U.S. November Consumer Confidence sees a limited response to the election, October new home sales hit by weather

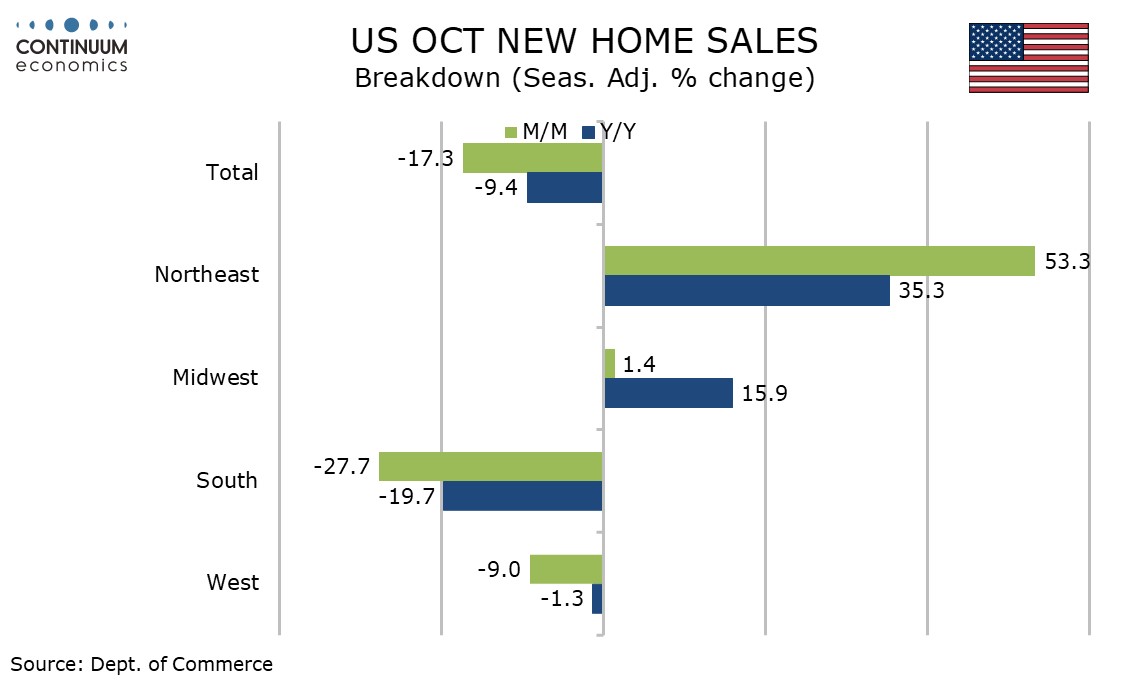

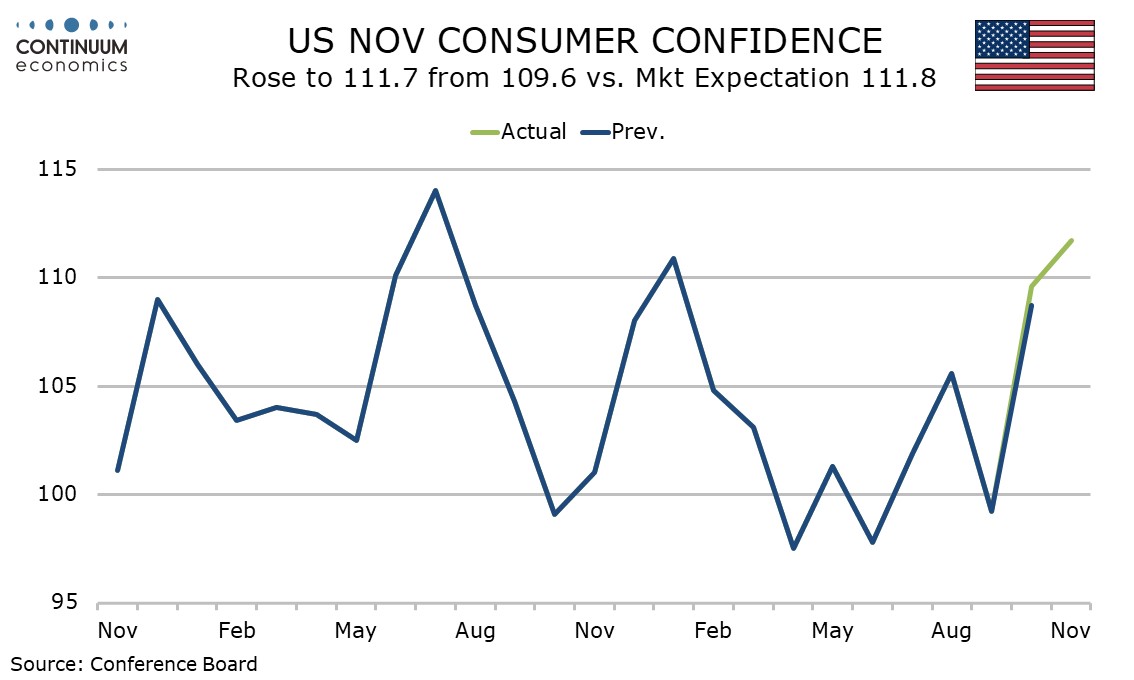

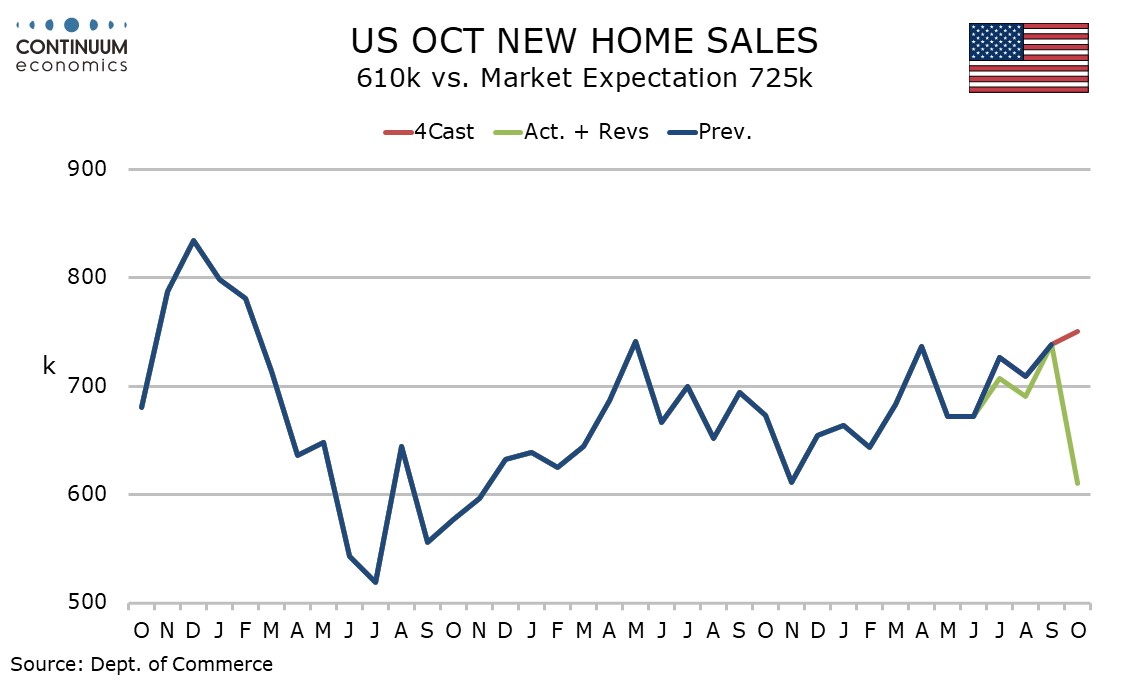

November consumer confidence is slightly stronger at 111.7 from 109.6 but has not shown a strong reaction to the election, presumably because similar numbers were pleased and disappointed with the result. New home sales have shown a sharp unexpected fall in October, by 17.3% to 610k, but appears to be weather-induced.

Supporting the view that the bounce in confidence is not due to the election is the fact the present situation saw a stronger bounce than expectations, though both were firmer.

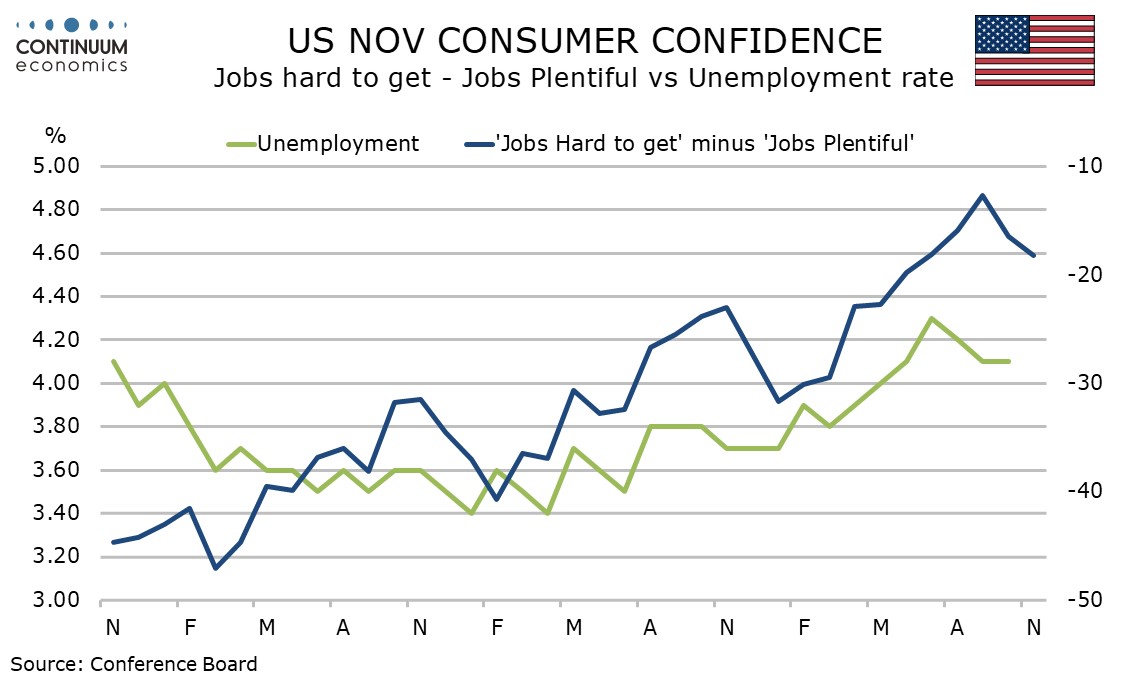

The present situation has been supported by a bounce in the labor differential, with 18.2% more seeing jobs as plentiful than hard to get, up from 16.5% in October and the highest since June.

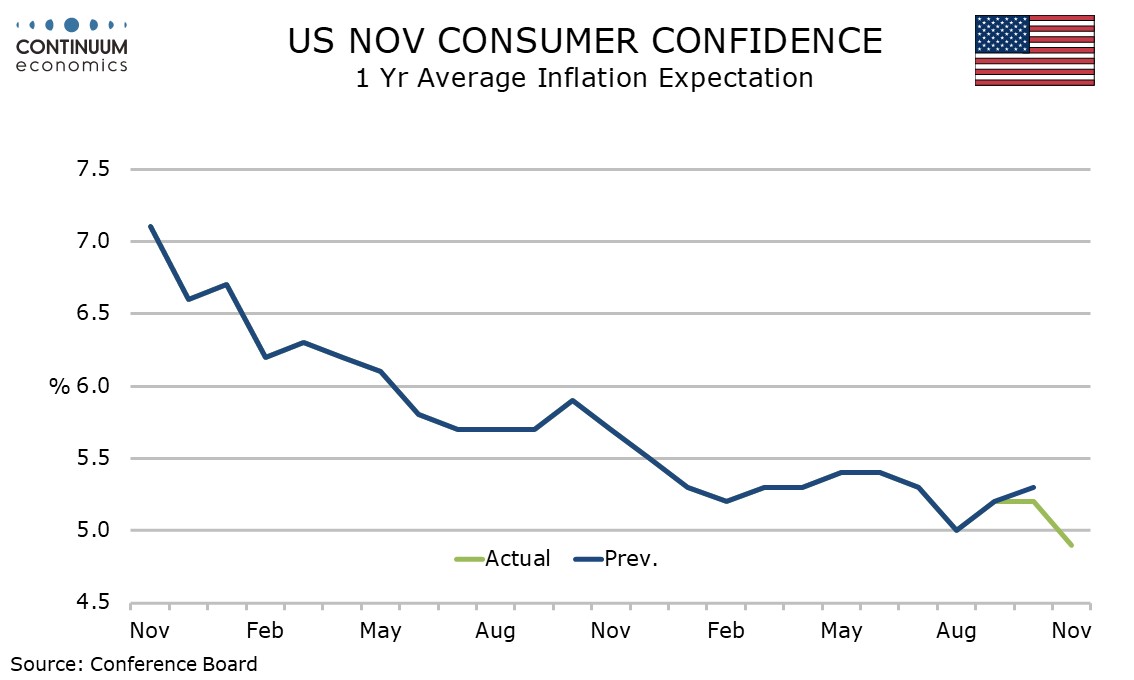

Inflation expectations eased, the median view to 4.9% from 6.2% (this series is consistently higher than actual inflation).

The new home sales decline was most pronounced in the South, which is the largest region and impacted by hurricanes, falling by 27.7%. The Northeast saw a strong rise and the Midwest a modest one, but the West did see a significant decline of 9.0%.

Price data was quite firm, the median up 2.5% and the average surging by 7.0% on the month, with respective yr/yr gains of 4.7% and 9.4%, breaking a recently fairly flat picture.