FX Daily Strategy: N America, November 5th

Focus on US election

Trump win likely to be a small USD positive, Harris win a bigger USD negative

Clean sweep for Republicans would likely be more of a USD boost

AUD unfazed by RBA

Focus on US election

Trump win likely to be a small USD positive, Harris win a bigger USD negative

Clean sweep for Republicans would likely be more of a USD boost

AUD unlikely to be much affected by RBA

The US election will dominate markets on Tuesday, although there won’t be any results until Wednesday at the earliest (European time). The 2020 election took place on Tuesday 3 November but US TV networks did not declare Joe Biden the winner until late morning on Saturday 7 November, after the result in Pennsylvania became clearer. In other recent elections, voters have had a much shorter wait.

In 2016, when Trump won the presidency, he was declared the winner shortly before 03:00 EST (08:00 GMT) the day after the election.

In 2012, when Barack Obama secured a second term, his victory was projected before midnight on polling day itself.

The 2000 election between George W Bush and Al Gore was a notable exception. The vote was held on 7 November, but the two campaigns went to war over a tight contest in Florida and the race was not decided until 12 December. The US Supreme Court voted to end the state's recount process, which kept Bush in place as winner and handed him the White House.

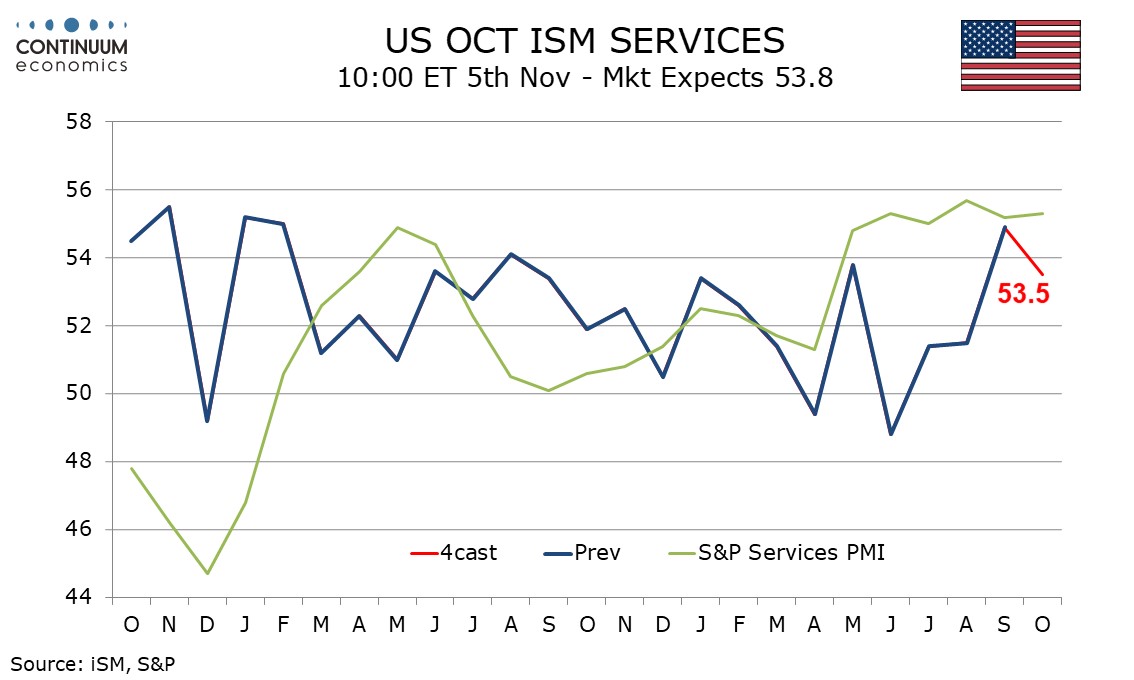

This time around the polls close in the swing states between 19:00 and 22:00 EST (00:00 and 03:00 GMT), so there is unlikely to be any significant election information before then. Major market will consequently probably be fairly quiet for most of the Asian and European day. The ISM services survey is the data of most interest, but seems unlikely to generate a great deal of market movement given the election focus. For what it’s worth, we expect October’s ISM services index to correct lower to 53.5 from September’s 54.9 outcome that was the highest since February 2023. An October index of 53.5 would still be stronger than most recent months. Our forecast is marginally below market consensus, but is unlikely to have any significant impact. We continue to expect a Harris victory to be USD negative and a Trump victory to be USD positive, but less so unless the Republicans also gain control of the House, as the market have to some extent priced in a Trump win.

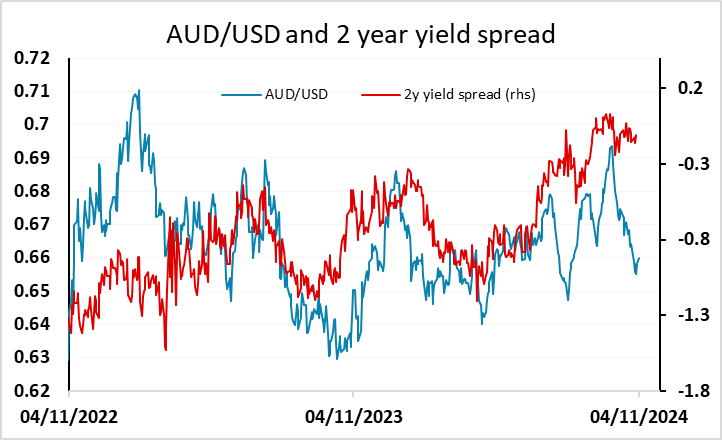

In Asia there was the RBA meeting. The RBA kept rates unchanged at 4.35% without a hint they will be cutting earlier despite headline CPI approaching the target range. RBA acknowledged the fall in inflation but highlighted such moderation was partially due to government rebates. The rhetoric continues to push back expectation of early easing but provides little news, suggesting their view of first cut in mid 2025 did not change. There was little tension on the actual decision, with no-one expecting any change in policy. However the market was pricing around a 20% chance of a 25bp cut in December, and 50bps of total easing by the end of 2025 ahead of the decision. Sunsequently, there is a little less easing priced in and the AUD has edged higher. The AUD might suffer from a Trump victory, as threatened tariff increases could undermine the Chinese equity market, and rate expectations might also rise, but might benefit from a Harris victory with lower US yields and more trade friendly policy.