the declining y/y rates are a positive in the progression towards the inflation target, so we still see the risks as being towards lower yields and somewhat faster rate cuts than the market is pricing in. But if anything EUR/USD looks a little below the levels that might be expected given current yields and spreads, so risks in the short term are slightly on the upside.

The EUR is currently trading slightly soft relative to our models, driven by a modest decline in front end yield spreads in the last few days. The picture will also depend on the US data due for release, particularly the US PCE price data for January. The consensus expectation is that this matches the 0.4% m/m rise in CPI, but we see a 0.3% rise which could be expected to lead to some modest decline in US yields. So even though we see some risks of lower yields in Europe, we suspect this will not lead to significant EUR weakness, partly because US yields may also fall, and partly because lower yields may prove supportive for equities, which will tend to support EUR/USD. Dips below 1.08 in EUR/USD are therefore unlikely to be sustained.

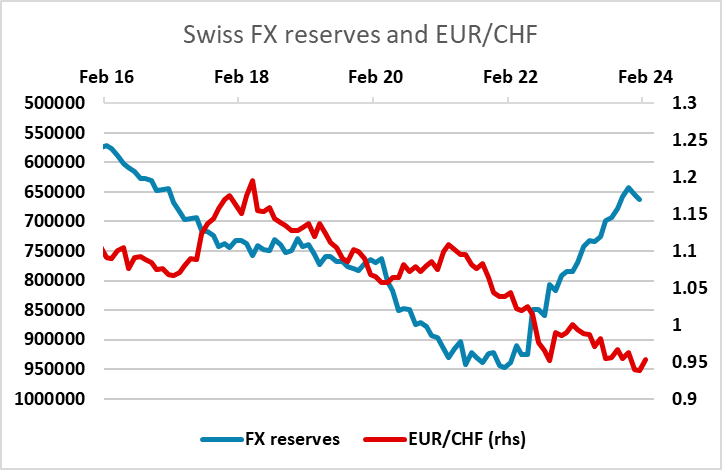

There is also other European data in Thursday, with Swedish and Swiss Q4 GDP data. The consensus was for a 0.1% gain in both, but the Swedish data showed a 0.1% decline, albeit with an upward revision to Q3, while the Swiss data showed a stornger than expected 0.3% rise. EUR/SEK looks likely to remain fairly static near 11.20, but in spite of the stronger data there is scope for the CHF to decline further. EUR/CHF has been in a 5 year downtrend, and while some of this is justified by the relatively low Swiss inflation rate over the period, it has also been supported by various risk concerns and the building of the SNB’s FX reserves over the period. Now that this build has been reversed, there is scope for the CHF to follow lower.

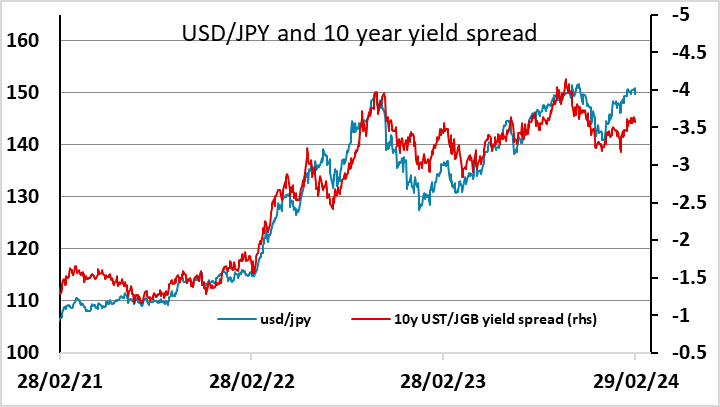

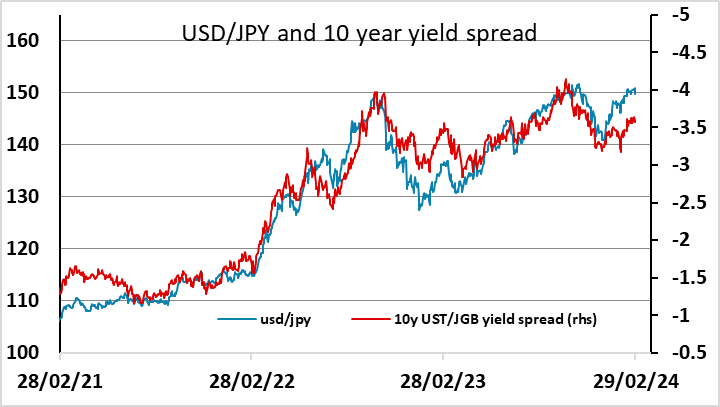

Overnight saw some JPY gains helped by some hawkish comments from the BoJ's Takata. There is still scope for the JPY to advance further against the USD based on current yield spread relationships. But from a bigger picture perspective, we still need lower yields in the US and Europe to trigger a bigger JY reocvery and return it to more sensible valuations. Lower yields in Europe and the US would support the JPY via reduced yield spreads, but the JPY hasn’t been particularly responsive to yield spread moves this year. Rather, it has been continuing to follow the declines in equity risk premia, but any yield decline will also typically mean a rise in equity risk premia, as equities will typically not react fully to the yield decline.