U.S. September Durable Goods Orders - Aircraft slip, but ex transport showing signs of improvement

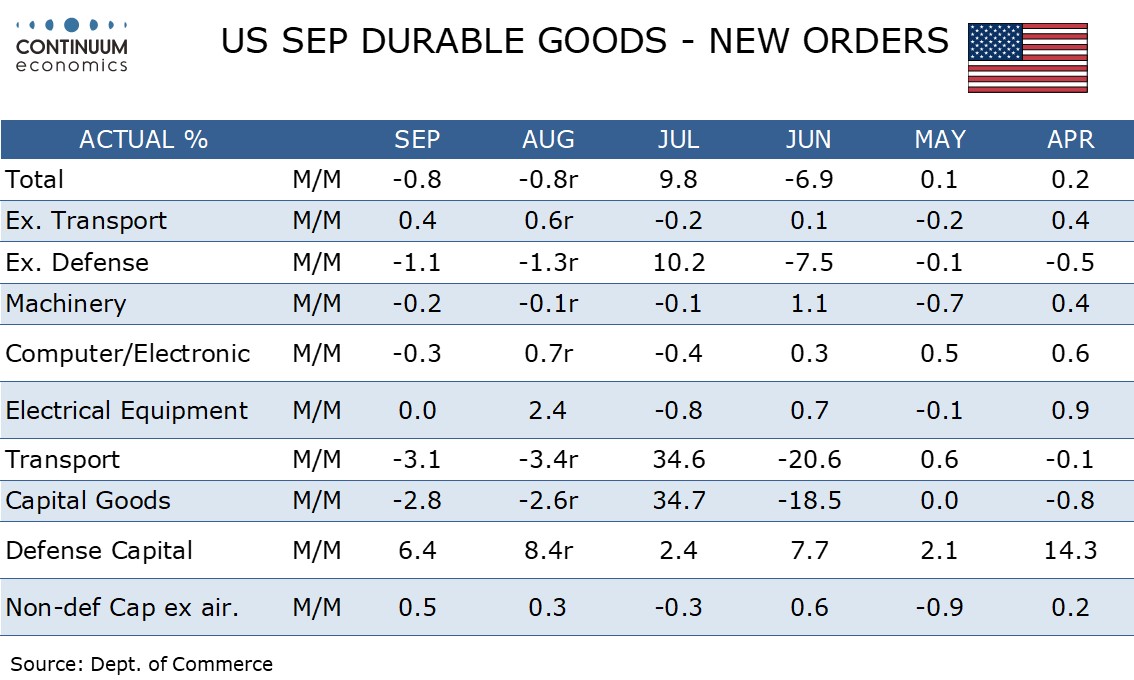

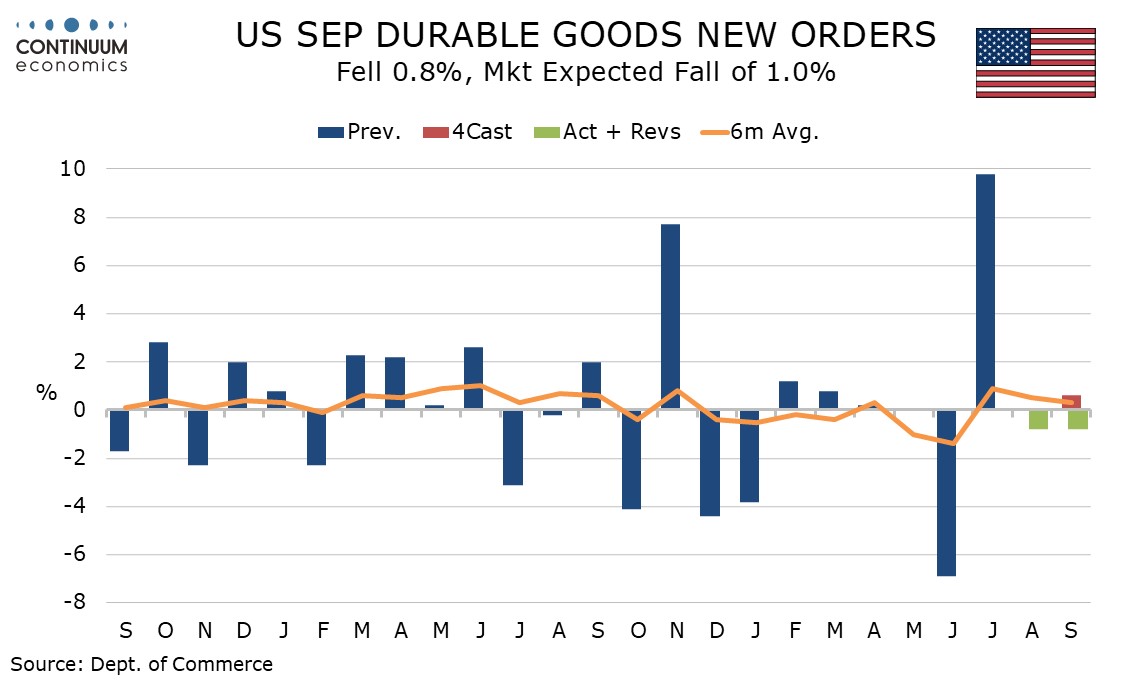

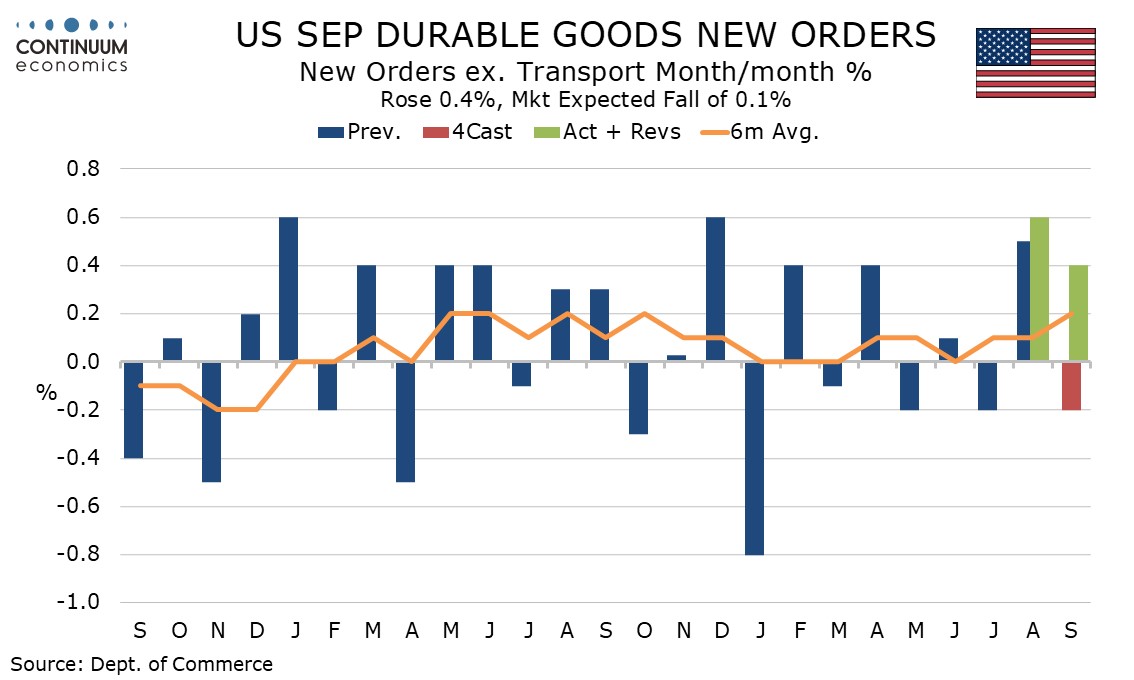

September durable goods orders fell by 0.8% in line with expectations with August revised down. Also to -0.8% from unchanged. The weakness of the headline however contrasts with a stronger than expected 0.5% rise ex transport, with August revised up to a 0.6% increase from 0.5%, hinting at underlying improvement in trend.

Aircraft slipped, both defense and non-defense, probably related to a strike at Boeing which started in mid-September and had been seen as a risk well before the strike started. Auto orders increased. While defense aircraft orders slipped defense capital orders overall were up and orders ex defense at -1.1% were weaker than the headline.

The latest data provides the first time ex transport data, where trend has been close to flat, delivered two straight positives since August and September of 2023, both of which at 0.3% were less strong than the latest data. The revised August gain of 0.6% is the strongest since December 2023. While trend still looks subdued there are hints that it is improving.

Non-defense capital orders ex aircraft, a key indicator of business investment, increased by 0.5% after a 0.3% August increase and that is positive for the outlook going forward. However shipments in the sector fell by 0.3% after a 0.1% August decline and that suggests business investment in the Q3 GDP breakdown may correct from Q2 strength. A 0.2% fall in inventories is also negative for GDP.