FX Daily Strategy: Asia, February 13th

U.S. January CPI A stronger month but slower yr/yr

More Correction in USD/JPY

Aussie Looks Set to Benefit From Solid Metal

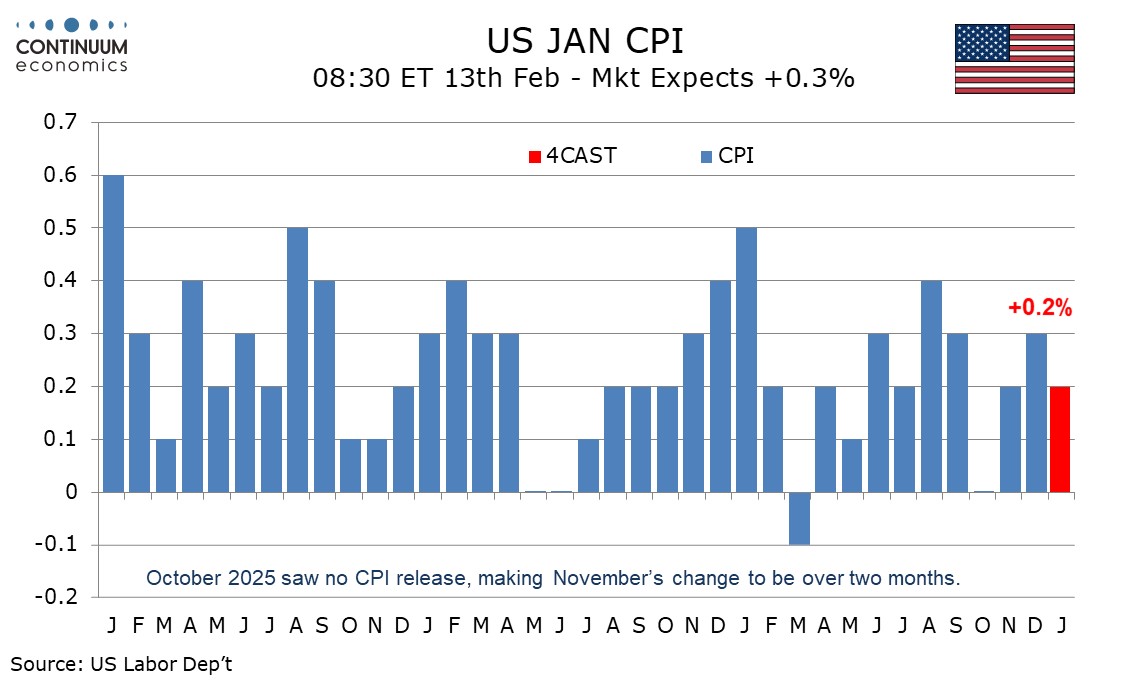

We expect a 0.2% increase in January’s CPI, with a 0.3% rise ex food and energy, though risks are to the upside with our forecasts before rounding being for gains of 0.24% overall and 0.34% ex food and energy. The latter would be the strongest since August. Pricing decisions are often made at the start of the year and January data in recent years has tended to be quite strong, with ex food and energy gains of 0.4% in January of 2025, 2024 and 2023 and 0.6% in 2022, though only the January 2025 gain was clearly above the trend seen at the time.

Reasons to expect a bounce this year include the January 14 Fed Beige Book stating that several contacts that initially absorbed tariff increases were starting to pass them on, and also that Q4 CPI data slowed more than did most other inflationary indicators, suggesting scope for a correction. However gasoline prices look weaker and we expect food to moderate after a strong 0.7% increase in December. December core CPI rose by only 0.24% before rounding despite strong gains in two of the most volatile components of services, air fares and lodging away from home, the latter part of housing which is expected to gradually lose momentum. Against this, autos, one of the more volatile components of goods, have scope to correct from a weak December. Upside risks appear more pronounced in goods, particularly if there is some tariff feed-though. We expect a 0.5% increase in commodities less food and energy but only a 0.3% rise in services less energy. We expect supercore CPI, excluding food, energy and housing, to rise by 0.3% in January, with housing converging towards the core.

USD/JPY looks set for more correction. The initial fear of fiscal irresponsibility from the sweeping LDP win seems to have dissipated. Moreover, hedge funds seem to have reignited their passion for JPY longs and has begun to build their position after repetitive verbal intervention from the Japanese government putting a lid on losses.

On the chart. anticipated losses have tested below congestion support at 153.00, with prices reaching 152.80 before bouncing back above 153.00. Oversold intraday studies are flat, suggesting room for minor consolidation above 153.00. But daily readings are bearish and broader weekly charts are under pressure, highlighting room for further losses in the coming sessions. A break back below 153.00 will open up critical support at the 152.10~ current year low of 27 January. Extension beneath here will confirm a near-term top in place at the 159.45 current year high of 14 January, as focus then turns to the 150.85 Fibonacci retracement. Meanwhile, resistance is lowered to congestion around 154.00. A close above here, if seen, will help to stabilise price action and prompt consolidation beneath 155.00.

The Aussie has been a strong performer since the beginning of the year. The precious metal rally has been supporting the Aussie, given their massive commodity export. Apart from the metal story, the hawkish RBA has add fuel to such rally. The RBA's hawkish tilt will make economic release more lively as it could spark speculation of an imminent hike before the two hikes are fully priced in. With Gold retaking the 5000 USD handle, any subsequent rally could propel the Aussie higher.

On the chart, cautious trade is giving way to a break above 0.7100, with prices posting a fresh 2026 year high around 0.7128, before settling into consolidation around 0.7115. Intraday studies are improving and daily readings are mixed/positive, highlighting room for further strength in the coming sessions. Resistance is at the 0.7155~ year high of February 2023. But flat overbought weekly stochastics are expected to limit any initial break beyond here in profit-taking/consolidation beneath the 0.7200 Fibonacci retracement. Meanwhile, support remains at 0.7050 and extends to congestion around 0.7000. This range should underpin any immediate setbacks.