FX Daily Strategy: N America, January 30th

Eurozone GDP provides some support for the EUR

GBP may start to follow EUR decline against the USD

Eurozone GDP provides some support for the EUR

GBP may start to follow EUR decline against the USD

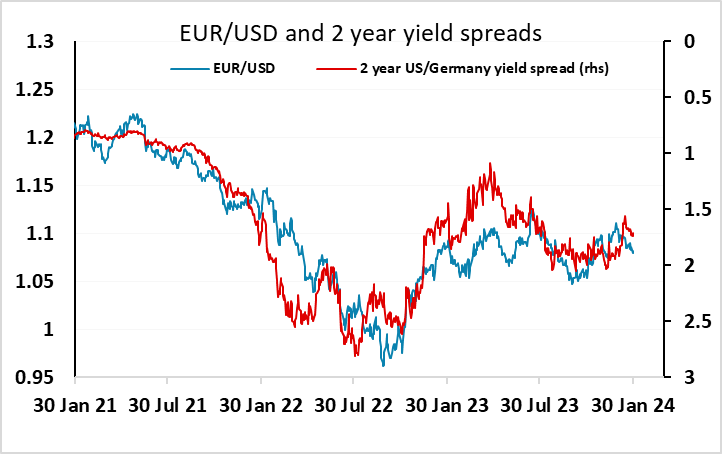

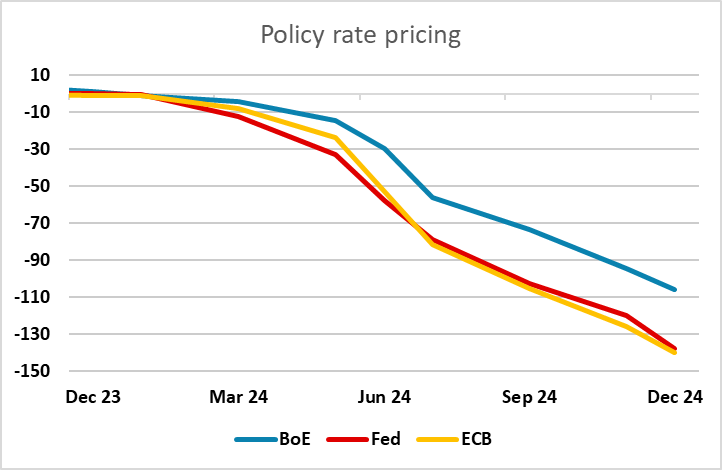

There’s a lot of European data due on Tuesday, with the Q4 Eurozone GDP data the main highlight. The market consensus was for a decline of 0.1%, the same as Q3, which would have consequently represented a recession by the standard definition, albeit the shallowest recession possible. However, in the end we saw a flat quarter due to strong Spanish and Italian numbers, despite a 0.3% decline in Germany, and this has provided the EUR with a little support, with EUR short end yields rising a little and EUR/USD edging up away from 1.08. Yield spreads have been a large part of the story of recent EUR weakness, with spreads moving steadily in the USD’s favour since the middle of the month, but the underperformance of the Eurozone economy is also a more direct negative factor, as the EUR does tend to suffer when European equities underperform. While European equities have done better in the last couple of days, they have underperformed over the month as well as over the last year. Weak growth is either going to lead to weaker equities (if the ECB stay hawkish) or lower yields (if the ECB turn more dovish). But the better than expected Q4 numbers should ensure 1.08 holds near term.

As well as the Eurozone GDP data, there was Spanish HICP data for January and the European Commission survey. Spanish CPI was strong, while the EU commission survey was essentially as expected. There was also a speech from ECB chief economist Lane, but this proved unremarkable. While the Eurozone data is hardly strong, today's numbers came out on the strong side of expectations, and the market is essentially fully pricing in an April rate cut. With the ECB still suggesting that the first cut is unlikely to come before the summer, it is hard to see any near term downside for front end EUR yields unless there is some external shock. So for now EUR/USD should remain supported into the FOMC meeting tomorrow.

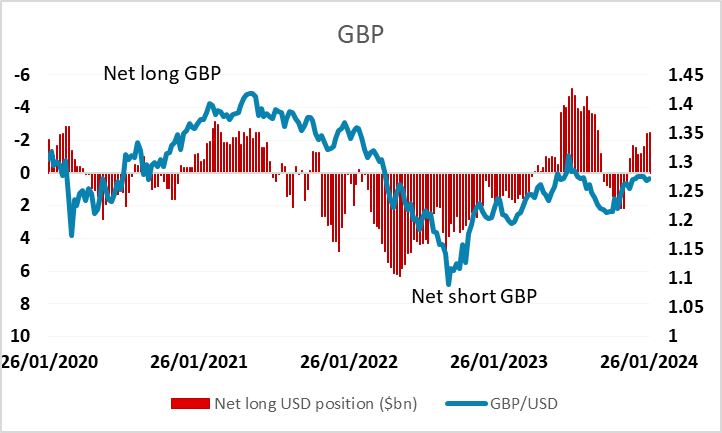

We also had UK money and credit data, which will inform the BoE MPC decisions later this week. This saw a drop back to weaker lending numbers after some slightly better data last month, although the M4 data did come in a little stronger than expected. In practice, there is unlikely to be much impact on GBP. GBP has made gains against the EUR in recent weeks, helped by some better UK surveys and expectations of a relatively less dovish path from the MPC. But positioning in GBP may now be getting a little stretched, and the UK is unlikely to be able to buck the impact of weakness in its largest trading partner, so we are wary of current GBP strength and see some risks that GBP catches up with EUR losses against the USD.