FX Daily Strategy: Asia, June 25th

Ceasefire Consistency in the Spotlight

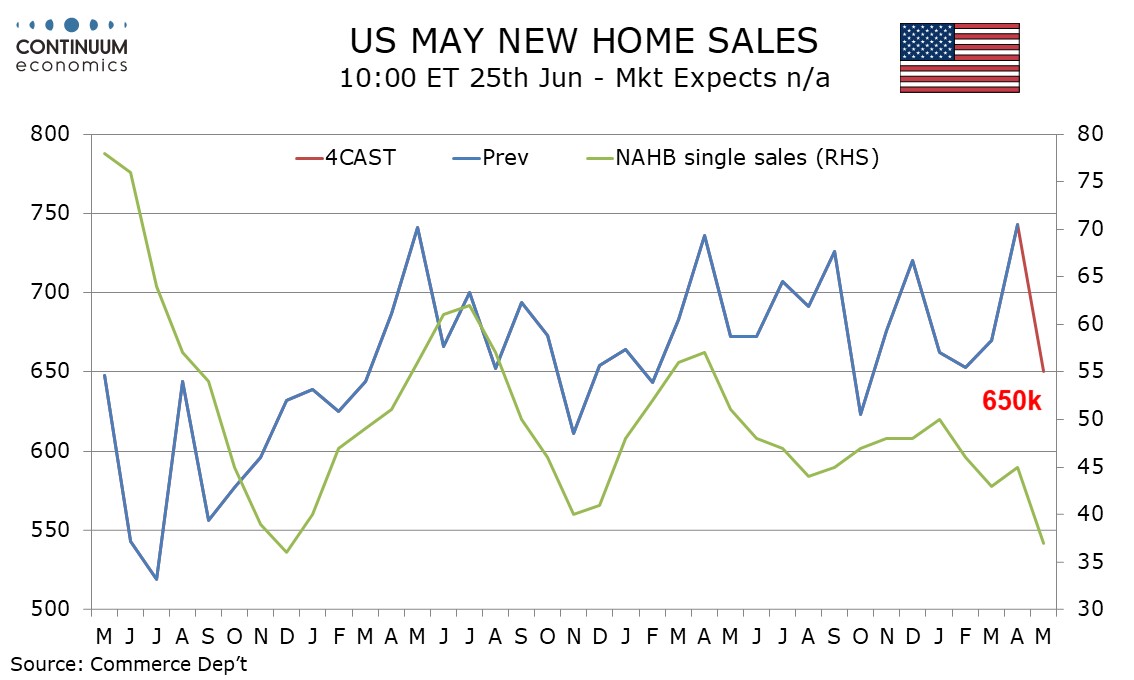

U.S. May New Home Sales unlikely to repeat April's strength

BoJ Summary Unlikely to Provide Cues

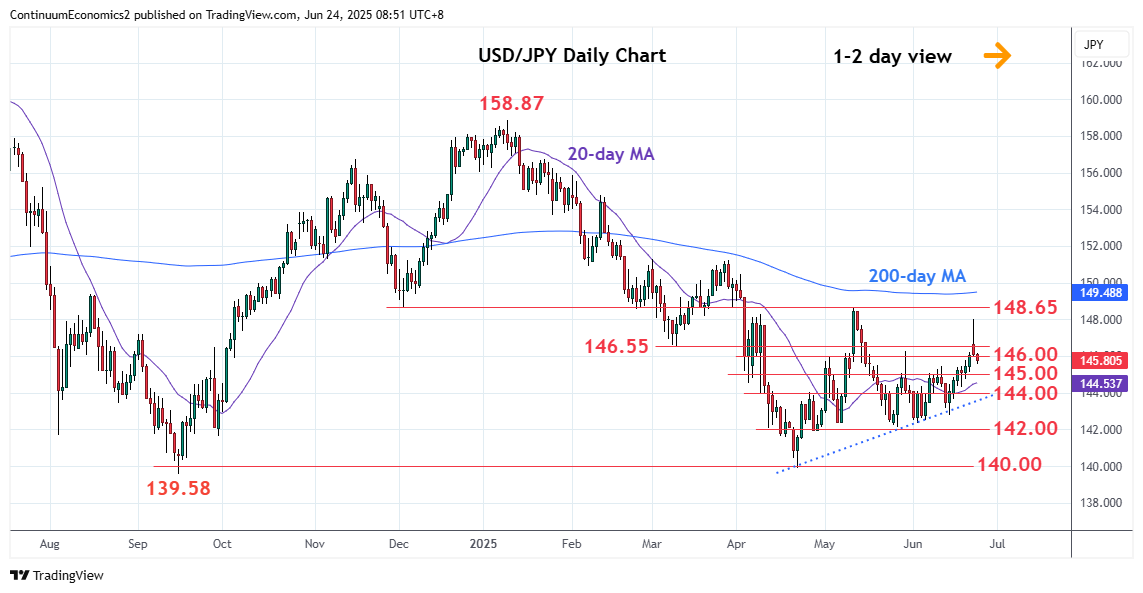

Could See a Stall in JPY Strength

While it is broadly positive for the Iran-Israel ceasefire, it is important to keep track of actual ceasefire between the two. Israel has detected multiple waves of missiles flew from Iran to Israel after the supposedly ceasefire hour. The remarks from the Iranian front seems to suggest those missiles were fired at the last hours and does not seem to want to re-escalate the situation. Market participants will be closely watching the geopolitical scene as a re-escalation may lead to a larger scale warfare.

We expect a May new home sales level of 650k, which would be a 12.5% decline if April’s surprisingly strong 10.9% increase to 743k is unrevised. April’s level was the highest since February 2021, but only marginally above the highs of 2023 and 2024, and a downward revision is possible. The strength of April existing home sales contrasted slippage in April existing and pending home sales. The NAHB homebuilders’ index slipped significantly in May, with rising bond yields putting upward pressure on mortgage rates. Our forecast for April is only marginally below the levels seen in each month of Q1. We expect the median price to fall by 1.5% on the month after a 0.9% April increase and the average price to fall by 2.5% on the month after a 3.7% April increase. This would leave yr/yr data slipping to a more negative -3.2% from -2.0% for the median, and to a less positive 1.2% versus 2.4% for the average.

The BoJ Summary of opinions will be released on Wednesday but unlikely to provide much cues for any further action. The latest remark from Japan PM Ishiba has poured cold water on an imminet deal between the U.S. and Japan as auto tariffs remain a big obstacle towards an agreement. The BoJ would not show their weak hands and instead downplay inflation to be largely transitory, though underlying pressure is mounting. Even with little forward guidance, it is likely the BoJ will seize the opportunity to hike once a U.S.-Japan trade agreement is done.

USD/JPY has retraced almost all of its post war gain as Iran-Israel reached a ceasefire. However, with the lack of commitment from the BoJ and potentail breaking of ceasefire will prevent market partcipants to fully unwind their position. If risk aversion creeps in again, USD will likely be preferred over JPY for haven seeking.

On the chart, the break above strong resistance at the 146.00/146.55 area has seen sharp gains to reach the 148.00 level before retracing back to the 146.00 level. Follow-through here open up room for deeper pullback to retrace gains from the 142.79 low. Lower will see room to support at 145.46 and the 145.00 congestion. Would take break of the latter to return focus to the 144.00 congestion and the April trend line at 143.60. Meanwhile, resistance is at the 146.55 March low is expected to cap and sustain losses from the 148.00 high.