FX Daily Strategy: Europe, October 11th

EUR/GBP to hold below 0.84 on consensus UK GDP data

Weaker USD after higher CPI may reflect higher jobless claims, but these may be hurricane related

Little reason to see a sustained weakening in risk sentiment

CAD vulnerable as unemployment rate rises

EUR/GBP to hold below 0.84 on consensus UK GDP data

Weaker USD after higher CPI may reflect higher jobless claims, but these may be hurricane related

Little reason to see a sustained weakening in risk sentiment

CAD vulnerable as unemployment rate rises

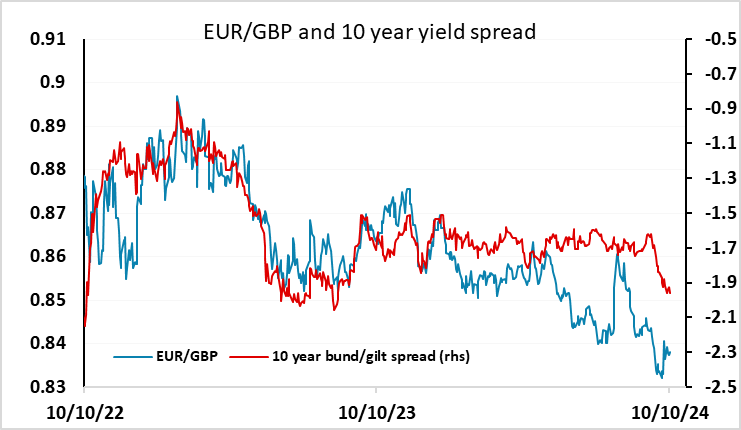

Friday kicks off with UK August GDP data, which is expected to deliver a 0.2% rise after a couple of months of flat data. The UK market is unlikely to react too much to these numbers, with most of the current focus on the UK Budget due on October 30 and the recent comments from BoE governor Bailey indicating the likelihood of more active easing. Even so, there might be more sensitivity to weak numbers than strong numbers after the flat data of the last couple of months. GBP has been the strongest major currency this year, largely because of the surprising strength seen in H1 growth, but evidence that growth is waning could undermine sentiment. If we see a 0.2% gain or better in August GDP, expect EUR/GBP to continue to hold sub-0.84.

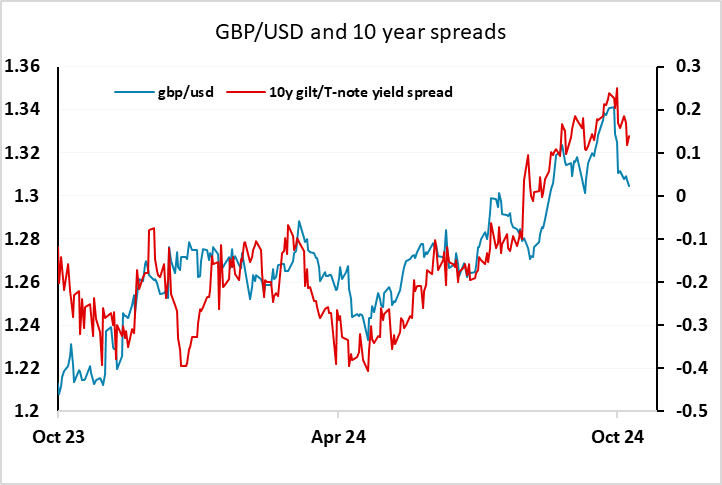

The USD reaction to the US data on Thursday was a little surprising, with the USD falling, mainly against the JPY, despite the stronger than expected CPI data. It may be that the market was reacting to the much higher than expected jobless claims numbers, but there is a strong possibility that the claims data were affected by Hurricane Helene. Even so, with future data potentially impacted by Hurricane Milton, we could see some more weak data in coming weeks, and similar weakness may be seen in the October employment report when it comes out. Even if distorted, weaker employment data is seen as significant. From a yield spread perspective, there is much more potential for the USD to correct lower against the JPY than the EUR, with US yields at the short end still high enough to suggest EUR/USD can test below 1.09.

There was a generally more risk negative tone to the markets after the US data, with commodity currencies falling back and the CHF and JPY gaining ground. But equities were only slightly lower, and we don’t see a strong case for a significant move lower in sentiment at this stage. Markets still expect two more Fed cuts by year end, and only if inflation problems are seen as a barrier to Fed easing is there likely to be any real concern in the equity market.

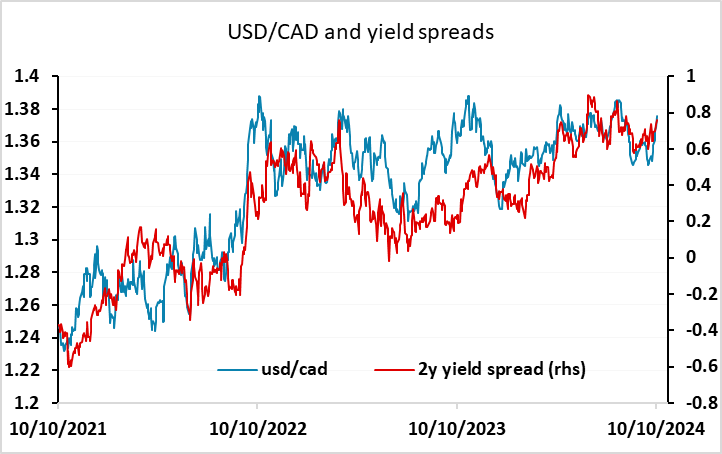

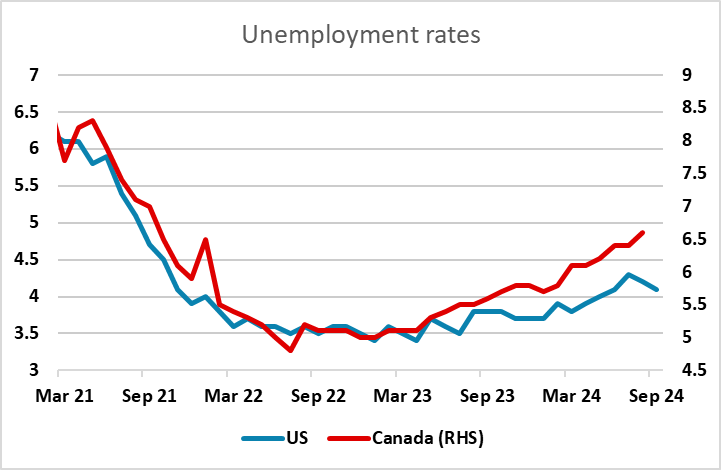

Friday also sees Canadian employment data. The market consensus anticipates another solid rise in employment in the region of 30k, but a rise in the unemployment rate to 6.7% from 6.6%. The recent trends in the US and Canadian unemployment are showing a significant difference, with the Canadian rate rising significantly faster, and numbers in line with consensus may well keep the CAD on the back foot. USD/CAD has been edging higher with spreads, and could well continue on that path.