EUR flows: German state CPIs broadly in line

German state CPIs suggest national CPI later will be broadly in line with consensus. EZ inflation numbers tomorrow look likely to be similarly in line. EUR/USD risks neverteheless slightly on the upside short term

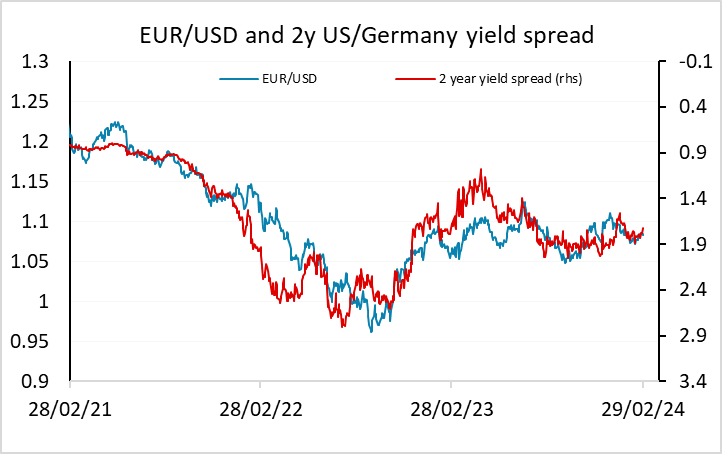

German state CPIs are coming in broadly in line with expectations, although the NRW data looks to be slightly on the low side. Nevertheless, national CPI later seems likely to come in essentially in line, and with Spanish data also in line and French data slightly on the high side, the Eurozone inflation numbers tomorrow look unlikely to deviate sufficiently from ECB expectations to change anything. Even so, the declining y/y rates are a positive in the progression towards the inflation target, so we still see the risks as being towards lower yields and somewhat faster rate cuts than the market is pricing in. But if anything EUR/USD looks a little below the levels that might be expected given current yields and spreads, so risks in the short term are slightly on the upside.