FX Daily Strategy: APAC, February 4th

JPY strength looks the clearest implication of recent developments

CAD weakness likely to extend

EUR should find support for now

GBP upside scope remains modest

JPY strength looks the clearest implication of recent developments

CAD weakness likely to extend

EUR should find support for now

GBP upside scope remains modest

There’s a very limited calendar on Tuesday, so the market will continue to be focused on the tariff story. While the USD initially gained ground across the board when the tariffs were announced, USD/JPY was lower by the end of the day on Monday and the other currencies were showing some recovery against the USD suggesting the implications for the USD are not entirely simple. Obviously a lot will depend on what happens from here, but we see some fairly clear market risks.

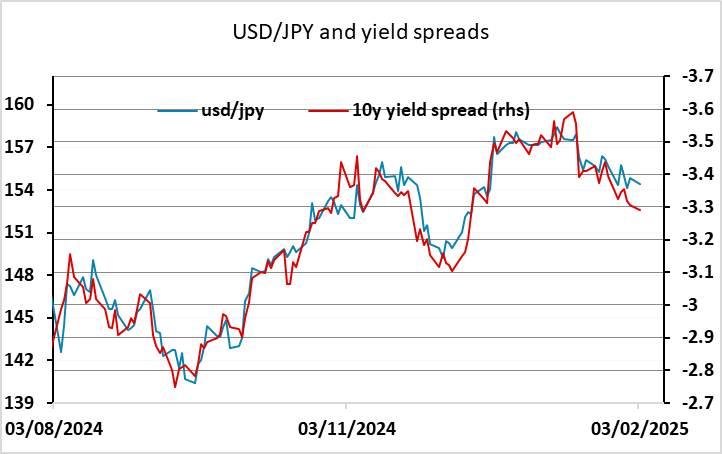

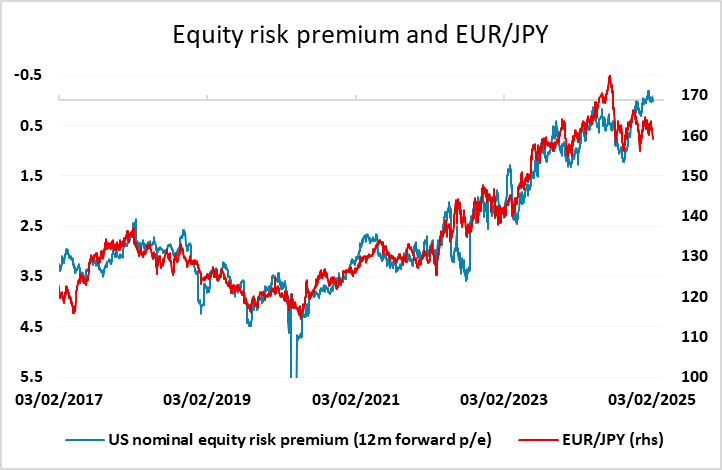

The JPY looks to be the most obvious beneficiary of any trade war. A trade war will be bad for global growth, and higher tariffs will lead to higher short-term inflation and higher short term rates than would otherwise have been the case. All of this is bad for equities, and what’s bad for equities is usually good for the JPY. Additionally, although short term rates may rise, long term yields have moved lower in response to the tariff news as markets price in a weaker growth picture. The USD/JPY correlation with yield spreads has been very tight in recent months and the decline in spreads we have already seen suggests USD/JP has scope to 153 or below. Of course, there is some risk that Japan will also face tariffs, but the extreme cheapness of the JPY means that even a large tariff won’t much change the relative cheapness of producing in Japan. While tariffs reduce demand (due to higher prices) if they are introduced on all imports when the US is at full employment there will be a limited impact on any one country, with the US lacking the resources to fill the gap with domestic production. The JPY therefore looks likely to benefit from the combination of lower US yields and reduced risk appetite.

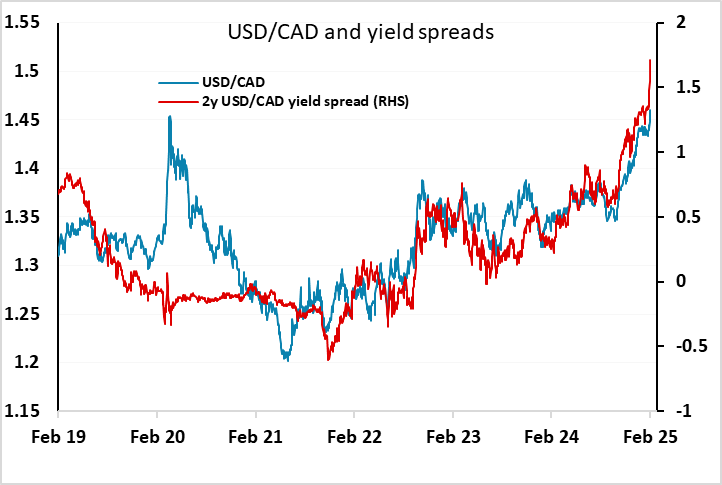

The CAD is the most obvious victim in the short term, with many (including the BoC) estimating that the 25% tariff will reduce Canadian GDP by 4%. While BoC governor Macklem has made it clear that a retaliatory rise in tariffs from Canada makes it harder for the BoC to ease policy to cushion the blow, due to the impact on inflation, we would expect the BoC to ease more in the face of recession concerns, and this suggests more scope for CAD weakness. Thus far, USD/CAD hasn’t risen dramatically, but as the market prices in more BoC easing expect a move above 1.50.

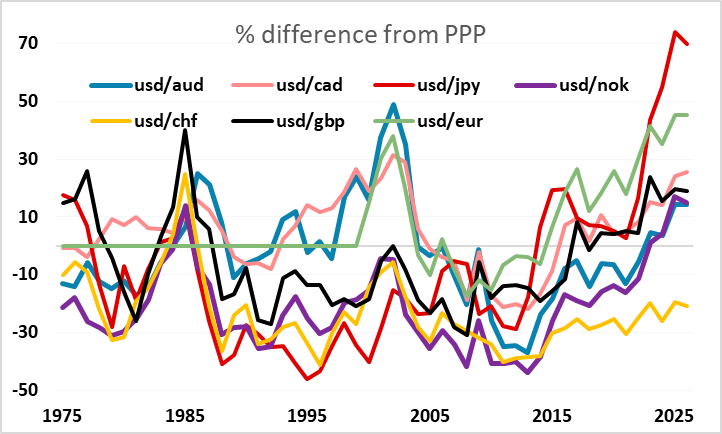

For European currencies, things will depend on what Trump’s next target is and how hard he is prepared to hit. The EU is an obvious target because of its large trade surplus, but is also a powerful bloc that can retaliate more aggressively and hurt US business. The business lobby might discourage him from aggressive action. The EUR is also of course very cheap here as well, so like the JPY the impact of a tariff may be less significant due to the low starting point. We are consequently not convinced that EUR/USD will test parity.

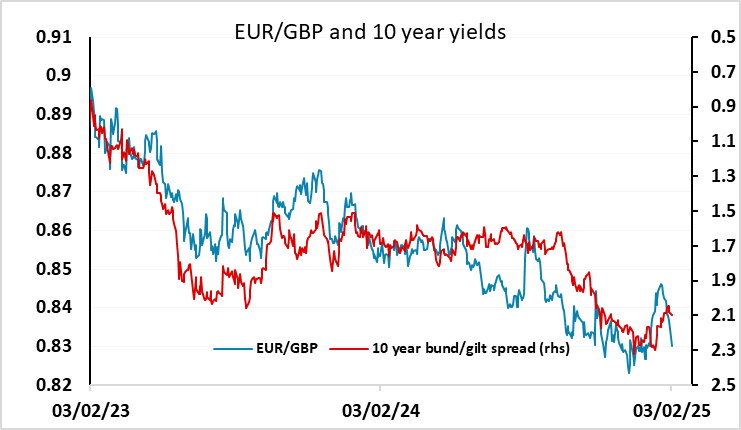

The UK looks to be less of a target for Trump than the EU, which could be beneficial for UK industry. But GBP is already at quite expensive levels, and the relative impact on the UK may well be overwhelmed by the general impact on global growth and risk appetite, so we don’t see further significant downside for EUR/GBP, at least until or unless we see some UK outperformance, and possibly not even then as weaker risk sentiment may undermine GB along with the other relatively high yielders.

Much will depend on how equities cope with all this. Monday’s decline was quite modest, but US valuations remain extremely high and while valuations elsewhere are much more reasonable, if the US market catches a cold everyone will, initially at least, be dragged down with it. We would certainly see the US market to be at major risk here, with the impact of tariffs combining with increased concern about AI in the wake of the DeepSeek news, and this leads us to see JPY strength as much the clearest consequence of recent developments.