FX Daily Strategy: N America, July 8th

RBA surprisingly on hold

AUD may need hawkish comments to hold above 0.65

JPY weakness continues as equities remain firm

SEK gains on Monday look overdone

RBA surprisingly on hold

AUD may need hawkish comments to hold above 0.65

JPY weakness continues as equities remain firm

SEK gains on Monday look overdone

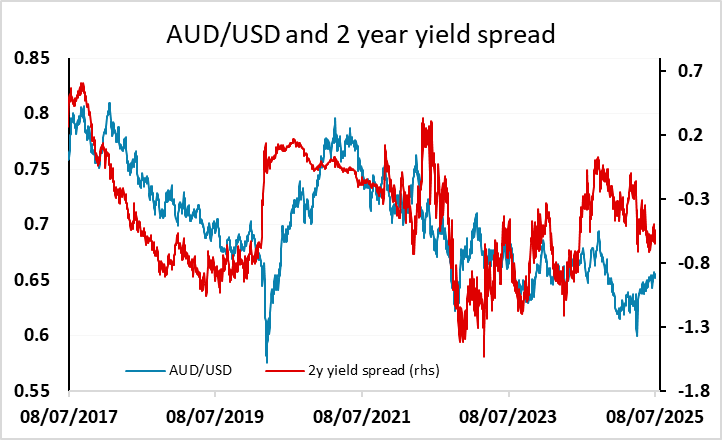

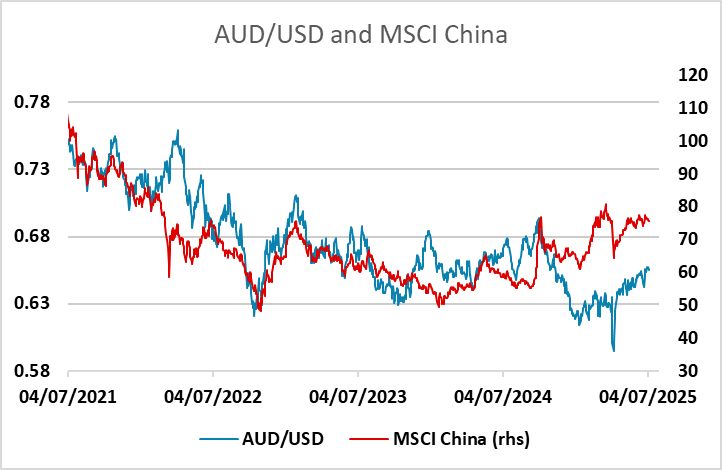

The main news overnight was the RBA decision not to cut rates further at this stage. A 25bp cut had been 95% priced so the AUD rallied on the news, although perhaps somewhat less than might have been expected. AUD/USD is only up 20 pips from the pre-meeting level and still below its closing level in the US. The RBA is now priced to cut 25bps in August, with a probability of 88%, and there are 63bps of easing priced by year end rather than 75bps as priced before the decision. The generally firm USD tone has likely limited the positive AUD reaction, but we do see some scope for gains to extend, with yield spreads still suggesting some upside risks and local equity markets also looking supportive.

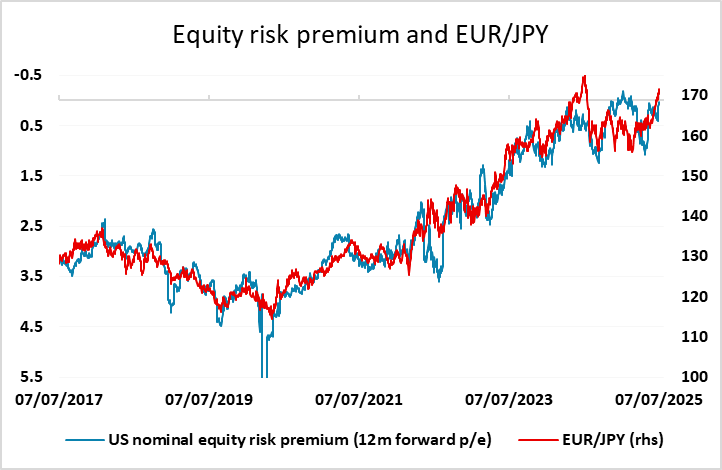

The JPY has remained weak overnight, once again reaching new all time lows against the CHF and new 1 year lows against the EUR. This is now the seventh consecutive week of EUR/JPY and CHF/JPY gains, a run that is rare and hasn’t been seen since 2016. At these levels , it looks hard to justify, but may relate to the heavy long JPY positioning still evident in the CFTC data. There isn’t a lot on today’s calendar to suggest this will reverse today, but there is likely to be a sharp reversal at some point, most likely on a sharp equity market decline.

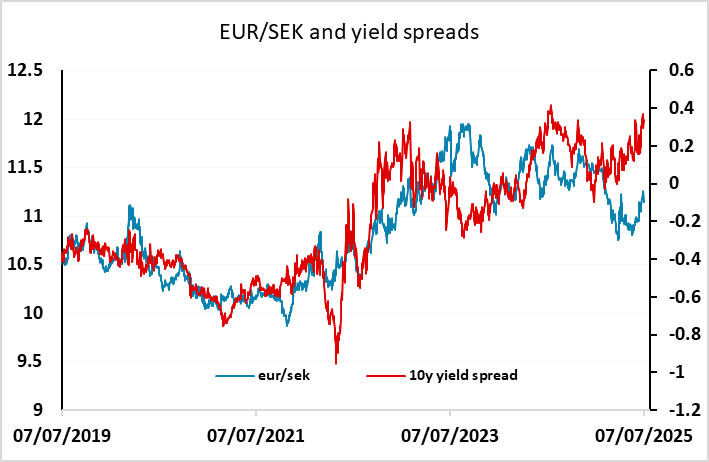

SEK strength on Monday also looks somewhat overdone. While the CPI data was much stronger than expected, real sector data has shown a slowdown in the last few data points, and we suspect the June CPI rise may prove erratic. The Riksbank still look likely to ease further this year, albeit probably not at the August meeting. The SEK is already trading on the strong side relative to yield spread movements, and if the USD start to perform better USD/SEK may see the biggest retracement as it has seen the biggest rise as the USD has fallen against Europe.