FX Daily Strategy: Asia, November 20th

CAD under pressure ahead of Canadian CPI

Further modest losses possible but positioning is extreme

GBP could soften if BoE hints at possibility of December rate cut

Some downside risks to UK CPI

GBP also biased lower as post-Budget risk premium emerges

JPY remains the favoured safe haven as risk appetite wanes on Russia concerns

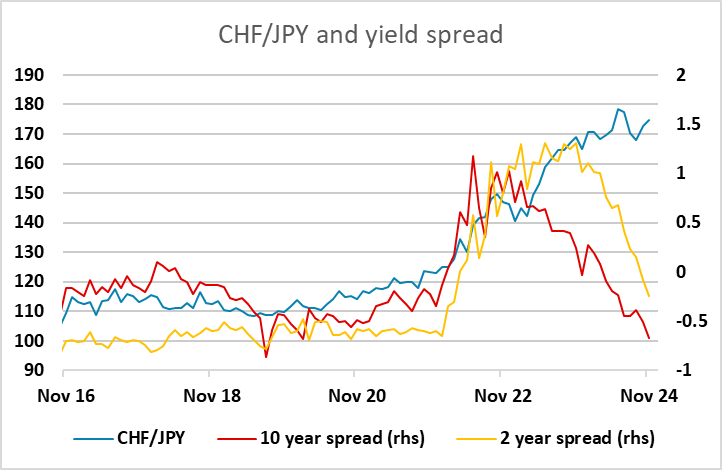

Figure 1: Clear UK Inflation Drop in Core to Continue?

Source: ONS, Continuum Economics

UK CPI will be the main data focus on Wednesday. Helped by a fall in fuel prices and airfares, amplified by base effects, alongside some belated broader softening in services costs, UK inflation dropped to 1.7% in the September CPI (from 2.2%), thus falling below target for the first time since April 2021. This drop was greater than expected and included an unexpectedly large fall in services inflation to a 28-mth low of 4.9%, in turn dragging the core down 0.4 ppt to a cycle low of 3.2% (Figure 1). Admittedly, that drop in the headline is likely to be short-lived as last month’s rise in the energy price cap (partly dampened by a drop in fuel prices) should pull the headline rate back to around 2.1% in October and average a notch or two higher for the whole of Q4. Regardless, the data backdrop is consistent with underlying inflation having fallen.

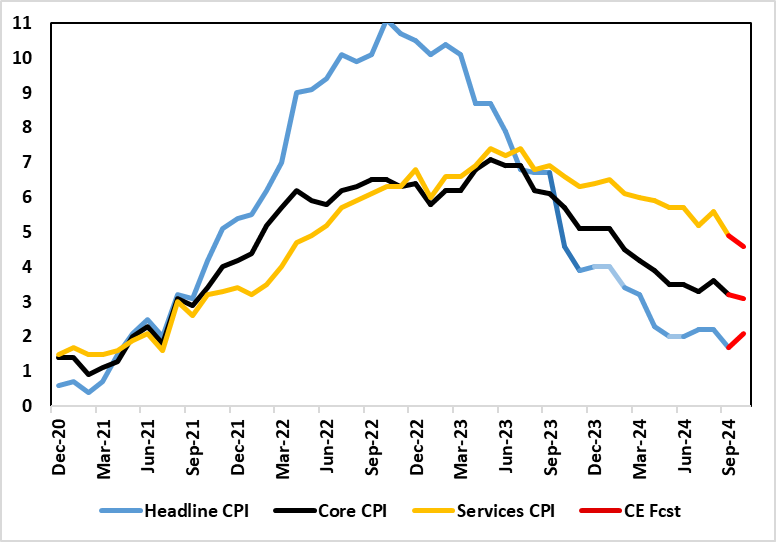

Figure 2: Adjusted Core CPI Pressures Falling Afresh

Source: ONS, Continuum Economics, smoothed is 3 mth mov average

The headline measure of services inflation has been driven mainly by volatile and indexed categories of late, so the MPC has built a gauge that excludes those categories and this has seemingly fallen more markedly and now for a few months in a row. Moreover, looking at shorter-term price dynamics, services inflation has fallen towards a near-target rate, this in turn pulling core measures even lower, either on a smoothed m/m basis or the 3-mth ann rate favored by the BoE (Figure 2). Moreover, around 0.5 ppt of services inflation is a result of rising rents, something some (not least ourselves) suggest is pro-cyclical element of the BoE policy stance. But this has not persuaded BoE Chief Economist Pill from citing policy caution ahead about how gradual a rate easing cycle may be. But amid a much softer inflation backdrop now emerging, albeit one we have stressed as being likely, it may actually be real economy matters that determined the pace of BoE easing ahead.

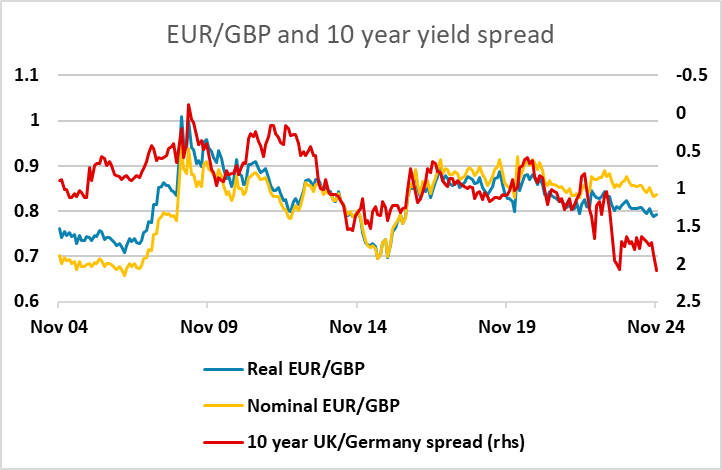

Our forecast is slightly below the market consensus of 2.2% for headline inflation, so the risk for GBP should be slightly to the downside. GBP has been underperforming yield spread implied moves since the Budget, suggesting there is something of a risk premium emerging in the pound because of concerns about the economic impact of the Budget, in a similar albeit less pronounced way to the Truss Budget in 2022. Against a less friendly risk backdrop due to the Russia/Ukraine developments, there is all the more reason to favour the GBP downside. While GBP looks a little cheap relative to yield spreads, it remains at historically high levels and has plenty of scope to decline if there is a loss of confidence in UK economic prospects.

The Russia/Ukraine developments have lent a generally more risk negative tone to the FX market, with the JPY and CHF the best performers on Tuesday. In practice, Putin’s comments about the Russian nuclear threat are intended to discourage aggressive Ukrainian attacks and we doubt he will follow through with action. But his comments do introduce further uncertainty heading into the new Trump presidency and it’s hard to take too positive a risk view given the already very low market risk premia. The JPY should remain the preferred safe haven here given its low valuation and the possibility of a BoJ rate hike in December, while the Fed and the SNB are likely to cut, possibly by 50bps in the SNB’s case.