FX Daily Strategy: N America, January 30th

Tokyo CPI Moderates

Rebound in trade to bring an above trend month for U.S. December PPI

Partial reversal of October's dip in November GDP

Tokyo CPI will be released on Friday. Following the previous month's moderation, the latest release is expected to show inflation to remain below 3%. While the numbers maybe deceiving from base effect, it won't be deceiving the BoJ as they kept their rhetoric in more hike to come. It would come as a hawkish surprise if we see core-core inflation being far higher than headline CPI, suggesting underlying inflation pressure is much stronger. Headline CPI could see another push lower in the coming month as new energy stimulus hits.

Indeed, the Tokyo headline CPI dips below 2% while the other two item also slips to 2%. Regardless of BoJ's hawkish rhetoric, the data eases pressure for them to perform any imminent hike. While energy subsidy is in play, the fact that core-core inflation also moderates to 2% shows that the inflationary pressure is luke warm at best as real wage remain choppy for the past quarters.

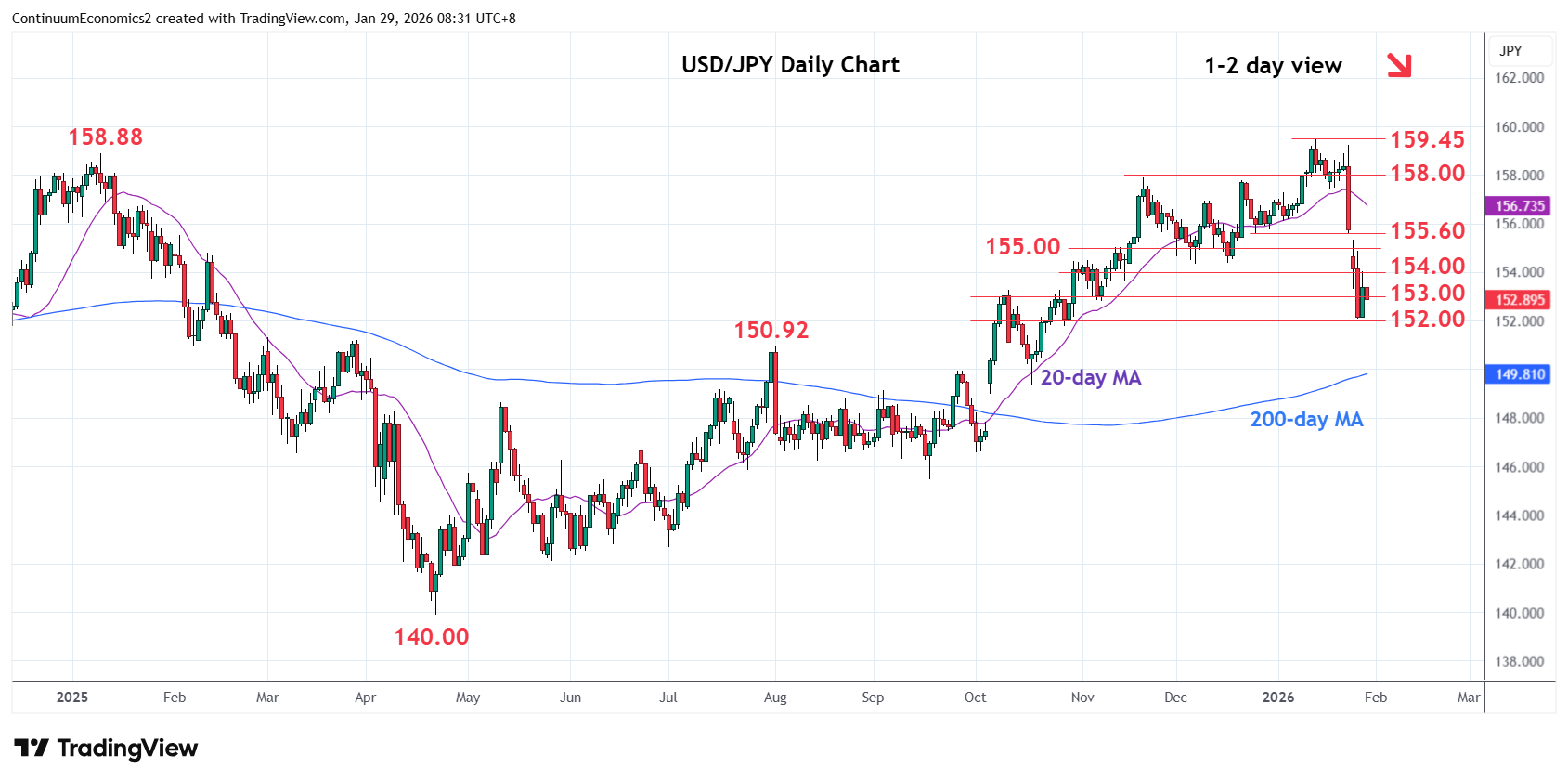

On the chart, the pair turned up from the 152.10 low as prices consolidate sharp losses from the high of last week. Consolidation see prices unwinding the oversold intraday and daily studies but this is expected to give way to renewed selling pressure later. Below this and the 152.00, 38.2% Fibonacci level, will open up room for extension to support at 150.92 August high where reaction can be expected. Below this will see room to the 150.00 figure. Meanwhile, resistance is raised to the 154.00 level and this extend to the 154.35/40 December lows are expected to cap. Only above here will open up room for stronger corrective bounce.

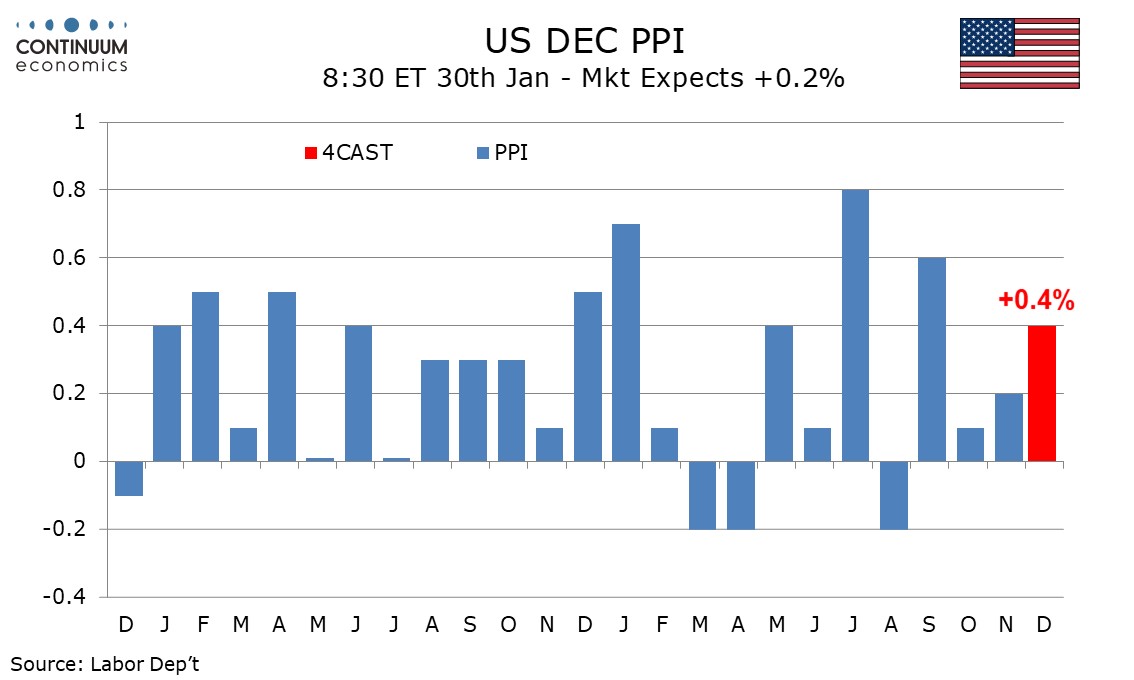

Despite signs in the CPI that inflationary pressure has slowed in Q4, we expect December PPI to show above trend gains of 0.4% both overall and ex food and energy. Ex food energy and trade however we expect a moderate gain of 0.2%, which would match November’s outcome in that series. We expect goods PPI to rise by 0.3% overall and ex food and energy, with food and energy both seeing modest gains. Goods ex food and energy have risen by 0.2% three times and 0.4% three times in the last six month suggesting trend remains near 0.3%, as were the gains seen in February, March, April and May.

Services may be due for a bounce from a flat November given that the volatile trade series fell by 0.8% in both October and November. We expect trade to explain around half of a 0.4% December rise in services. Yr/yr PPI would then slip to 2.8% from 3.0% overall, and to 2.9% from 3.0% ex food and energy. Ex food energy and trade we also expect yr/yr growth to slow, to 3.3% from 3.5%.

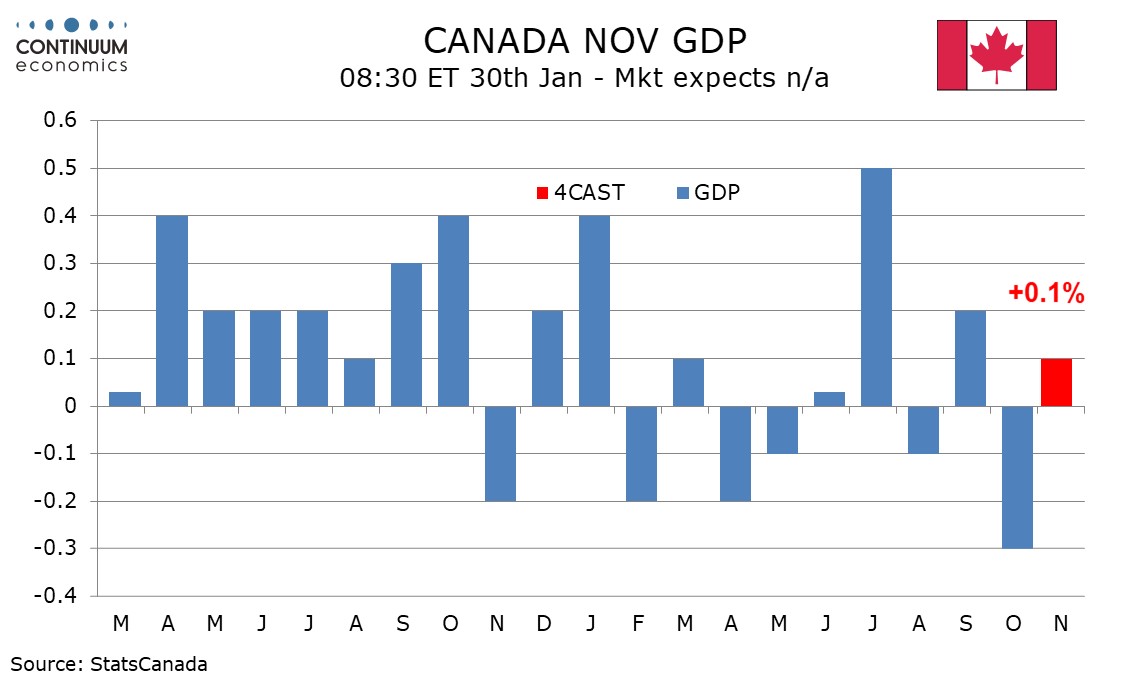

We expect November Canadian GDP to increase by 0.1% in line with a preliminary estimate made with October’s report, when a 0.3% decline was reported. We expect the preliminary estimate for December will also show a modest increase. If November GDP rose by 0.1% and October is unrevised, a flat December would leave GDP down by around 0.5% annualized, correcting a 2.6% increase in Q3. If December manages a modest increase, Q4 may be close to unchanged.

The preliminary estimate for November saw weakness in manufacturing and mining but gains in construction, educational services and transport and warehousing. This suggests that goods will slip for a second straight month, even with a rise in construction, but services will recover from an October decline. Given a dip in November 2024, yr/yr GDP would then pick up to 0.7% from 0.4% in October. October saw these lowest yr/yr gain since February 2021 ended a string of negatives seen because of the pandemic.