USD flows: USD softer after retail sales

USD lower after retail sales come in below consensus in May, but impact unlikely to be large

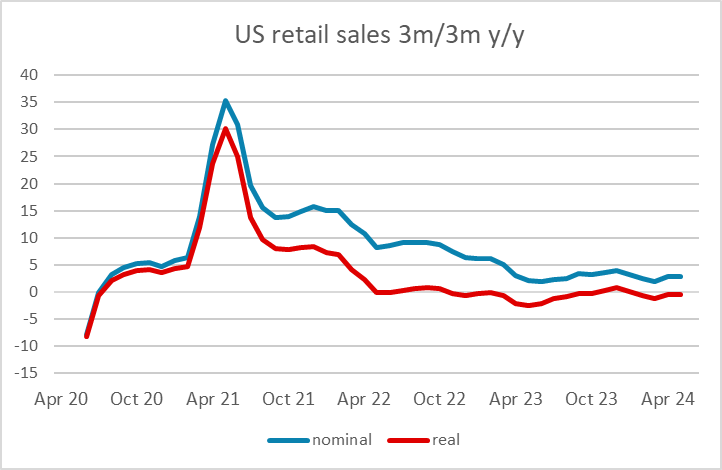

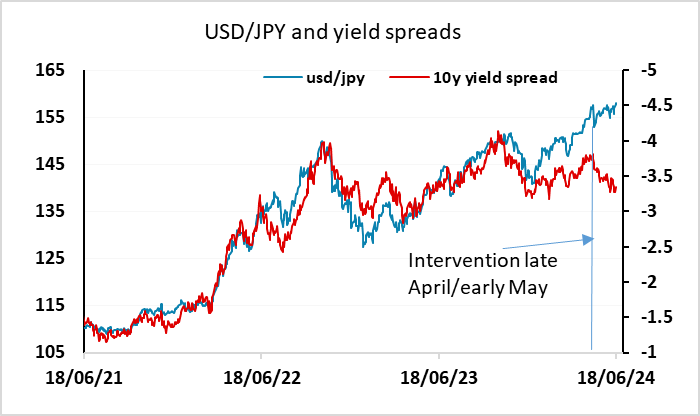

US retail sales were weaker than expected in May at 0.1% headline and -0.1% core. The USD is a little lower in response but it’s hard to see this data as particularly significant, as retail sales have been essentially flat in real terms for a couple of years, and month to month volatility makes little difference. Also, the retail control measure, which is the part that contributes to GDP, was in line with expectations at 0.4% m/m. The USD is off around 0.1-0.2% as US yields fall around 4bps. USD/JPY continues to look by far the most extended USD pair, but without some more significant weakening in US equities, a major move lower is unlikely.

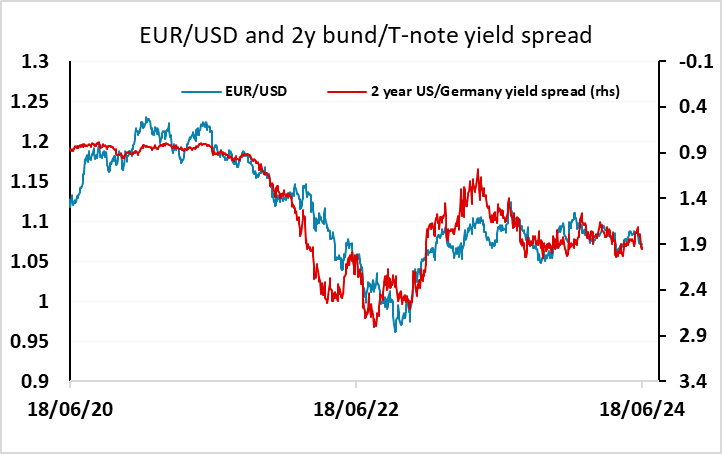

EUR/USD upside continues to be restricted by concerns around the French elections and the French public finances. On this score, tomorrow the EU Commission is expected to announce infringement procedures for excessive deficits against many countries, including possibly France. While the timing isn’t entirely clear, and an announcement may be delayed, it would be surprising if France wasn’t one of the countries to fall foul of the EU’s fiscal rules when the decision is made. This should help to limit any recovery in the EUR near term.