Brazil GDP Review: Stagnation in Q4, but 2.9% Growth in 2023

Brazil's GDP remained stable in Q4 2023, growing marginally lower than expected. Agriculture saw a significant contraction, while Industry and Services showed modest growth. Government consumption offset household contraction, and investment reversed a five-quarter decline. Despite annual growth, deceleration is attributed to monetary policy effects, with future growth prospects reliant on fiscal policy and consumption, forecasting a 1.5% growth in 2024.

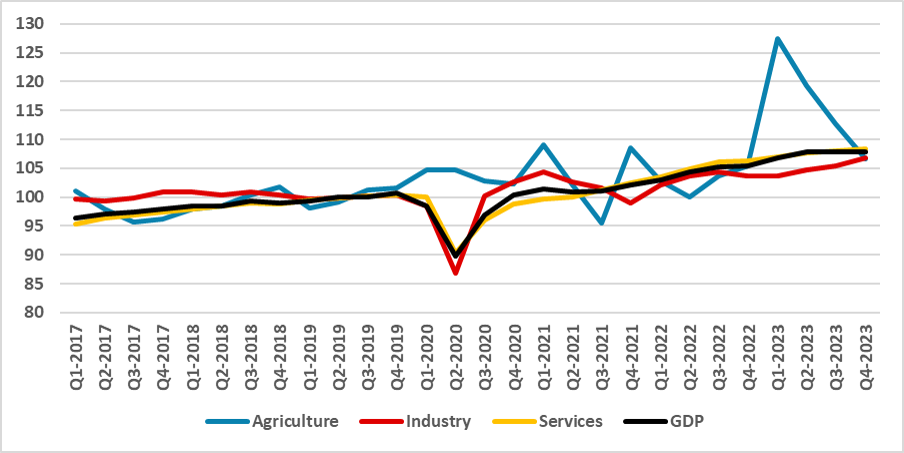

Figure 1: Brazil’s GDP by Sectors (Seasonally Adjusted 2019=100)

Source: IBGE

The Brazilian National Statistics Institute (IBGE) has released the GDP data for the last quarter of 2023. The data shows that the Brazilian economy was stable during this quarter, growing 0% in comparison with the third quarter, marginally lower than market expectations, which were expecting a 0.1% (qoq) growth. Looking at the sectors, Agriculture has contracted -5.1% (qoq) since the remarkable 20% growth in the first quarter of 2024, this sector has accumulated three consecutive drops. The Industry sector has grown 1.3% (qoq) during Q4, pushed by the Mining sector (+4.6% qoq) and Construction (+4.2%), while Manufacturing contracted -0.2% (qoq). Services have grown only 0.3% (qoq), influenced negatively by the contraction in trade (-0.8% qoq) and Transport (-0.6%), while Financing Activities (+0.7% qoq) and Other Services (+1.2% qoq) contributed positively.

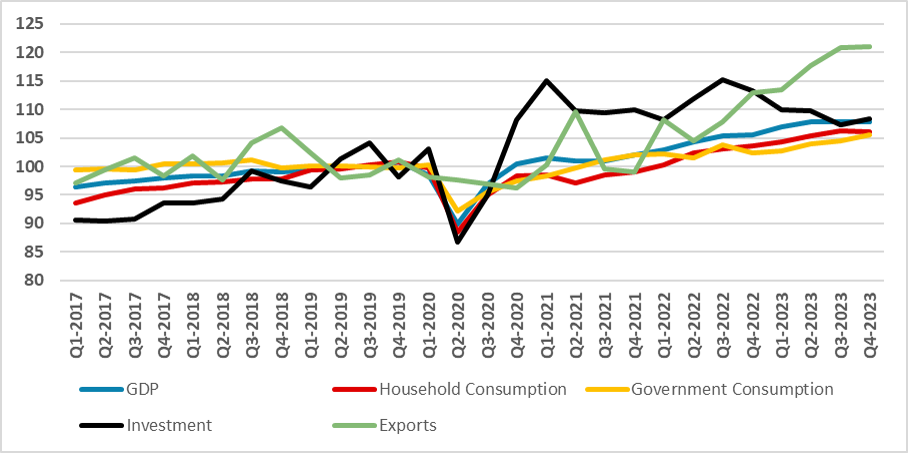

Figure 2: Brazil’s GDP by Demand (Seasonally Adjusted, 2019 = 100)

Source: IBGE

Looking at the demand components, household consumption has contracted -0.2% in the quarter, but government consumption has grown 0.9%, compensating for it. Investment has grown 0.9% after five consecutive quarters of falling. Exports have grown 0.1%, while Imports have grown -0.9%; therefore, net exports have contributed negatively to Q4 GDP. Looking at the annual terms, the GDP has grown 2.9%, the biggest contributors being the Agricultural sector (+15.1%) and the Services sector (+2.4%). The Industrial sector has grown 1.6%, pushed especially by the mining sector (+8.7%). Household Consumption grew 3.1% in 2023, while exports grew a remarkable 9.1%.

This recent deceleration in growth is mostly due to the effects of lagged monetary policy, but the favorable push by the external sector and consumption in the first half of the year compensated for this recent deceleration. It is important to remember that this strong push of the external sectors and consequently strong growth of the Agricultural sector are not set to repeat next year. However, as 2024 will be an electoral year in Brazilian municipalities, fiscal policy will tend to be looser, and this fact coupled with the strong number of job creations and high salaries could present a push for growth, especially through consumption, with lagged effects of monetary policy being a headwind. We continue to see the Brazilian economy decelerating and growing around 1.5% in 2024.